- Japan

- /

- Auto Components

- /

- TSE:5108

Bridgestone (TSE:5108) Valuation: Is There More Upside After a 28% Share Price Rally?

Reviewed by Simply Wall St

Bridgestone (TSE:5108) shares have shifted slightly in recent trading. Investors may be taking stock of recent performance, as the stock has risen nearly 28% over the past year and year-to-date gains are at a similar level.

See our latest analysis for Bridgestone.

Bridgestone's momentum has remained strong after last year's rally, with a 27% year-to-date share price return that builds on a robust 28% total shareholder return over the past twelve months. Solid long-term results suggest that investors are warming to the company's growth prospects and improved earnings outlook.

If Bridgestone's gains have you rethinking your own watchlist, this could be a good moment to broaden your search and discover See the full list for free.

But with shares rising so sharply, the key question for investors is whether Bridgestone still trades at an attractive valuation or if the market has already priced in its future growth prospects and left little room for upside.

Most Popular Narrative: 5.5% Undervalued

The current narrative sets Bridgestone's fair value at ¥7,222 per share, notably above its recent close of ¥6,827. This narrative comes to life through bold expectations. Here is what’s driving its upbeat outlook.

Bridgestone is focusing on restructuring and rebuilding its European and Latin American operations, particularly aiming to improve profitability by optimizing production and distribution. This effort should positively impact net margins as efficiency improves by 2026.

Craving the full story behind this valuation? The narrative banks on sharp profit growth, margin recovery, and aggressive operational changes. What precise shifts in financials justify these numbers, and how optimistic are they? Dive in to uncover the assumptions that underpin Bridgestone’s surprising upside.

Result: Fair Value of ¥7,222 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds persist, including continued competitive pressure in Latin America and restructuring costs in Europe, which could delay Bridgestone’s anticipated margin recovery.

Find out about the key risks to this Bridgestone narrative.

Another View: Multiples Raise Concerns

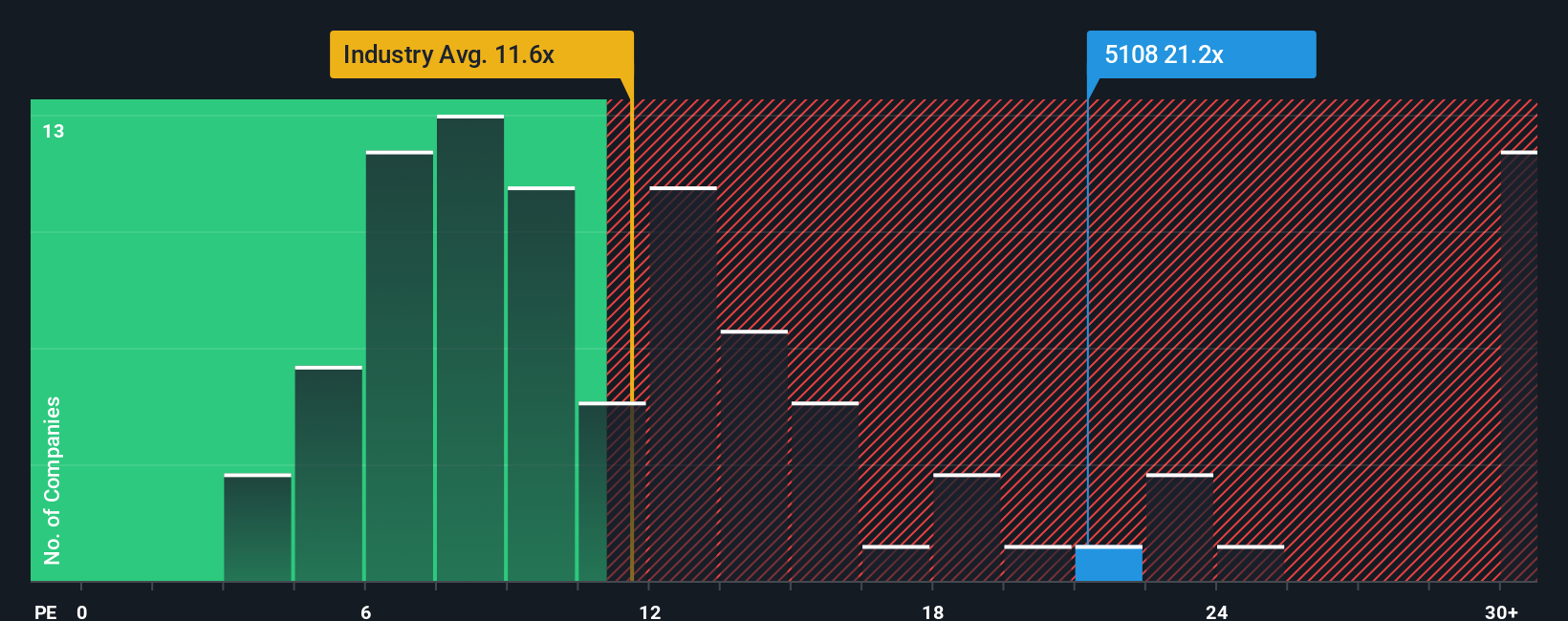

While the narrative suggests Bridgestone is undervalued, the market’s current price-to-earnings ratio of 22.4× tells a different story. This figure is not only above the industry average of 11.2× and the peer average of 15.5×, but also higher than its own fair ratio of 19.5×. Such a premium could signal that the market already expects strong growth, leaving little margin for error if forecasts prove too optimistic. Is the optimism overextended, or is it justified given recent momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bridgestone Narrative

If the narrative does not align with your perspective or you would rather rely on your own analysis, you can craft a custom view quickly using Do it your way.

A great starting point for your Bridgestone research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart investment opportunities?

Don't limit your potential by focusing on just one stock. Stay ahead of the market by using Simply Wall Street's Screener to spot fresh investment ideas tailored to your interests. Check out these exciting options right now before others snap them up.

- Catalyze your returns by targeting these 850 undervalued stocks based on cash flows, identified as trading below their intrinsic worth based on cash flow analysis.

- Access income-generating companies with strong yields by checking out these 20 dividend stocks with yields > 3%, delivering consistent payouts above 3%.

- Step into the future of healthcare by exploring these 33 healthcare AI stocks, harnessing artificial intelligence to transform patient care and diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bridgestone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5108

Bridgestone

Manufactures and sells tires and rubber products in Japan, China, India, the Asia Pacific, the United States, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives