- Japan

- /

- Auto Components

- /

- TSE:5991

Will NHK Spring (TSE:5991) Balance Global Restructuring With Reliable Shareholder Returns?

Reviewed by Sasha Jovanovic

- NHK Spring Co., Ltd. recently announced a second quarter-end dividend increase to JPY 33.00 per share for the six months ended September 30, 2025, and affirmed year-end dividend guidance at JPY 33.00 per share for the fiscal year ending March 31, 2026.

- The board also reviewed the potential dissolution and liquidation of its local subsidiaries in China, a decision that could reshape the company’s geographic operations.

- We’ll explore how the dividend increase reflects NHK Spring’s commitment to shareholder returns and its evolving investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is NHK Spring's Investment Narrative?

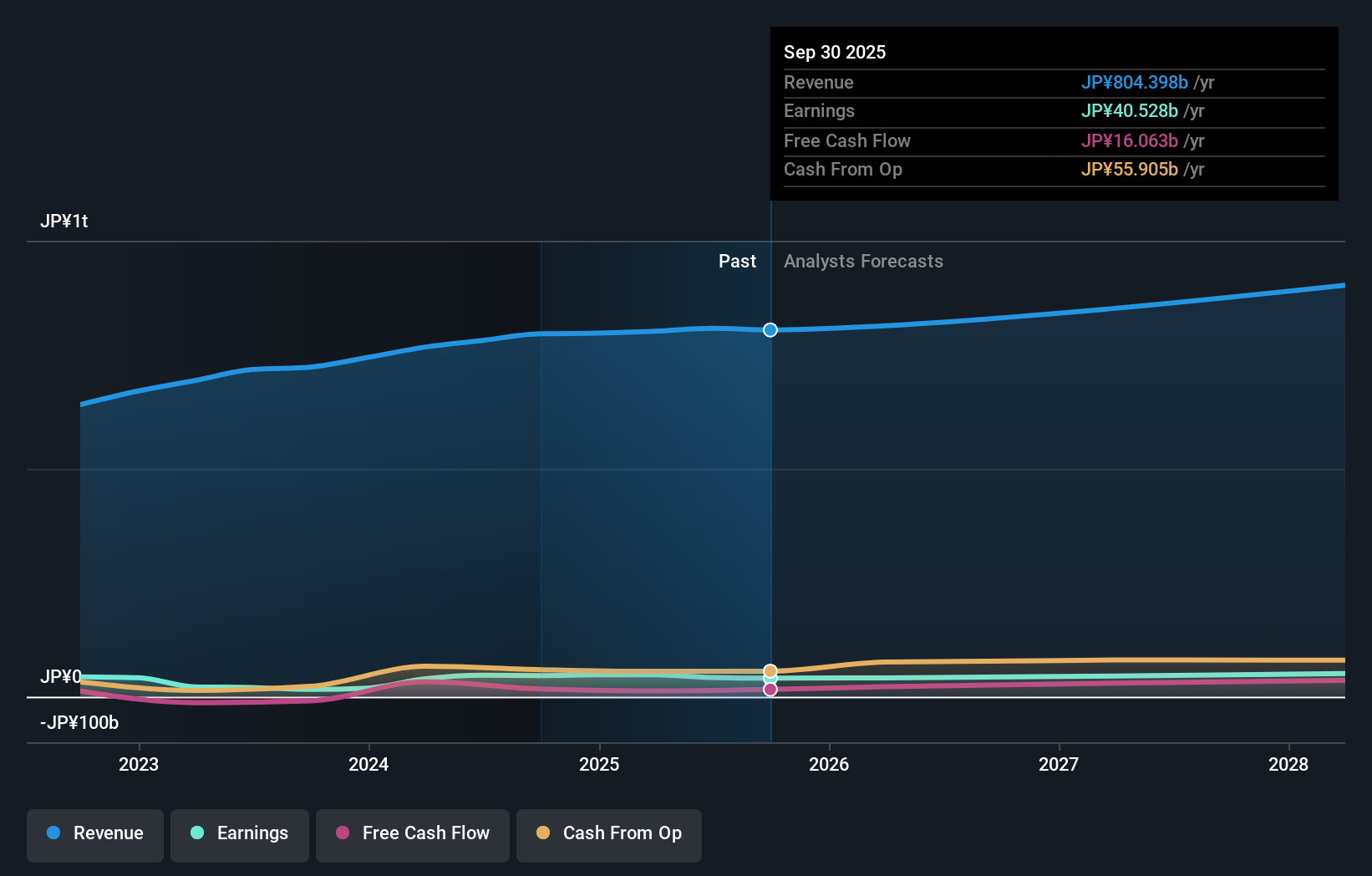

If you’re considering NHK Spring for your portfolio, the key logic is belief in steady value creation driven by shareholder-friendly policies and disciplined operational shifts. The boost in interim dividends, coming while the board weighs a potential China withdrawal, puts a spotlight on short-term catalysts like cash returns and regional focus. While the dividend raise signals ongoing cash generation capacity, the possible exit from China could alter growth prospects and geographic risk profiles. Before this announcement, most saw the company’s slow revenue growth and board turnover as risks competing with strong valuation and profitable operations. Now, with the Chinese business potentially winding down, risk calculations around future revenue and diversification could shift, but the immediate market reaction suggests that for now, the material impact isn’t clear cut. The stock’s recent volatility only adds to the wait-and-see mood.

But in contrast to dividend optimism, the uncertainty over Chinese operations is information no investor should ignore. Despite retreating, NHK Spring's shares might still be trading 37% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on NHK Spring - why the stock might be worth just ¥3718!

Build Your Own NHK Spring Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NHK Spring research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NHK Spring research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NHK Spring's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NHK Spring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5991

NHK Spring

Manufactures and sells automotive parts in Japan, rest of Asia, America, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives