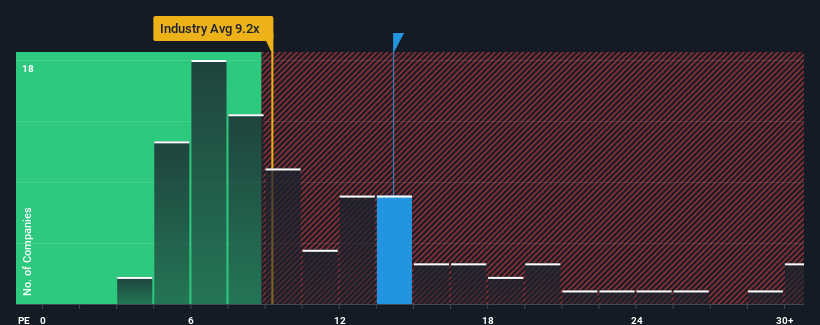

With a median price-to-earnings (or "P/E") ratio of close to 15x in Japan, you could be forgiven for feeling indifferent about Bridgestone Corporation's (TSE:5108) P/E ratio of 14.2x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Bridgestone's earnings growth of late has been pretty similar to most other companies. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Check out our latest analysis for Bridgestone

How Is Bridgestone's Growth Trending?

Bridgestone's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a decent 8.6% gain to the company's bottom line. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 10% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 10% per year, which is not materially different.

In light of this, it's understandable that Bridgestone's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Bridgestone maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Bridgestone you should be aware of.

If you're unsure about the strength of Bridgestone's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bridgestone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5108

Bridgestone

Manufactures and sells tires and rubber products in Japan, China, India, the Asia Pacific, the United States, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives