- Japan

- /

- Auto Components

- /

- TSE:7282

Toyoda Gosei (TSE:7282): Evaluating Valuation After Major Share Buyback Authorization

Reviewed by Simply Wall St

Toyoda Gosei (TSE:7282) has announced a large share buyback plan, aiming to repurchase up to 10,000,000 shares, or about 8% of its issued stock. This is part of a strategy to enhance shareholder returns and capital efficiency.

See our latest analysis for Toyoda Gosei.

Toyoda Gosei’s buyback comes after a strong period for shareholders, with a 38% year-to-date share price return reflecting renewed investor confidence and robust operating momentum. Over the last year, the company delivered an impressive 52% total shareholder return, highlighting both price appreciation and dividends as catalysts for longer-term growth potential.

If this move from Toyoda Gosei has you thinking about what’s next in autos, now is a great moment to explore leaders in the sector with our See the full list for free.

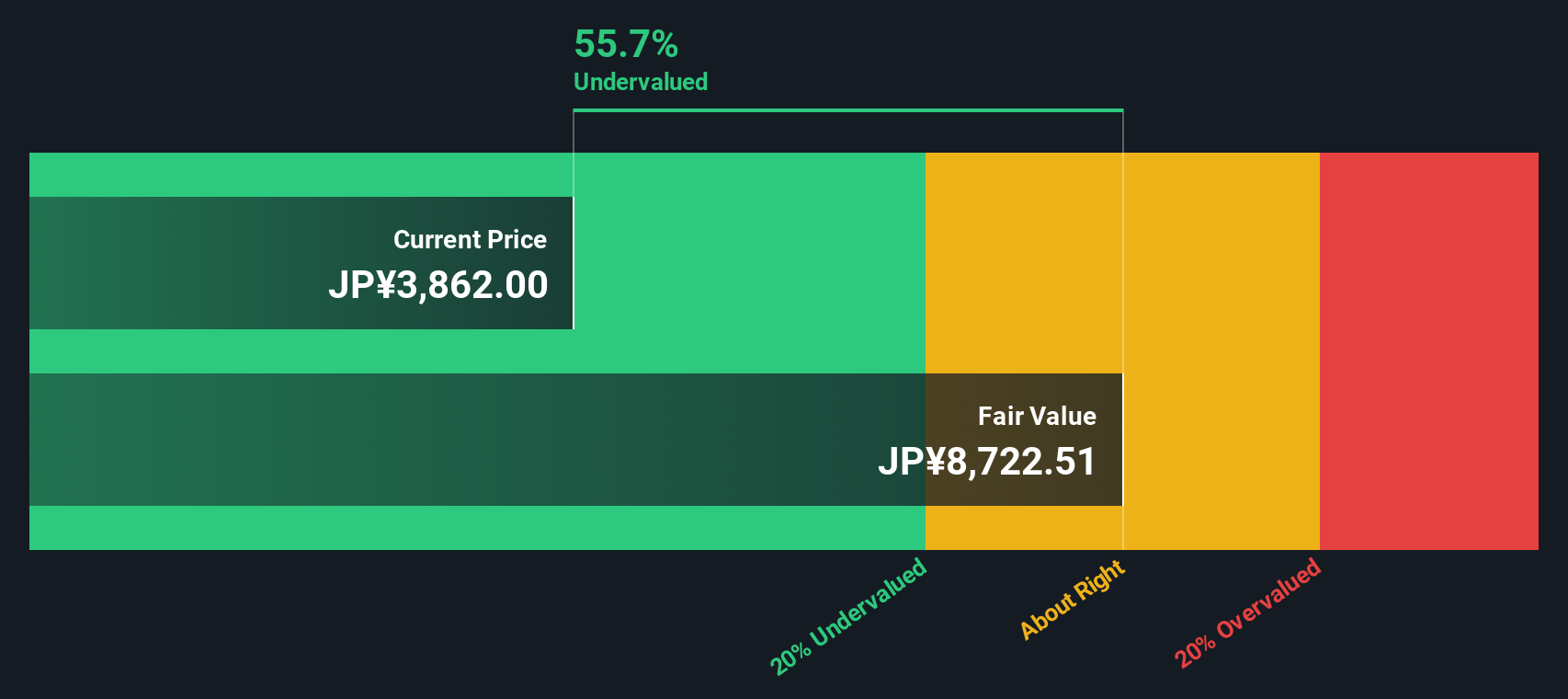

With such powerful gains and a fresh buyback announcement, investors might wonder if Toyoda Gosei is still undervalued or if the market has already priced in the company’s growth prospects, leaving little room for a bargain.

Price-to-Earnings of 10.4x: Is it justified?

At a Price-to-Earnings (P/E) ratio of 10.4x, Toyoda Gosei's shares currently command a modest premium to the industry’s average but remain well below peer benchmarks. The last close price of ¥3,753 reflects this valuation landscape, with investors signaling confidence yet stopping short of euphoria.

The P/E ratio measures how much investors are willing to pay today for each yen of Toyoda Gosei’s earnings. In the auto components industry, this is a key metric as it encapsulates expectations for future profit growth and business stability. A lower P/E can mean investors expect weaker growth or higher risk. By contrast, a higher P/E suggests optimism about future prospects.

Despite the company trading at 10.4x earnings, which is slightly above the JP Auto Components industry average of 10x, it stands out as much cheaper compared to the average P/E of its direct peers (14.9x). The market could be undervaluing the company’s solid five-year profit growth or not fully pricing in recovery potential. Compared to its estimated fair P/E of 12.5x, there appears to be room for re-rating if performance trends persist or improve.

Explore the SWS fair ratio for Toyoda Gosei

Result: Price-to-Earnings of 10.4x (ABOUT RIGHT)

However, softer revenue growth or an unexpected drop in net income could quickly dampen momentum and challenge the current optimism around Toyoda Gosei.

Find out about the key risks to this Toyoda Gosei narrative.

Another View: Discounted Cash Flow Suggests Deeper Value

While the price-to-earnings ratio hints at fair or modest value, our DCF model points to something more dramatic. According to this method, Toyoda Gosei is trading at a deep discount, around 58% below its estimated fair value. Is the market overlooking hidden value, or is caution justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyoda Gosei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyoda Gosei Narrative

If the analysis above doesn’t match your perspective or you’d like to take a different approach, you can gather the numbers and shape your own narrative in just a few minutes with our tools. Do it your way

A great starting point for your Toyoda Gosei research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next winning opportunity slip by. The right stock could be one step away. Give yourself an edge and start searching with these powerful tools:

- Uncover fast-moving tech trends by reviewing these 27 AI penny stocks, which stand at the forefront of artificial intelligence breakthroughs and innovation.

- Target steady income potential as you browse these 15 dividend stocks with yields > 3%, featuring companies with yields above 3% to help boost your portfolio’s cash flow.

- Position yourself ahead of emerging financial revolutions by selecting these 81 cryptocurrency and blockchain stocks, where blockchain and cryptocurrency leaders are redefining what is possible in the markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyoda Gosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7282

Toyoda Gosei

Manufactures and sells automotive parts, optoelectronic products, and general industry products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives