The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Nifco (TSE:7988). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Nifco Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Nifco's EPS has grown 25% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Nifco may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

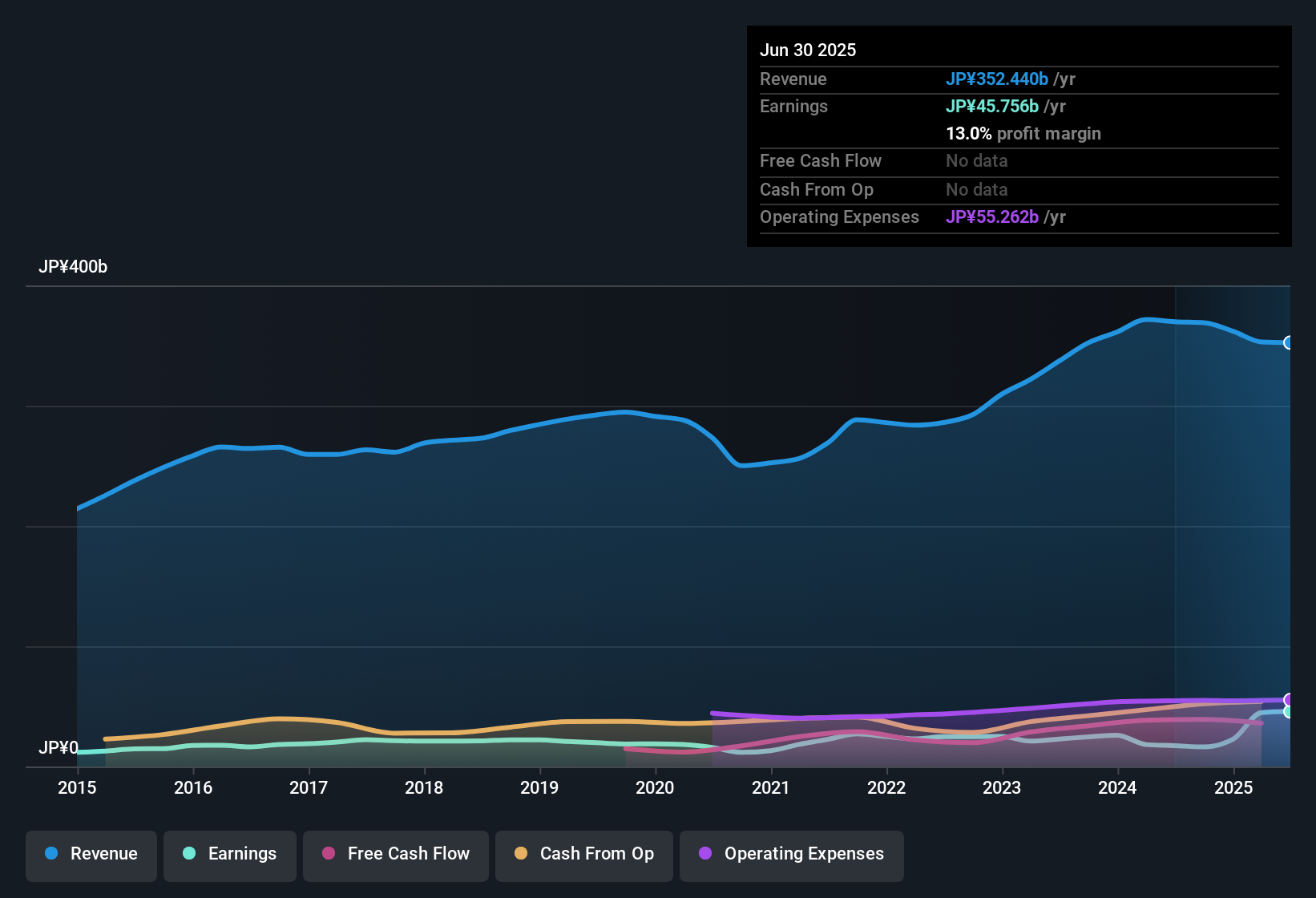

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

See our latest analysis for Nifco

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Nifco?

Are Nifco Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to Nifco, with market caps between JP¥305b and JP¥977b, is around JP¥138m.

Nifco offered total compensation worth JP¥110m to its CEO in the year to March 2025. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Nifco Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Nifco's strong EPS growth. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. You still need to take note of risks, for example - Nifco has 1 warning sign we think you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Japanese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nifco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7988

Nifco

Manufactures and sells industrial plastic parts and components in Japan, Asia, North America, China, South Korea, the United States, and Europe.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives