- Japan

- /

- Auto Components

- /

- TSE:7259

Aisin (TSE:7259): Assessing Valuation Following Strong 3-Month Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Aisin.

Aisin’s strong run has turned heads, with the 3-month share price return of 13% reflecting renewed confidence in its growth story. Even with a dip this week, the one-year total shareholder return is over 70%, which shows that momentum is still very much intact in the bigger picture.

If Aisin’s climb has you interested in what else is driving the automotive sector, don’t miss this chance to check out See the full list for free.

With Aisin’s valuation climbing alongside its share price, the question now is whether the stock remains undervalued given its fundamentals, or if the market has already priced in the company’s future growth prospects. Could there still be room to buy?

Price-to-Earnings of 11.6x: Is it justified?

Aisin’s shares are currently trading at a price-to-earnings (P/E) ratio of 11.6x, which puts the valuation above the average for Japanese auto components peers. With the last close at ¥2,674.5, this pricing points to a potential high market expectation for future earnings.

The price-to-earnings ratio is a snapshot of how much investors are willing to pay today for a unit of current earnings. It is especially important for the auto components sector, where margins and growth prospects can shift quickly based on industry cycles and global demand. The P/E figure shows how Aisin stacks up against competitors in terms of profitability and growth outlook.

At 11.6x, Aisin is notably more expensive than the Japanese industry average, which sits at 9.8x. This signals that the market may be placing a premium on Aisin’s recent surge in profits and dominant positioning. However, when tracked against the estimated fair price-to-earnings ratio of 14.7x, the current multiple suggests there may still be upside potential if performance stays robust and expectations hold.

Explore the SWS fair ratio for Aisin

Result: Price-to-Earnings of 11.6x (ABOUT RIGHT)

However, softening annual revenue growth and a dip from this week highlight that changing industry trends or future earnings slowdowns could reduce momentum.

Find out about the key risks to this Aisin narrative.

Another View: Discounted Cash Flow Undervalues the Stock

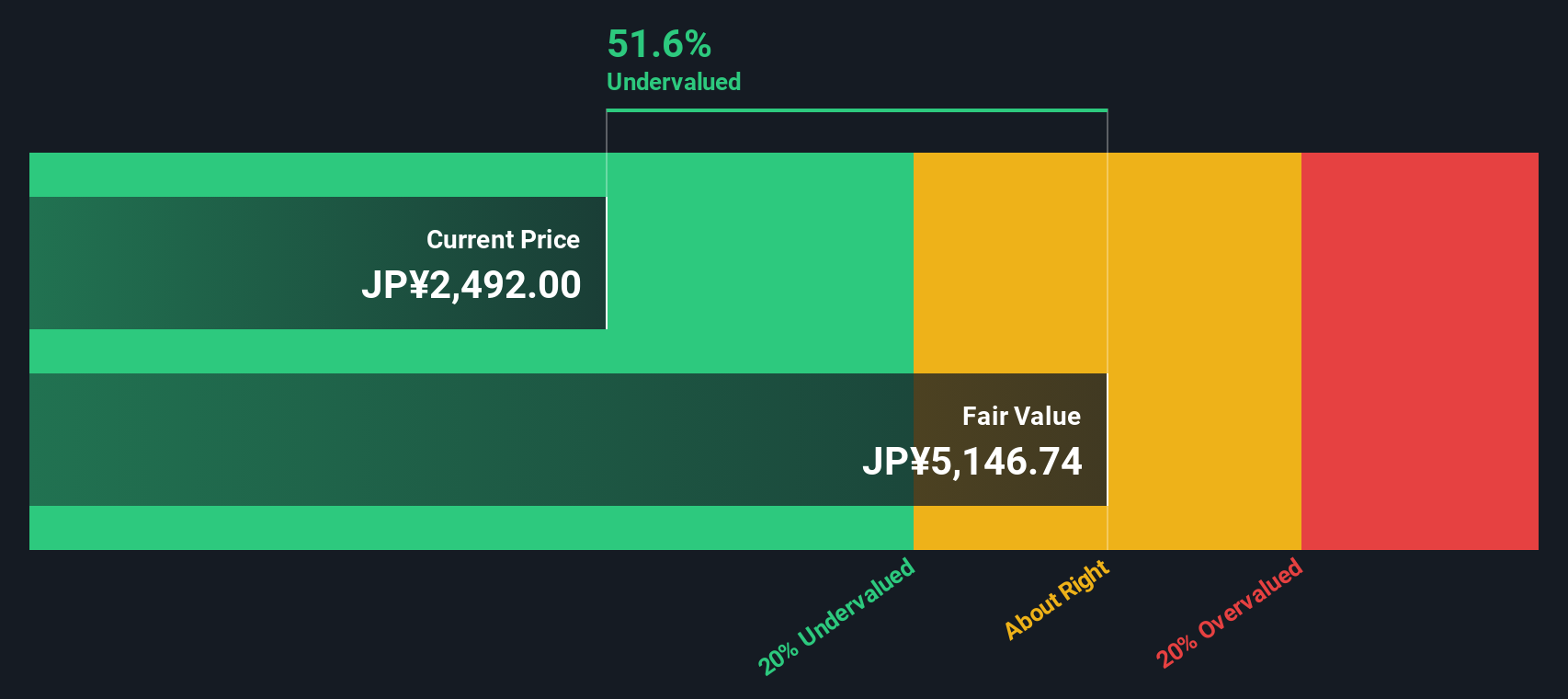

While the price-to-earnings ratio suggests Aisin could be trading close to a fair price, a completely different picture emerges when using the SWS DCF model. According to this analysis, Aisin's current share price appears well below its estimated fair value, indicating a possible undervaluation. Could this highlight potential upside that the market is overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aisin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aisin Narrative

If you have your own perspective or want to dig deeper, you can explore the data and build your own narrative in just a few minutes. Do it your way

A great starting point for your Aisin research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Expand your investing horizons and don’t let smart opportunities slip by. The Simply Wall Street Screener is your launchpad for finding tomorrow’s winners before the crowd.

- Tap into future healthcare breakthroughs and spot market leaders now by checking out these 30 healthcare AI stocks, which is making waves in medical innovation and AI-powered treatments.

- Seize the chance to build your portfolio with these 926 undervalued stocks based on cash flows, offering compelling value based on their future cash flows and solid fundamentals.

- Position yourself at the forefront of financial transformation by exploring these 81 cryptocurrency and blockchain stocks, which is redefining the digital economy and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7259

Aisin

Manufactures and sells automotive parts, lifestyle, and energy and wellness related products in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives