Tokyo Kiraboshi Financial Group (TSE:7173) Net Profit Margin Surges, Reinforces Bullish Narratives

Reviewed by Simply Wall St

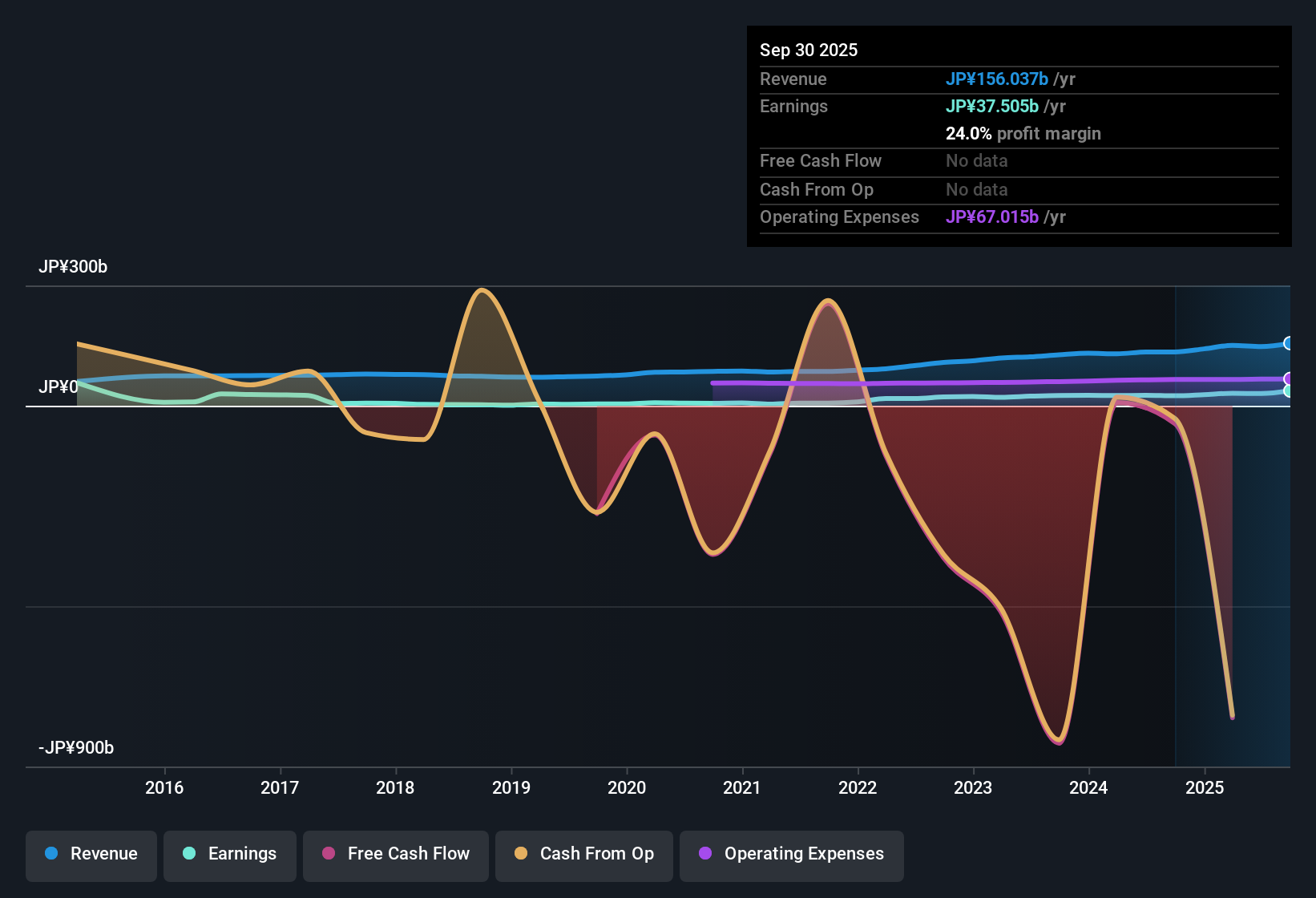

Tokyo Kiraboshi Financial Group (TSE:7173) posted a net profit margin of 24% for the latest period, up from 18.5% the previous year. Annual earnings surged by 51.3%, far outpacing the company’s five-year average annual earnings growth rate of 29.7%. Over the last five years, earnings have grown significantly at an average rate of 29.7% per year, supporting a consistent expansion in profitability. Investors are likely to focus on the accelerating earnings, a minimal risk profile, and ongoing signals such as attractive dividends and steady growth as key drivers for the stock.

See our full analysis for Tokyo Kiraboshi Financial Group.Next, we will compare these results to the key narratives that shape market sentiment and see where the numbers substantiate or disrupt prevailing opinions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Closes Gap With Industry

- Tokyo Kiraboshi’s net profit margin advanced to 24%, significantly higher than last year’s 18.5% and approaching the upper tier in regional banks.

- The prevailing market view regards this margin improvement as a sign of effective cost and risk controls in a low-rate environment.

- Consistent expansion of profitability, paired with high quality earnings, heavily supports the view that Tokyo Kiraboshi is managing operational challenges better than many competitors.

- Persistent low rates in Japan can make such margin gains difficult. This result bolsters confidence in the group’s underlying credit and lending strategies.

Profit Growth Outpaces Long-Term Trend

- Earnings jumped by 51.3% over the past year, well ahead of the already-strong 29.7% five-year average annual growth rate.

- According to the prevailing market view, this acceleration substantiates optimism about sustainable profit drivers.

- Investors optimistic about digital transformation and efforts to boost operational efficiency can point to multiple years of sturdy growth, not just a short-term spike.

- Strong reported earnings growth occurs alongside ongoing dividend stability. This provides evidence for bulls that Tokyo Kiraboshi has room to return capital while growing profit.

Trading at a Steep Discount to DCF Fair Value

- With a share price of 7,340.00 yen well below DCF fair value of 13,706.40, Tokyo Kiraboshi trades at a substantial discount in both absolute and industry-relative terms (P/E: 5.9 vs. 11.5 for JP Banks).

- The prevailing market view highlights how this value gap presents a supportive backdrop for further re-rating.

- The low valuation multiples contrast with consistent profit and dividend growth, which typically warrant higher peer-comparable prices.

- Minimal flagged risks further reinforce the argument that the discount reflects investor caution about the sector rather than any specific company concern.

See what the community is saying about Tokyo Kiraboshi Financial Group

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tokyo Kiraboshi Financial Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive earnings momentum and a discounted valuation, Tokyo Kiraboshi still contends with low valuation multiples relative to peers. This suggests sector caution and limited re-rating.

If you want to focus on companies where strong cash flows are being recognized in the share price, try finding better opportunities with these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Kiraboshi Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7173

Tokyo Kiraboshi Financial Group

Provides financial services for small and medium-sized enterprise in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives