Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, H-One Co.,Ltd. (TSE:5989) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for H-OneLtd

What Is H-OneLtd's Net Debt?

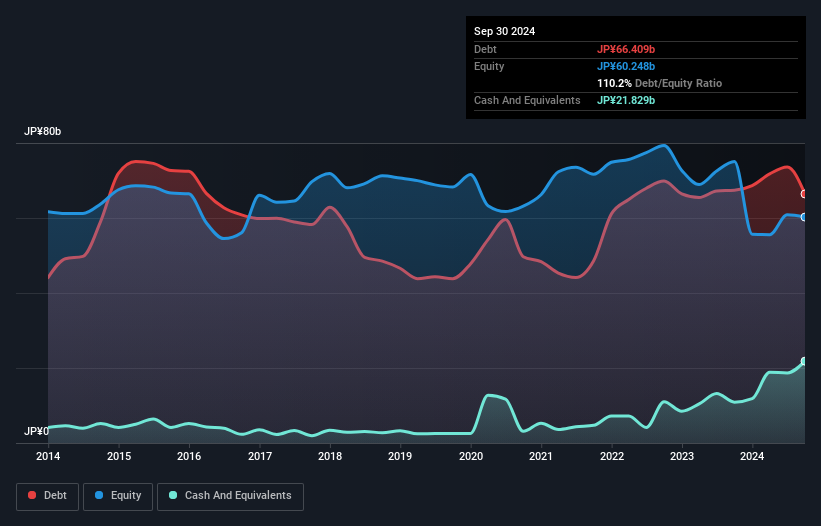

As you can see below, H-OneLtd had JP¥66.4b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has JP¥21.8b in cash leading to net debt of about JP¥44.6b.

How Healthy Is H-OneLtd's Balance Sheet?

The latest balance sheet data shows that H-OneLtd had liabilities of JP¥83.2b due within a year, and liabilities of JP¥36.4b falling due after that. On the other hand, it had cash of JP¥21.8b and JP¥35.8b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥62.0b.

This deficit casts a shadow over the JP¥30.1b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, H-OneLtd would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

H-OneLtd's net debt of 2.1 times EBITDA suggests graceful use of debt. And the fact that its trailing twelve months of EBIT was 7.2 times its interest expenses harmonizes with that theme. We also note that H-OneLtd improved its EBIT from a last year's loss to a positive JP¥10b. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since H-OneLtd will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, H-OneLtd actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

H-OneLtd's level of total liabilities and net debt to EBITDA definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. When we consider all the factors discussed, it seems to us that H-OneLtd is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that H-OneLtd is showing 3 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if H-OneLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5989

H-OneLtd

Manufactures and sells automotive and motorcycle parts, and dies and welding equipment in Japan and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives