If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Terna (BIT:TRN) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Terna:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.092 = €1.3b ÷ (€21b - €6.1b) (Based on the trailing twelve months to March 2023).

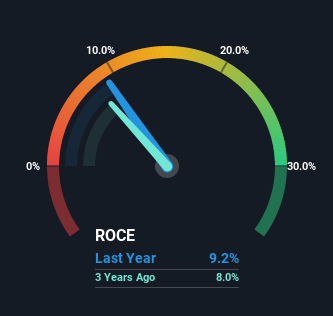

Therefore, Terna has an ROCE of 9.2%. Even though it's in line with the industry average of 9.1%, it's still a low return by itself.

See our latest analysis for Terna

In the above chart we have measured Terna's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

SWOT Analysis for Terna

- Earnings growth over the past year exceeded its 5-year average.

- Debt is well covered by earnings.

- Earnings growth over the past year underperformed the Electric Utilities industry.

- Dividend is low compared to the top 25% of dividend payers in the Electric Utilities market.

- Expensive based on P/E ratio and estimated fair value.

- Annual revenue is forecast to grow faster than the Italian market.

- Debt is not well covered by operating cash flow.

- Dividends are not covered by cash flow.

- Annual earnings are forecast to grow slower than the Italian market.

The Trend Of ROCE

There hasn't been much to report for Terna's returns and its level of capital employed because both metrics have been steady for the past five years. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. So unless we see a substantial change at Terna in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger. That probably explains why Terna has been paying out 77% of its earnings as dividends to shareholders. Most shareholders probably know this and own the stock for its dividend.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 30% of total assets, this reported ROCE would probably be less than9.2% because total capital employed would be higher.The 9.2% ROCE could be even lower if current liabilities weren't 30% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

The Bottom Line On Terna's ROCE

We can conclude that in regards to Terna's returns on capital employed and the trends, there isn't much change to report on. Investors must think there's better things to come because the stock has knocked it out of the park, delivering a 115% gain to shareholders who have held over the last five years. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

On a final note, we found 2 warning signs for Terna (1 makes us a bit uncomfortable) you should be aware of.

While Terna may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Terna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TRN

Terna

Provides electricity transmission and dispatching services in Italy, other Euro-area countries, and internationally.

Solid track record average dividend payer.