- Japan

- /

- Auto Components

- /

- TSE:5108

Bridgestone (TSE:5108) Valuation: Assessing Price After Potenza RE-71RZ Performance Tire Launch

Reviewed by Simply Wall St

Bridgestone (TSE:5108) has expanded its Potenza line with the launch of the Potenza RE-71RZ, a tire designed for grassroots racing that highlights the company’s focus on performance, innovation, and sustainability. This latest product uses ENLITEN technology to enhance both track results and on-road durability.

See our latest analysis for Bridgestone.

The launch of Bridgestone’s latest Potenza tire lands at a time when momentum is clearly building. After an impressive 36% year-to-date share price return and a standout total shareholder return of over 41% in the past year, investors are seeing renewed confidence in the company’s growth story and innovation streak. The strong rally underscores how product breakthroughs and a sharper focus on technology have helped boost market sentiment over both the short and long term.

If you’re curious about how similar innovation is shaping the auto sector, it’s a great moment to explore See the full list for free.

But with shares riding high after outsized gains, the key question is whether Bridgestone still offers value or if recent successes are now fully reflected in the price. Is this a buying opportunity, or has the market already priced in future growth?

Most Popular Narrative: 4.3% Undervalued

Bridgestone’s most popular narrative suggests fair value is slightly above the latest closing price. This reflects an outlook where recent performance only partly captures its true earnings potential. Here’s a closer look at the catalyst powering this perspective.

Bridgestone is focusing on restructuring and rebuilding its European and Latin American operations, particularly aiming to improve profitability by optimizing production and distribution. This effort should positively impact net margins as efficiency improves by 2026.

What is fueling the bullish fair value? The story hinges on revenue and profit margin upgrades as well as a planned transformation in how Bridgestone earns across multiple regions. Want to see which major assumptions are driving their outlook? Find out what could spark the next move directly from the analysts’ playbook.

Result: Fair Value of ¥7,629 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in Latin America and increased low-cost imports in North America could pressure margins. This may potentially temper the upbeat outlook for Bridgestone.

Find out about the key risks to this Bridgestone narrative.

Another View: Examining Price-to-Earnings Signals

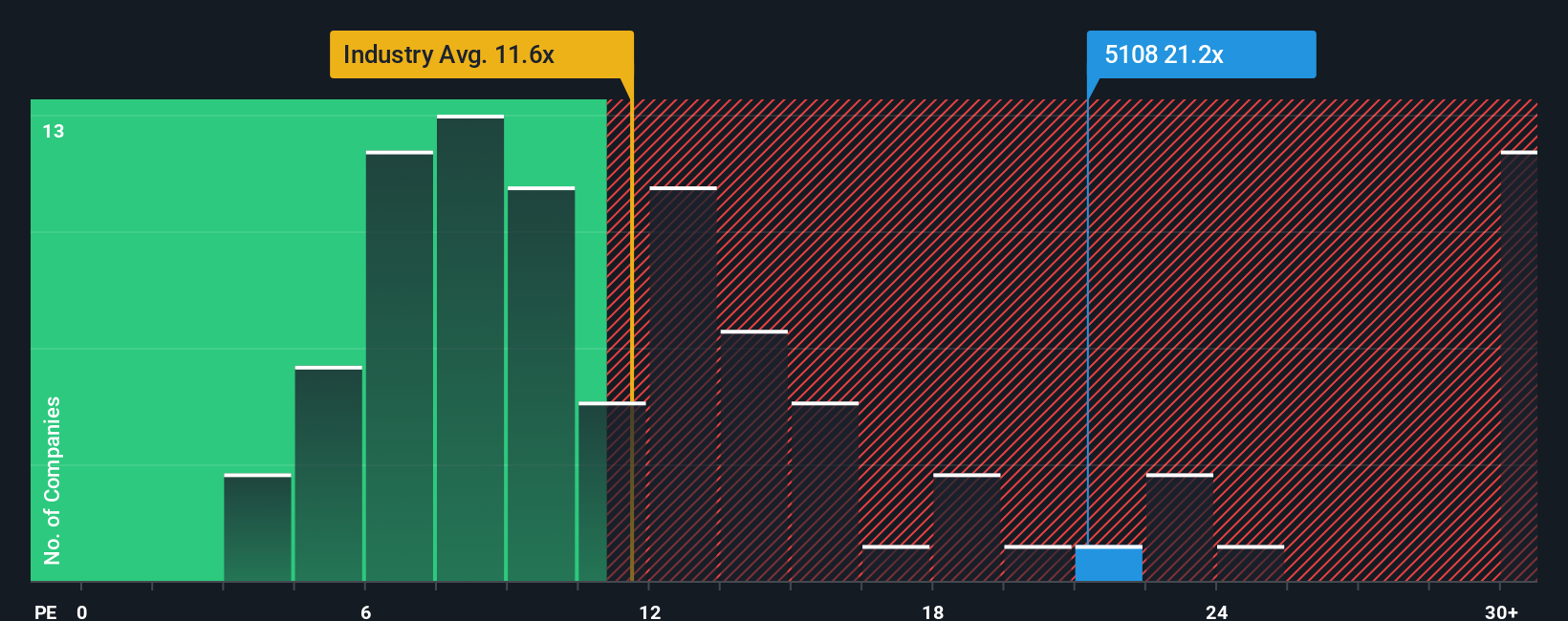

Stepping back from fair value estimates, if we look at Bridgestone’s price-to-earnings ratio, a different picture emerges. The company’s P/E ratio of 19.9x is much higher than both the auto components industry average at 9.9x and its peers’ average of 15.8x. Even compared to a fair ratio of 16x, Bridgestone stands out as expensive. This raises the stakes as investors consider whether they are paying too much for expected growth or if fundamentals could soon catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bridgestone Narrative

If this perspective doesn’t quite fit your expectations, you can explore the numbers and craft your own interpretation in just a few minutes. Do it your way.

A great starting point for your Bridgestone research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the next wave of market opportunities that others might miss, and use the power of Smart Screening to stay ahead of the curve on Simply Wall Street.

- Turbocharge your passive income potential and sort through these 14 dividend stocks with yields > 3% offering robust yields above 3% for long-term growth and stability.

- Get ahead of the curve in tech innovation and spot what’s driving value across these 25 AI penny stocks as artificial intelligence reshapes industries worldwide.

- Capitalize on unrecognized opportunities and find these 928 undervalued stocks based on cash flows based on real cash flow forecasts before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bridgestone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5108

Bridgestone

Manufactures and sells tires and rubber products in Japan, China, India, the Asia Pacific, the United States, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026