- Japan

- /

- Auto Components

- /

- TSE:5991

NHK Spring (TSE:5991): Valuation Insights Following Dividend Increase and China Restructuring Plans

Reviewed by Simply Wall St

NHK Spring (TSE:5991) just revealed a higher interim dividend for the six months ended September 2025, increasing from last year’s payout. The company also announced plans to review its subsidiary structure in China. Both moves are significant for investors tracking the company’s strategic direction.

See our latest analysis for NHK Spring.

NHK Spring’s shareholder moves come amid a year of standout momentum, with the share price rising 2.6% over the past week and a substantial 27.9% over the last three months, despite some volatility in recent weeks. The one-year total shareholder return sits at an impressive 37.5%. Long-term holders have seen the company multiply their investment several times over across five years. The recent dividend lift and restructuring talk seem to have reinforced investor optimism for both steady income and future growth.

If you’re looking for more opportunities in the automotive sector, discover what’s trending with our comprehensive See the full list for free..

With such strong numbers and new strategic actions, it raises the question for investors: is NHK Spring’s upside just beginning, or have markets already factored in its future growth potential at these levels?

Price-to-Earnings of 11.9x: Is it justified?

NHK Spring’s current share price of ¥2,378 puts its price-to-earnings (P/E) ratio at 11.9x, higher than the auto components industry average but lower than that of its broader peer group.

The P/E ratio represents how much investors are willing to pay today for a yen of current earnings. It serves as a quick indicator of expectations for future profit growth. For a manufacturer like NHK Spring, it reflects anticipated stability and expansion potential in earnings streams, shaped by both global auto demand and company-specific strategies.

At 11.9x, NHK Spring’s P/E is above the typical 9.8x seen among Japanese auto parts makers, which signals a premium. However, it trades below the peer group’s average of 16.4x, suggesting the market sees some upside but remains cautious. Notably, our fair P/E estimate stands at 14.5x, a level the market could move toward if the optimism for earnings growth continues to strengthen.

Explore the SWS fair ratio for NHK Spring

Result: Price-to-Earnings of 11.9x (ABOUT RIGHT)

However, a slowdown in global auto demand or unexpected regulatory shifts in China could quickly temper current optimism for NHK Spring’s future growth.

Find out about the key risks to this NHK Spring narrative.

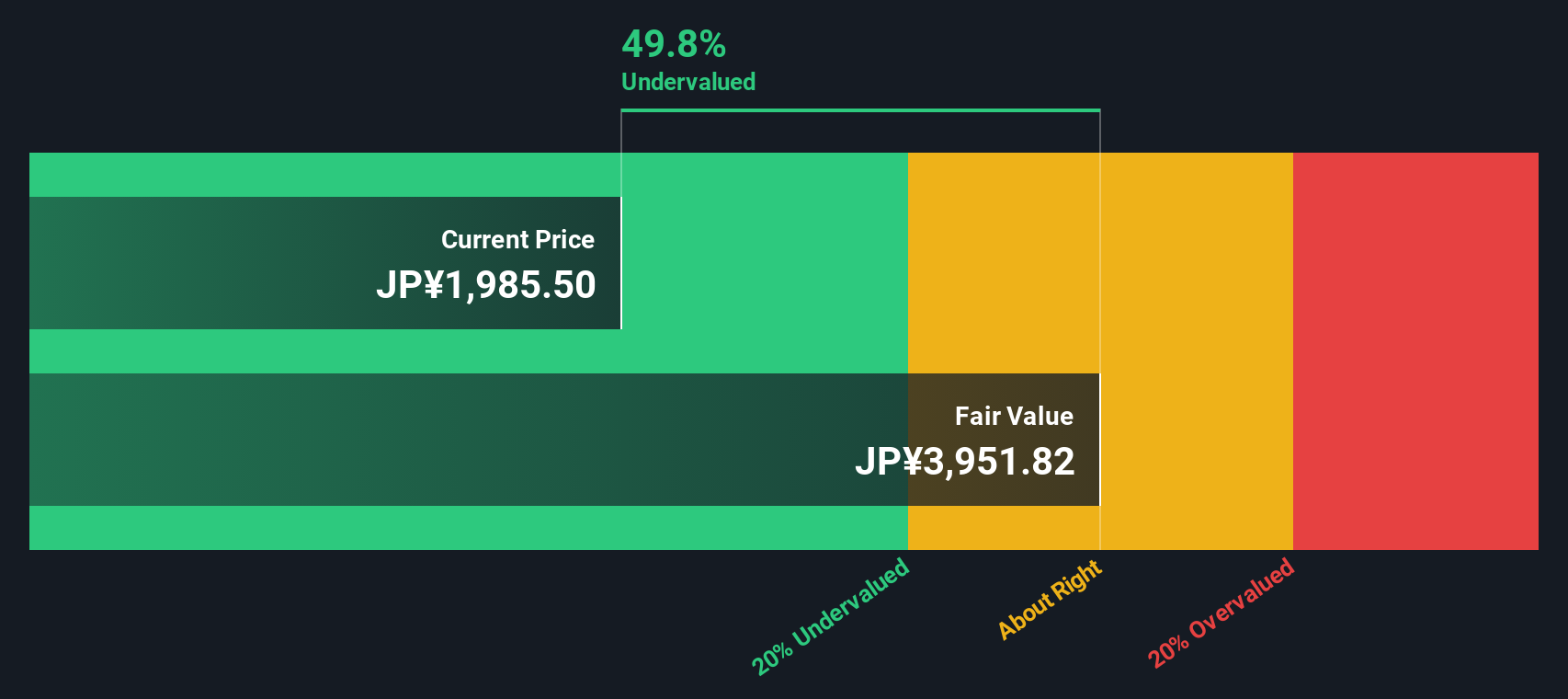

Another View: Discounted Cash Flow Suggests More Upside

While the current P/E ratio points to only a moderate premium for NHK Spring, our DCF model provides a strikingly different perspective. Based on projected future cash flows, the SWS DCF model calculates a fair value of ¥3,730, well above today’s price, suggesting NHK Spring may be significantly undervalued by the market. Could this mean the upside story is bigger than many expect?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NHK Spring for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NHK Spring Narrative

If you’d like to test your own ideas or take a different angle on NHK Spring’s outlook, it only takes a few minutes to build your own analysis. Do it your way.

A great starting point for your NHK Spring research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd with investment opportunities that might surprise you, each tailored to different goals and market trends for savvy decision makers.

- Kickstart your search for big returns with these 3580 penny stocks with strong financials, offering solid financials and untapped growth potential waiting to be harnessed.

- Target tomorrow's breakthroughs by checking out these 30 healthcare AI stocks, where innovation meets healthcare for those who want early exposure to transformational trends.

- Power up your portfolio with steady income through these 14 dividend stocks with yields > 3%, highlighting strong companies boasting yields over 3% for reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NHK Spring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5991

NHK Spring

Manufactures and sells automotive parts in Japan, rest of Asia, America, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success