A Fresh Look at Iyogin Holdings (TSE:5830) Valuation Following New Share Buyback Program Approval

Reviewed by Simply Wall St

Iyogin Holdings, Inc. (TSE:5830) has kicked off a new share buyback program following board approval. The company is targeting the repurchase of up to 1.71% of its outstanding shares for ¥7,000 million to boost corporate value and capital efficiency.

See our latest analysis for Iyogin HoldingsInc.

Iyogin Holdings Inc’s buyback news comes on the heels of a strong run for the stock. Despite a slight pullback over the last week, momentum remains robust, with a 21.2% gain in the past three months and an impressive year-to-date share price return of 52.5%. For shareholders looking at the bigger picture, its total return has soared over the past several years, highlighting solid long-term outperformance.

If you’re interested in finding other fast-moving names with management skin in the game, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

But does the recent buyback signal that Iyogin Holdings shares are trading below their intrinsic value? Or is positive sentiment and future growth already fully reflected in the price, leaving little room for new investors?

Price-to-Earnings of 10.3x: Is it justified?

Iyogin Holdings is currently trading at a price-to-earnings ratio of 10.3x, which suggests undervaluation compared to both its peers and its own estimated fair level. With the last close at ¥2,352, the stock appears to offer attractive value for investors eyeing sector and peer benchmarks.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each unit of a company’s earnings. For banks like Iyogin Holdings, this multiple is a common gauge to compare share valuations within the sector. It reflects both historical and expected profitability.

Iyogin’s 10.3x P/E sits below the JP Banks industry average of 11.5x and the peer average of 12.2x. Notably, it also trades below its estimated fair P/E ratio of 12x, suggesting the market may not be fully recognizing its recent acceleration in earnings growth or sustained profit margins. There is potential for the multiple to move closer to fair value as market sentiment shifts.

Explore the SWS fair ratio for Iyogin HoldingsInc

Result: Price-to-Earnings of 10.3x (UNDERVALUED)

However, slowing annual revenue and muted net income growth could challenge further upside if underlying business momentum does not improve soon.

Find out about the key risks to this Iyogin HoldingsInc narrative.

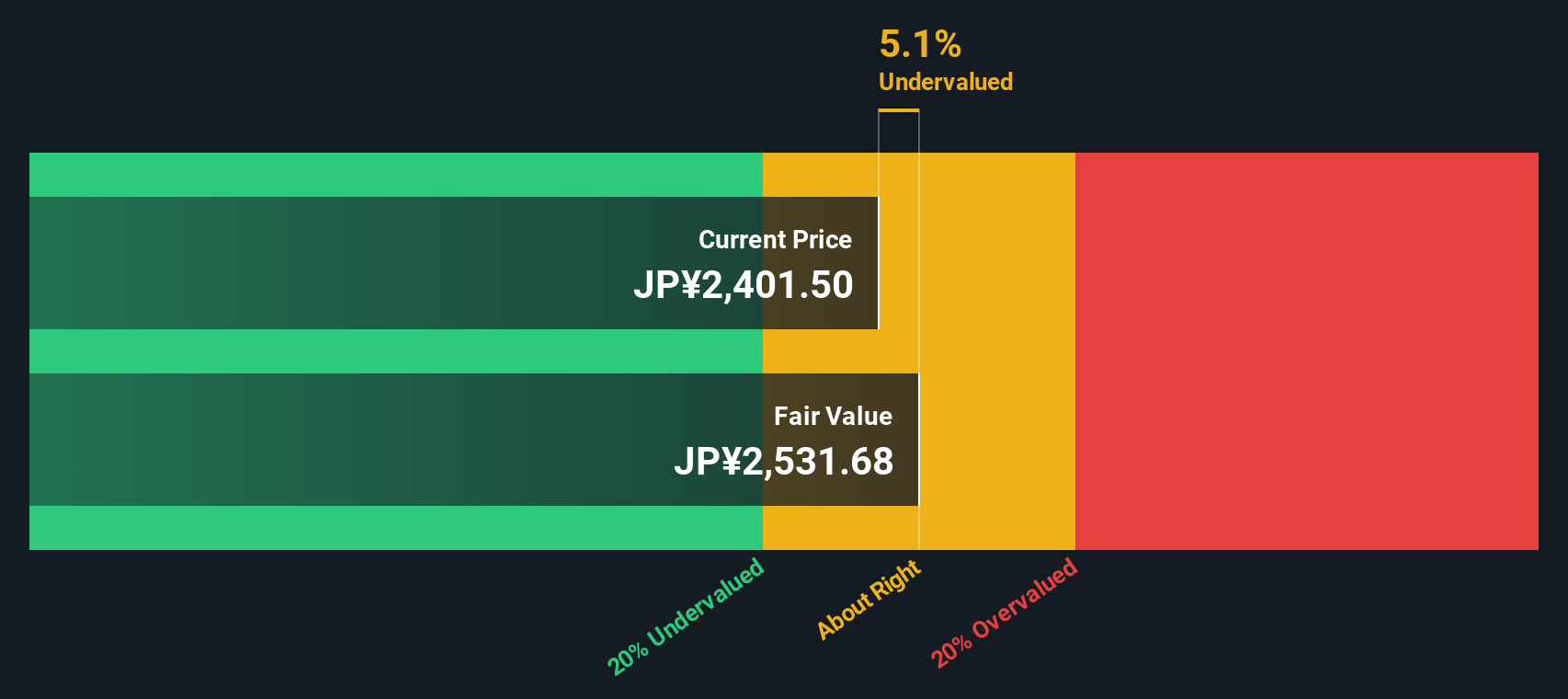

Another View: SWS DCF Model Weighs In

Looking from a different angle, our SWS DCF model values Iyogin Holdings shares at 7% above the current trading price. This suggests the stock may be undervalued by the market. This approach bases valuation on projected future cash flows rather than earnings multiples, raising the question of whether there is more upside left for patient investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Iyogin HoldingsInc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Iyogin HoldingsInc Narrative

If you have a different perspective or prefer to dive deeper on your own, you can craft your own take in just a few minutes, so Do it your way.

A great starting point for your Iyogin HoldingsInc research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Supercharge your portfolio with standout opportunities you might otherwise miss. Secure your edge by searching stocks with traits the market can't ignore. If you wait, others will seize them first.

- Capture high income potential by targeting these 16 dividend stocks with yields > 3% offering yields above 3% and dependable cash flows.

- Spot rapid disruptors and future tech leaders by reviewing these 24 AI penny stocks making waves in artificial intelligence innovations.

- Find unbeatable value by screening for these 865 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5830

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives