- Italy

- /

- Electric Utilities

- /

- BIT:TRN

Is Now The Time To Put Terna - Rete Elettrica Nazionale Società per Azioni (BIT:TRN) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Terna - Rete Elettrica Nazionale Società per Azioni (BIT:TRN). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Terna - Rete Elettrica Nazionale Società per Azioni

Terna - Rete Elettrica Nazionale Società per Azioni's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Terna - Rete Elettrica Nazionale Società per Azioni has grown EPS by 5.1% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

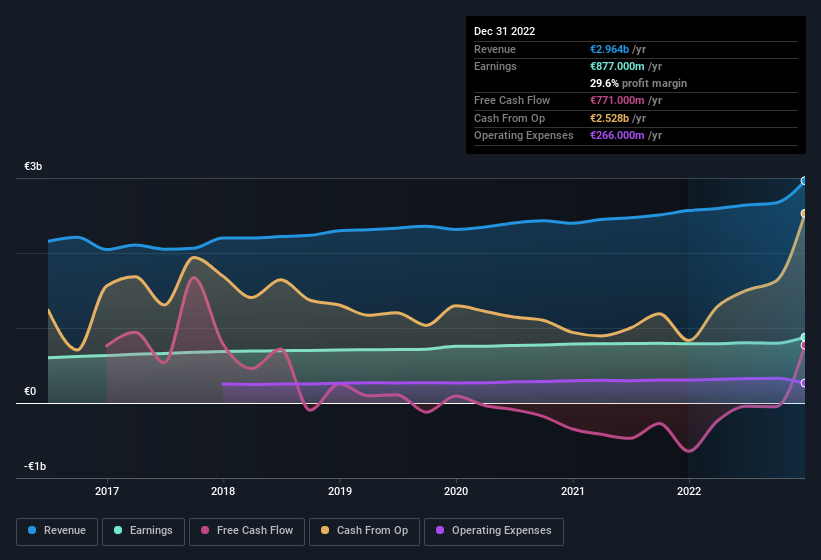

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Terna - Rete Elettrica Nazionale Società per Azioni maintained stable EBIT margins over the last year, all while growing revenue 16% to €3.0b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Terna - Rete Elettrica Nazionale Società per Azioni.

Are Terna - Rete Elettrica Nazionale Società per Azioni Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like Terna - Rete Elettrica Nazionale Società per Azioni, with market caps over €7.3b, is about €4.0m.

Terna - Rete Elettrica Nazionale Società per Azioni offered total compensation worth €2.2m to its CEO in the year to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Terna - Rete Elettrica Nazionale Società per Azioni To Your Watchlist?

One positive for Terna - Rete Elettrica Nazionale Società per Azioni is that it is growing EPS. That's nice to see. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. So all in all Terna - Rete Elettrica Nazionale Società per Azioni is worthy at least considering for your watchlist. You still need to take note of risks, for example - Terna - Rete Elettrica Nazionale Società per Azioni has 1 warning sign we think you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Terna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TRN

Terna

Provides electricity transmission and dispatching services in Italy, other Euro-area countries, and internationally.

Solid track record average dividend payer.