A Look at Nishi-Nippon Financial Holdings (TSE:7189) Valuation Following Dividend Hike and Upgraded Payout Outlook

Reviewed by Simply Wall St

Nishi-Nippon Financial Holdings (TSE:7189) is stepping up its pace on shareholder returns by announcing a boost to its second-quarter dividend and raising its year-end payout forecast after reviewing business performance.

See our latest analysis for Nishi-Nippon Financial Holdings.

Nishi-Nippon Financial Holdings has seen momentum pick up in its shares, recently up 2.7% on the day and delivering a robust 15.8% share price return for the past month. That has added to a remarkable 46.7% total shareholder return over the last year and an impressive long-term gain of 358% for investors over five years. This suggests the company’s renewed focus on boosting shareholder rewards is being recognized by the market.

If moves like this have you looking for your next opportunity, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With share prices rallying and dividends surging, the key question is whether Nishi-Nippon Financial Holdings remains undervalued or if the market is already pricing in all that future growth. Could there still be a buying opportunity here?

Price-to-Earnings of 11x: Is it justified?

At a price-to-earnings (PE) ratio of 11x, Nishi-Nippon Financial Holdings is trading above both the Japanese Banks industry average of 10.4x and the peer average of 10.8x. Despite a recent rally and strong long-term returns, this higher multiple signals the market is attaching a premium to the stock compared to its sector peers.

The price-to-earnings ratio tracks what investors are willing to pay for each yen of current profits. In financial services, this measure balances expected growth, earnings quality, and risk. For Nishi-Nippon Financial Holdings, a higher PE can indicate that investors are optimistic about future profit potential or believe the quality of earnings supports such a premium.

Yet, the justification depends on whether Nishi-Nippon Financial Holdings can sustain its rapid growth. While earnings have surged by 45.6% over the past year, against a five-year average of 8.3%, the current premium price suggests expectations are running high. If growth momentum continues, this multiple may be warranted, but it also raises the stakes for future results.

Compared to the sector, the company stands out for both recent performance and a higher valuation. The question is whether the pace of growth and operational improvements can continue to justify this premium. There is not enough data to determine the fair ratio that the market could move towards next.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11x (OVERVALUED)

However, risks such as a disconnect between high expectations and actual performance, or a broader downturn in bank valuations, could quickly reverse recent gains.

Find out about the key risks to this Nishi-Nippon Financial Holdings narrative.

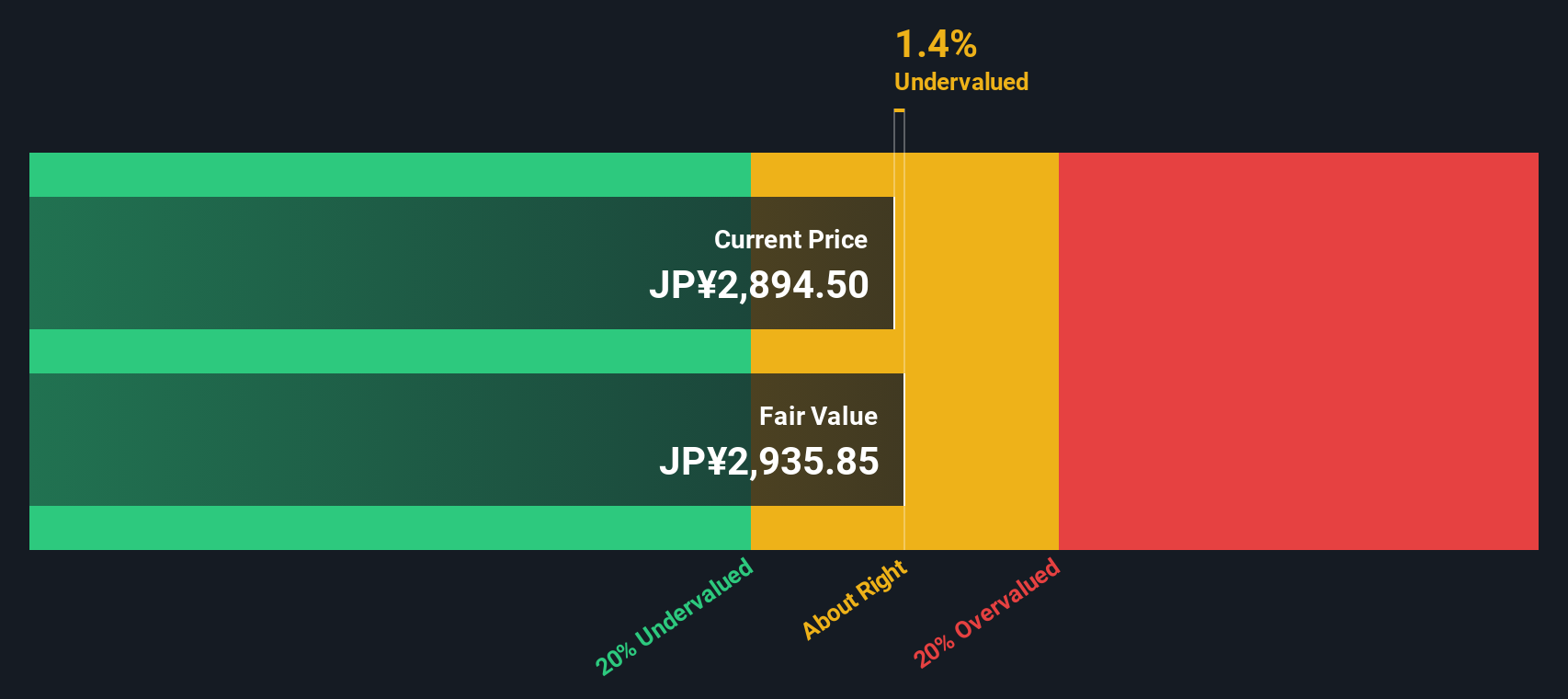

Another View: Our DCF Valuation Suggests Undervaluation

While the price-to-earnings ratio indicates that Nishi-Nippon Financial Holdings is trading at a premium compared to its peers, our SWS DCF model presents a different perspective. According to this analysis, the shares are trading 3.9% below their estimated fair value, suggesting that the stock might be undervalued. Does this gap present an opportunity, or does it reflect risks that are not apparent in valuation multiples alone?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nishi-Nippon Financial Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nishi-Nippon Financial Holdings Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily create your own view in just a few minutes. This allows you to shape the narrative to fit your outlook. Do it your way

A great starting point for your Nishi-Nippon Financial Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

No smart investor stakes everything on just one opportunity. Make sure you're ahead of the crowd by checking out these hand-picked selections on Simply Wall Street:

- Uncover income potential by tapping into these 16 dividend stocks with yields > 3%, which consistently offer attractive yields above 3% for income-focused portfolios.

- Catch the latest tech trends by reviewing these 25 AI penny stocks, which power breakthroughs in artificial intelligence, automation, and digital transformation.

- Diversify into tomorrow's financial frontier with these 81 cryptocurrency and blockchain stocks, featuring companies pushing boundaries in cryptocurrency and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishi-Nippon Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7189

Nishi-Nippon Financial Holdings

Through its subsidiaries, provides financial and non-financial products and services in Japan, China, Hong Kong, and Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives