- Japan

- /

- Auto Components

- /

- TSE:6923

Stanley Electric (TSE:6923) Share Buyback Sparks Fresh Look at Company Valuation

Reviewed by Simply Wall St

Stanley Electric (TSE:6923) revealed it bought back 1,944,600 of its own shares in November 2025, following a Board-approved program to purchase up to 35 million shares. This initiative is intended to strengthen shareholder value and refine the company’s capital structure.

See our latest analysis for Stanley Electric.

The recent share buyback adds a new layer of momentum to Stanley Electric’s story, following a year where the share price climbed 17.8% year-to-date and total shareholder return hit 22% over the past 12 months. This pace suggests investor enthusiasm is building as the company signals greater focus on capital efficiency, supported by steady business growth and the latest repurchase activity.

If you’re interested in broadening your search beyond Stanley Electric, now could be the perfect time to discover See the full list for free.

Yet with shares up nearly 18% this year and trading less than 10% below analyst price targets, investors have to ask: is there more value to unlock in Stanley Electric, or is projected growth already reflected in the current price?

Price-to-Earnings of 12.7x: Is it justified?

Stanley Electric’s shares closed at ¥3,048, trading at a price-to-earnings (P/E) ratio of 12.7x. Despite recent momentum, this figure indicates the stock is valued above the average P/E for the Japanese auto components industry.

The P/E ratio measures how much investors are paying for each yen of earnings and serves as a benchmark for expectations of future growth. For a company like Stanley Electric, which has delivered steady profit increases, a higher P/E could reflect optimism about ongoing business strength or future prospects.

However, Stanley Electric’s P/E of 12.7x is higher than the industry’s 9.9x and also above our estimated fair P/E of 11.5x. This suggests that the current price may be factoring in more growth than is currently being achieved. While the company’s earnings have grown, the premium relative to both peers and fair value leaves less margin of safety for investors if growth slows down.

Explore the SWS fair ratio for Stanley Electric

Result: Price-to-Earnings of 12.7x (OVERVALUED)

However, slower revenue growth or an industry pullback could challenge Stanley Electric’s current valuation and temper recent investor optimism.

Find out about the key risks to this Stanley Electric narrative.

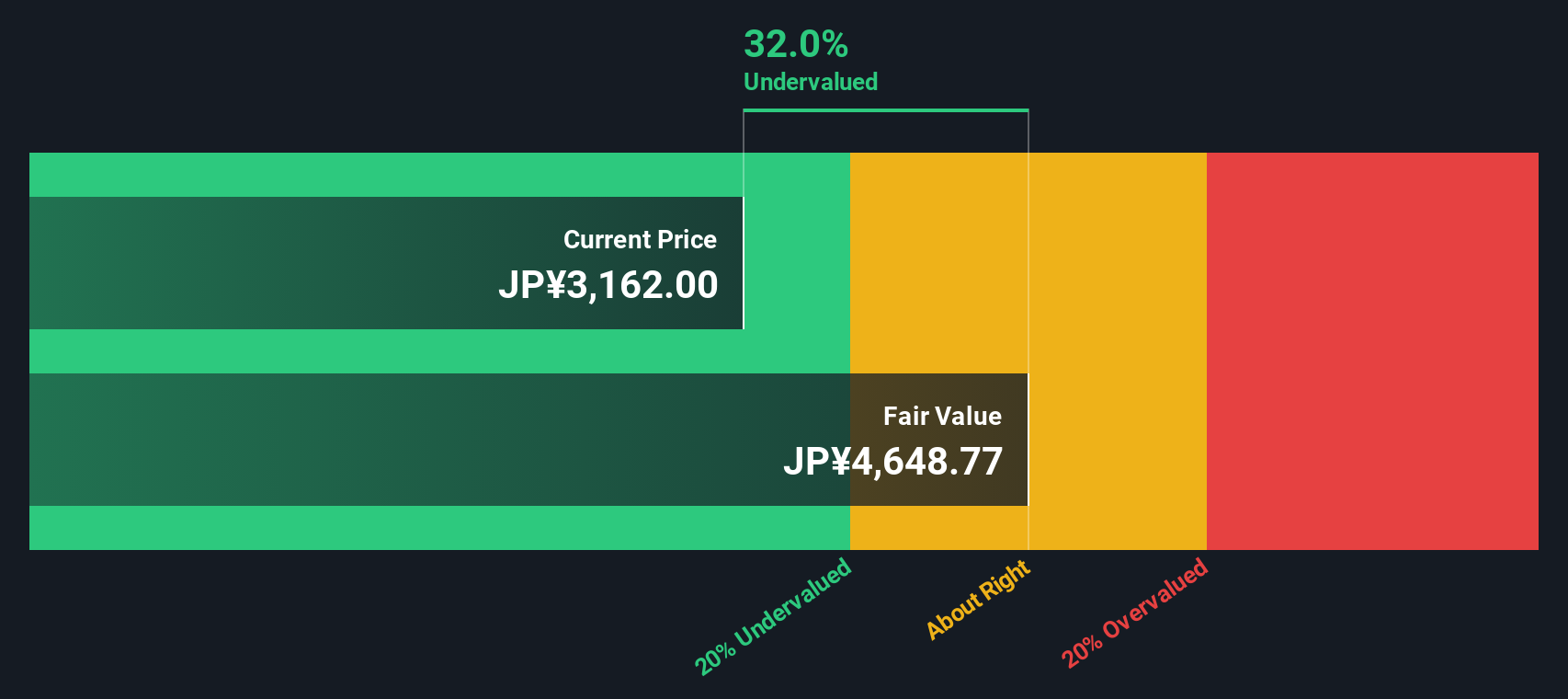

Another View: Our DCF Model Offers a Contradictory Signal

Taking a different perspective, the SWS DCF model suggests Stanley Electric shares are actually trading about 36.6% below their estimated fair value. While traditional valuation ratios imply the stock is pricey, the DCF analysis points toward a potential undervaluation. This gap may reveal an opportunity that simple ratios might miss.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stanley Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stanley Electric Narrative

Feel free to dig into the numbers and develop your own perspective. Crafting your own narrative is possible in just a few minutes. Do it your way

A great starting point for your Stanley Electric research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

The right screener can spark your next winning idea and help you spot underrated gems right before they catch the market’s attention. Don’t let the next big opportunity slip by as others move ahead. Try these handpicked stock ideas today:

- Benefit from breakthrough innovation and jump on these 25 AI penny stocks that are redefining the boundaries of artificial intelligence in the markets.

- Unlock steady returns by tapping into these 14 dividend stocks with yields > 3% known for robust yields and a history of rewarding loyal shareholders.

- Ride the digital finance wave and grow your portfolio with these 81 cryptocurrency and blockchain stocks set to transform payment systems and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6923

Stanley Electric

Engages in the manufacture, sale, and import/export of automotive and other light bulbs in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026