- Japan

- /

- Auto Components

- /

- TSE:5108

How Bridgestone's Stock Split and Lower Guidance Will Impact Investors (TSE:5108)

Reviewed by Sasha Jovanovic

- On November 12, 2025, Bridgestone’s board approved a stock split and changes to its Articles of Incorporation, alongside a downward revision of its full-year earnings guidance due to weaker North American performance and challenging market conditions.

- This combination of corporate actions and guidance adjustment reflects mounting pressure on Bridgestone’s business from both economic headwinds and operational disruptions in the region.

- Given the revised outlook, we'll explore how the softer U.S. market and cyber incidents may alter Bridgestone's investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bridgestone Investment Narrative Recap

Owning Bridgestone means believing in its ability to rebound from cyclical pressure in core markets while capturing value from premium tire solutions and ongoing restructuring efforts, despite near-term headwinds. The recent downward revision to full-year guidance underscores the biggest immediate risk: lower unit sales and profit pressure in North America, exacerbated by operational challenges such as cyber incidents, which may affect even the most promising growth catalysts in the short term.

Among the latest announcements, the board-approved stock split stands out. While stock splits do not alter the company’s intrinsic value, this corporate action, paired with amendments to Bridgestone’s Articles of Incorporation, may affect accessibility and liquidity but is unlikely to materially shift the current risk-reward profile for investors in light of ongoing operational pressures.

By contrast, cyber incidents impacting North American operations represent a risk that investors should watch closely for changes in...

Read the full narrative on Bridgestone (it's free!)

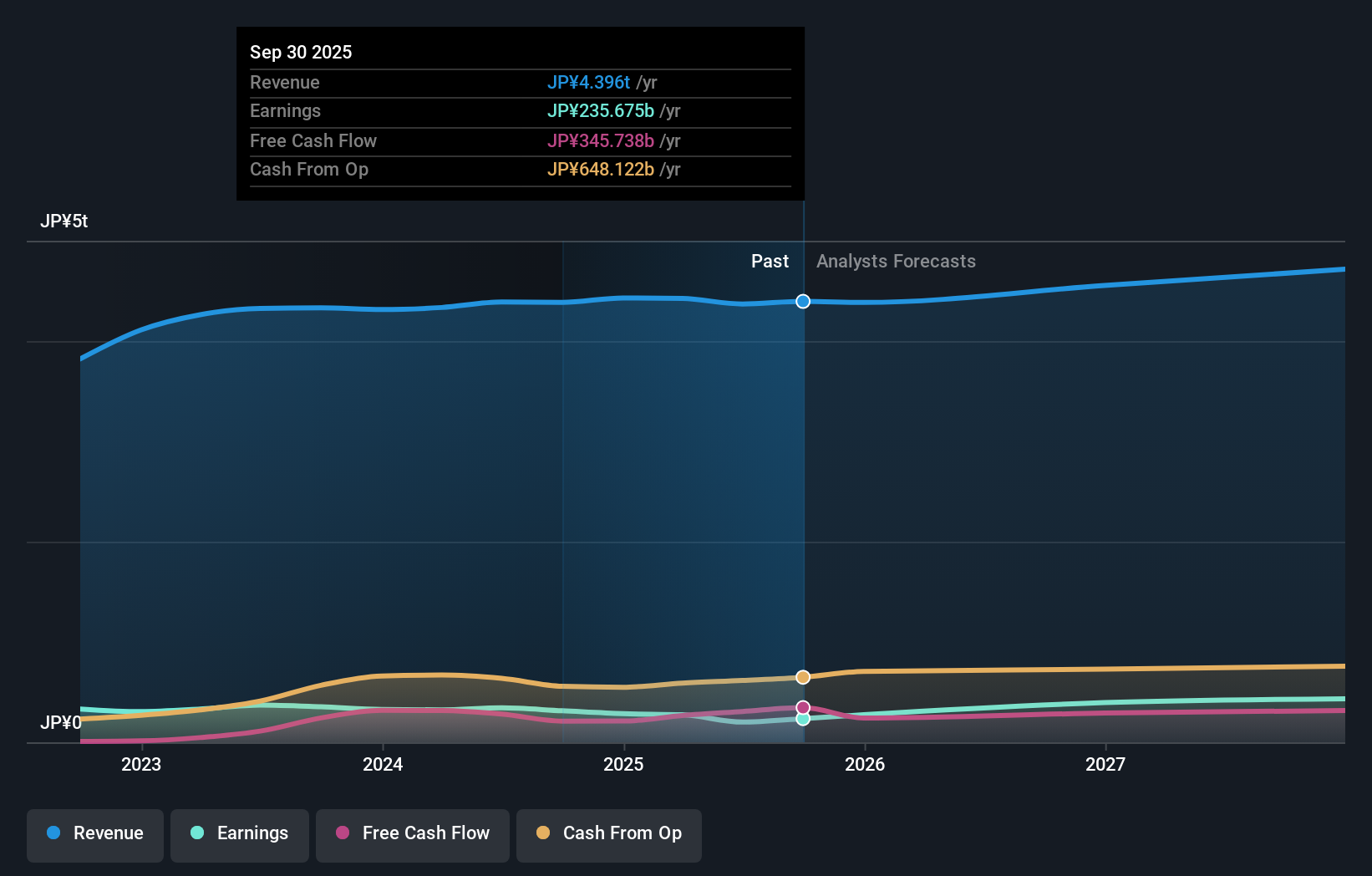

Bridgestone's outlook forecasts ¥4,780.0 billion in revenue and ¥453.9 billion in earnings by 2028. This is based on an annual revenue growth rate of 3.0% and a ¥252.8 billion increase in earnings from the current level of ¥201.1 billion.

Uncover how Bridgestone's forecasts yield a ¥7332 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community has contributed 1 estimate of fair value for Bridgestone, all clustering at ¥7,331.82. While investor opinions can vary, the lowered guidance and pressure in core North American segments reinforce the need to weigh different outlooks for the company’s next steps.

Explore another fair value estimate on Bridgestone - why the stock might be worth as much as ¥7332!

Build Your Own Bridgestone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bridgestone research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bridgestone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bridgestone's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bridgestone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5108

Bridgestone

Manufactures and sells tires and rubber products in Japan, China, India, the Asia Pacific, the United States, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives