- Japan

- /

- Auto Components

- /

- TSE:7282

A Piece Of The Puzzle Missing From Toyoda Gosei Co., Ltd.'s (TSE:7282) Share Price

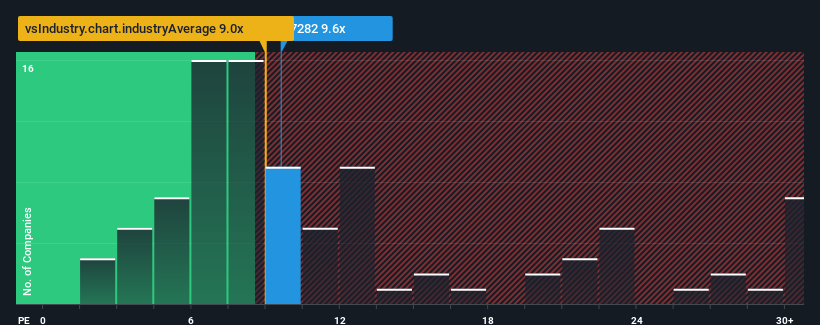

With a price-to-earnings (or "P/E") ratio of 9.6x Toyoda Gosei Co., Ltd. (TSE:7282) may be sending bullish signals at the moment, given that almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 21x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, Toyoda Gosei's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Toyoda Gosei

How Is Toyoda Gosei's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Toyoda Gosei's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. Even so, admirably EPS has lifted 58% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the seven analysts watching the company. With the market only predicted to deliver 9.6% each year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Toyoda Gosei's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Toyoda Gosei currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Toyoda Gosei that you should be aware of.

If you're unsure about the strength of Toyoda Gosei's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Toyoda Gosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7282

Toyoda Gosei

Manufactures and sells automotive parts, optoelectronic products, and general industry products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success