Honda (TSE:7267): Assessing Valuation After Steady Gains and Long-Term Outperformance

Reviewed by Simply Wall St

See our latest analysis for Honda Motor.

Honda Motor’s share price has made modest moves recently, but the bigger story is its steady climb over the past year. While 1-year price gains are minimal, the total shareholder return stands at an impressive 20%, and the five-year total return has nearly doubled investors’ money. That solid long-term track record is drawing renewed attention as industry momentum shifts and automakers focus on future growth.

If you’re curious how other automakers are performing or want to discover what is ahead for the sector, check out the full list of opportunities in our See the full list for free..

With the stock’s steady climb and strong total returns, investors are left to wonder: Is Honda Motor undervalued at today’s price, or is the market already factoring in much of the company’s growth ahead?

Most Popular Narrative: 9.1% Undervalued

Honda Motor’s last closing price of ¥1,585 is nearly 10% below the most widely followed narrative’s fair value estimate, suggesting more upside potential in the current stock price. There is a clear focus among narrative followers on long-term growth drivers and the evolving competitive landscape.

Persistent investment in mobility services and partnerships in advanced technologies (including collaborations with GM, Sony, and exploration of ADAS/OTA solutions) is setting the stage for Honda to access new high-margin revenue streams beyond traditional car sales. This fosters long-run earnings growth and margin enhancement as the mobility industry evolves.

Want to uncover what’s fueling this bullish outlook? The narrative’s fair value leans heavily on future margin expansion and a profit trajectory not seen in years. What are analysts banking on that the market might be missing? Tap in to see the bold expectations behind these numbers.

Result: Fair Value of ¥1,744.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weakening automobile sales in major Asian markets and ongoing electric vehicle losses could quickly challenge the current bullish narrative regarding Honda’s outlook.

Find out about the key risks to this Honda Motor narrative.

Another View: Discounted Cash Flow Model

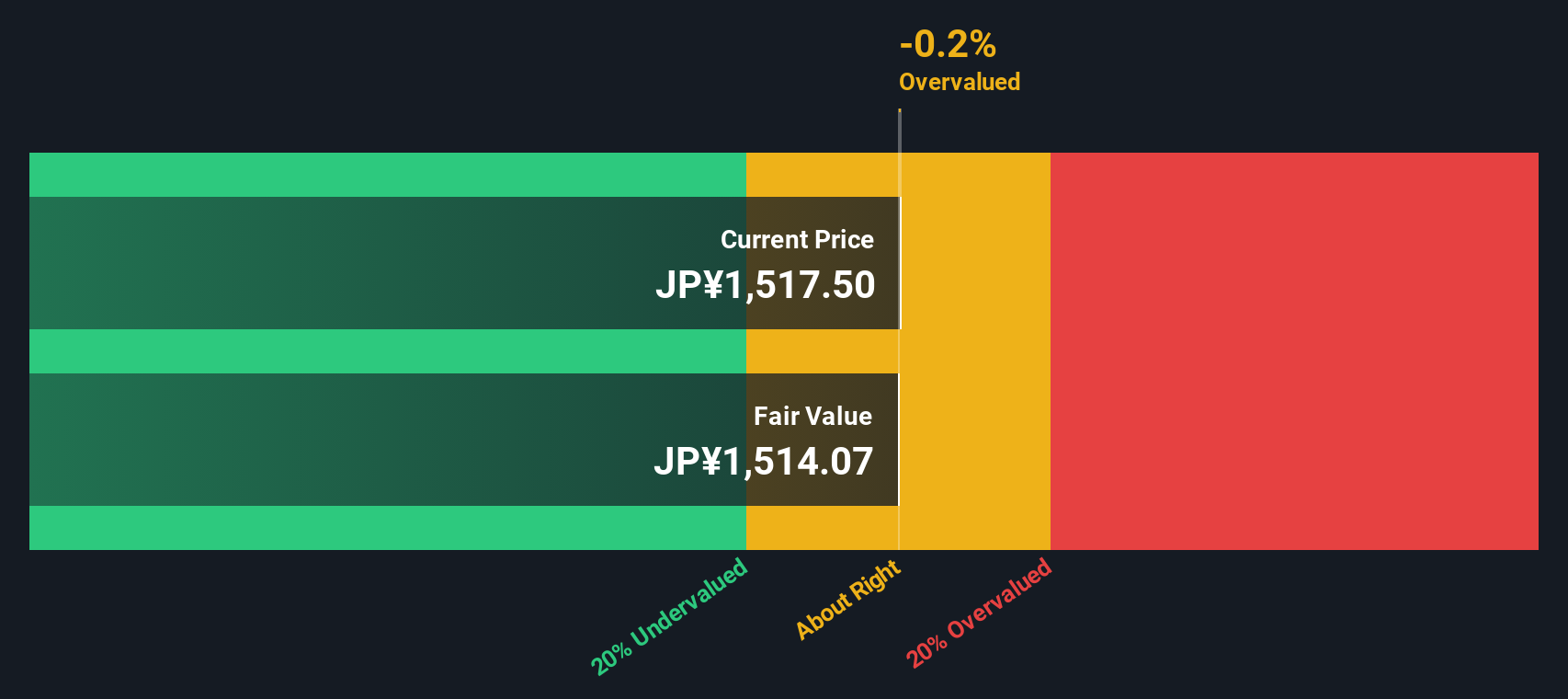

While analyst estimates suggest Honda Motor is trading close to fair value, our SWS DCF model offers a slightly different perspective. According to our latest calculation, the shares currently trade above the estimated fair value, indicating some overvaluation by this method. Does this suggest downside risk if growth fails to meet forecasts, or is the market expecting outcomes beyond what the numbers indicate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Honda Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Honda Motor Narrative

If you have your own perspective or want to test your own view with the numbers, you can build your own Honda Motor narrative in just a few minutes. Do it your way.

A great starting point for your Honda Motor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart moves set you apart in the market, and you don’t want to be the one missing unique opportunities. Let Simply Wall Street’s powerful screener help you spot investments others might overlook.

- Uncover hidden value by tapping into these 876 undervalued stocks based on cash flows poised for potential. Strong cash flow can signal attractive entry points.

- Lock in compounding returns with these 16 dividend stocks with yields > 3% offering juicy yields above 3% for your income strategy.

- Seize tomorrow’s trends early with these 25 AI penny stocks and position yourself at the forefront of artificial intelligence advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honda Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7267

Honda Motor

Develops, manufactures, and distributes motorcycles, automobiles, and power products in Japan, North America, Europe, Asia, and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives