- Japan

- /

- Auto Components

- /

- TSE:7313

TS TECH (TSE:7313): Reviewing Valuation as Board Weighs Potential Treasury Stock Disposal

Reviewed by Simply Wall St

TS TECH (TSE:7313) has called a board meeting for November 14, where directors will discuss the potential disposal of treasury stock. Actions like this can shift a company’s shareholder mix and affect market liquidity.

See our latest analysis for TS TECH.

TS TECH’s shares have come under pressure lately, sliding 8.2% in the past week and drifting down 3.7% year-to-date. Despite this, the company has achieved a 1-year total shareholder return of 6.1% and a solid 33% gain over five years. Momentum has faded in the short term, yet the company’s long-term performance suggests resilience as the market gauges the impact of possible treasury stock changes.

If you’re curious where other auto stocks are heading next, now’s a great opportunity to discover See the full list for free.

Given recent declines but healthy long-term returns, is TS TECH now trading at a bargain? Or has the market already factored in the company’s growth prospects, leaving little room for upside?

Price-to-Earnings of 37.9x: Is it justified?

TS TECH currently trades at a price-to-earnings (P/E) ratio of 37.9x, which stands out against its peers and raises big questions about investor expectations.

The price-to-earnings ratio measures the price investors are willing to pay for a yen of the company’s earnings. In sectors like auto components, this metric helps gauge how the market is rating future profit potential relative to current performance. For TS TECH, the elevated P/E suggests the market may be pricing in strong earnings growth or unique company advantages, even though there have been recent profit declines.

Compared to the JP Auto Components industry average P/E of 10x, TS TECH’s multiple appears steep. It also trades well above an estimated fair P/E of 18.9x, which highlights just how high current expectations are for profit recovery or growth. This significant premium could lead to future adjustments if company results do not match these high assumptions.

Explore the SWS fair ratio for TS TECH

Result: Price-to-Earnings of 37.9x (OVERVALUED)

However, continued earnings volatility and a price target below the current share price could quickly challenge the market’s optimistic view on TS TECH.

Find out about the key risks to this TS TECH narrative.

Another View: Our DCF Model Weighs In

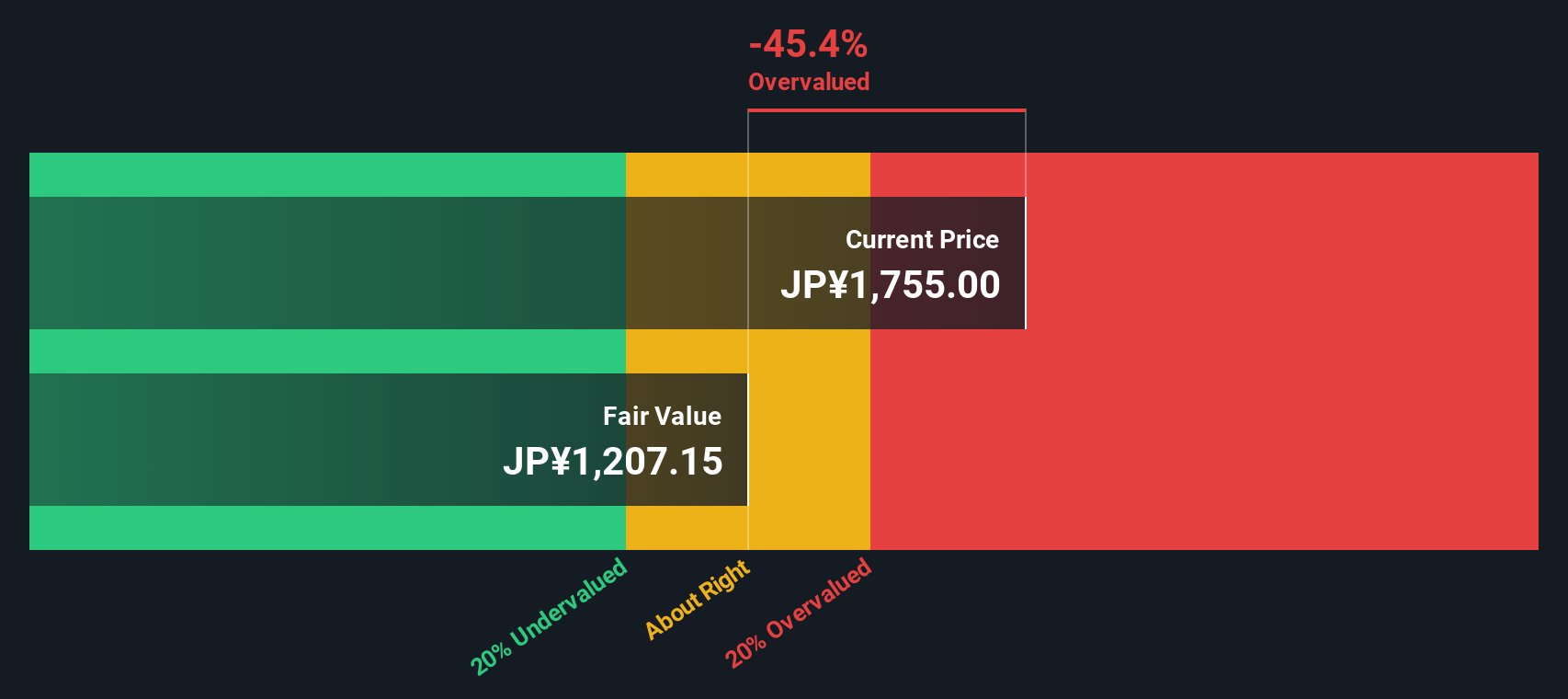

Taking a different lens, the SWS DCF model estimates TS TECH’s intrinsic value at ¥1,197.3. This is well below its current market price of ¥1,726.5, which signals the shares could be overvalued and raises the stakes if the company’s growth fails to accelerate. Which approach will prove right as results unfold?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TS TECH for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TS TECH Narrative

If you see things differently or want to dig deeper yourself, it only takes a few minutes to shape and share your own perspective. Do it your way

A great starting point for your TS TECH research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities rarely wait around, and the best investors act fast. Don’t let the next wave of growth stocks or market winners slip past you.

- Boost your passive income strategy by tapping into these 15 dividend stocks with yields > 3%, with yields designed to reward patient investors.

- Get ahead of the curve with these 27 AI penny stocks, which are powering breakthroughs in machine learning, automation, and real-world applications.

- Expand your portfolio’s potential with these 898 undervalued stocks based on cash flows, supported by strong fundamentals and future upside in mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TS TECH might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7313

TS TECH

Engages in development, manufacture, and sale of seats for automobiles.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives