- Japan

- /

- Auto Components

- /

- TSE:6923

Stanley Electric (TSE:6923) Valuation in Focus After Boosted Dividend and Upgraded Payout Forecast

Reviewed by Simply Wall St

Stanley Electric (TSE:6923) held a board meeting to approve an increase in its surplus dividend and revise its year-end dividend forecast for the fiscal year ending March 2026. This type of move usually reflects management’s confidence in the business outlook.

See our latest analysis for Stanley Electric.

Stanley Electric’s decision to boost its dividend forecast seems to have struck a chord with investors, as reflected by the 4.05% one-day share price return and a solid 22.1% gain so far this year. Momentum has clearly been building, with the one-year total shareholder return reaching 24.26% despite a market that has not always been easy for auto parts manufacturers.

If the company’s latest move has you thinking bigger about what’s next in autos, this is a good time to discover See the full list for free.

Yet with the recent run-up, investors may wonder if Stanley Electric’s shares are undervalued after the dividend hike or if the market is already pricing in the next wave of expected growth. Could this still be a buying opportunity?

Price-to-Earnings of 13.4x: Is it Justified?

Stanley Electric trades at a price-to-earnings ratio (P/E) of 13.4x, based on its most recent closing price of ¥3,158. This is above both industry and peer averages, raising questions about whether the market is expecting outsized profit growth or simply reflecting recent momentum in the price.

The price-to-earnings multiple indicates how much investors are willing to pay per ¥1 of the company’s earnings. For auto components makers, the P/E ratio reflects how investors evaluate the company’s growth prospects, profitability, and risk compared to others in the sector.

Stanley Electric’s P/E ratio of 13.4x is higher than the JP Auto Components industry average of 11.3x and peers at 13.1x. This also exceeds its estimated fair P/E of 12.3x, which suggests that shares may be priced at a premium relative to both the sector and the company's fundamentals. If market perception changes or earnings growth does not accelerate, the multiple could move closer to the fair level implied by broader factors.

Explore the SWS fair ratio for Stanley Electric

Result: Price-to-Earnings of 13.4x (OVERVALUED)

However, shifts in industry demand or a slowdown in profit growth could quickly challenge Stanley Electric’s premium valuation and market momentum.

Find out about the key risks to this Stanley Electric narrative.

Another View: What Does the SWS DCF Model Show?

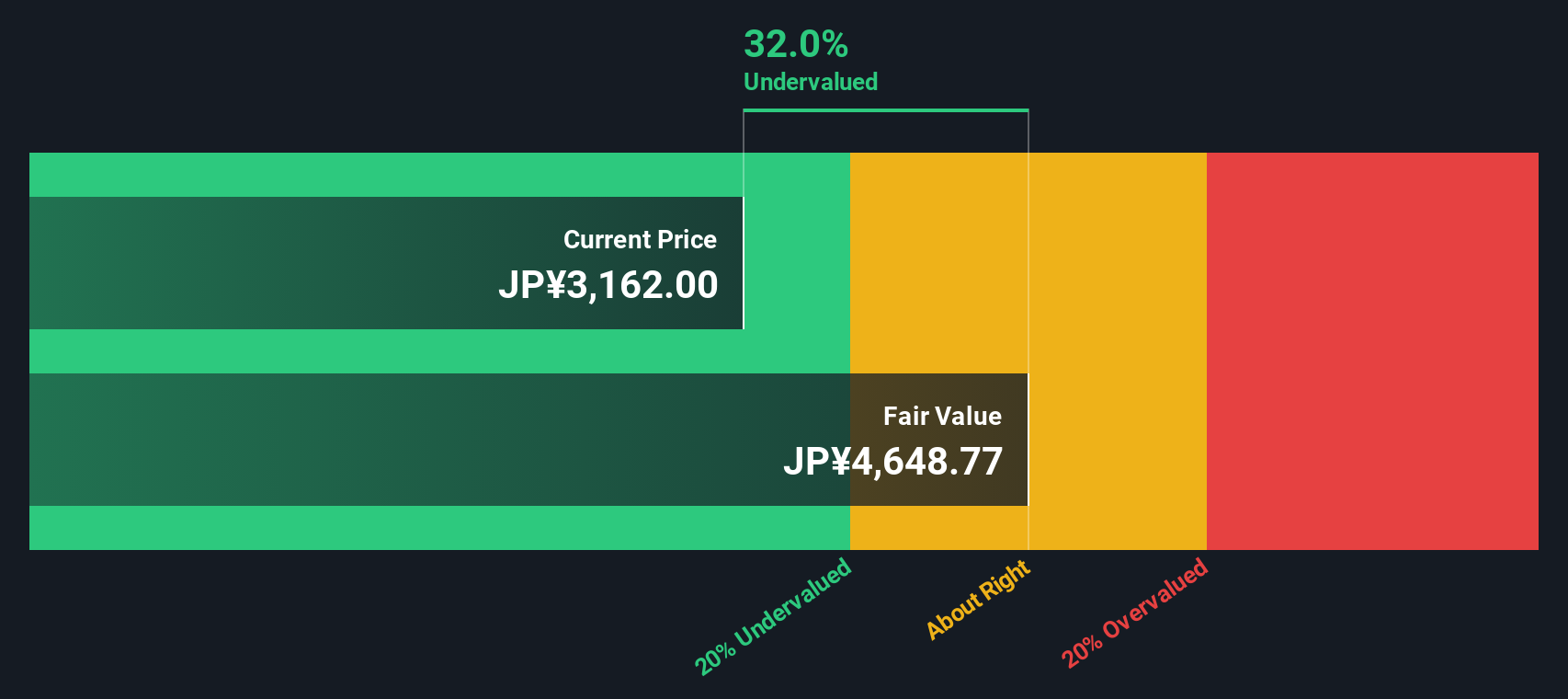

While the price-to-earnings ratio points to a premium valuation, our SWS DCF model provides a different angle. According to this model, Stanley Electric’s shares are trading at a significant 31.8% discount to their estimated fair value. This suggests the stock could have more room to run. Still, does this fundamental assessment tell the complete story, or is the market focusing elsewhere?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stanley Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stanley Electric Narrative

If you want to dig deeper into Stanley Electric’s numbers yourself or prefer forming your own view, you can quickly build and share a personalized take in under three minutes. Do it your way

A great starting point for your Stanley Electric research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunities to just one company. The market is full of fresh possibilities waiting for smart investors like you.

- Capture untapped growth by checking out these 843 undervalued stocks based on cash flows and see which companies the numbers say are still trading below their potential.

- Lock in reliable cash flow with these 18 dividend stocks with yields > 3% offering yields above 3% for investors who want income and stability combined.

- Ride the wave of breakthrough innovation and explore these 33 healthcare AI stocks changing healthcare with next-generation artificial intelligence solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6923

Stanley Electric

Engages in the manufacture, sale, and import/export of automotive and other light bulbs in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives