The European market has recently experienced a lift, with the pan-European STOXX Europe 600 Index rising by 1.77% following the reopening of the U.S. federal government, although enthusiasm was tempered by cooling sentiment around artificial intelligence investments. In this environment, dividend stocks can be particularly appealing as they offer potential income stability amidst fluctuating market conditions and economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.28% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.45% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.21% | ★★★★★★ |

| Evolution (OM:EVO) | 4.98% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.43% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.32% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.77% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.75% | ★★★★★★ |

| Afry (OM:AFRY) | 4.00% | ★★★★★☆ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

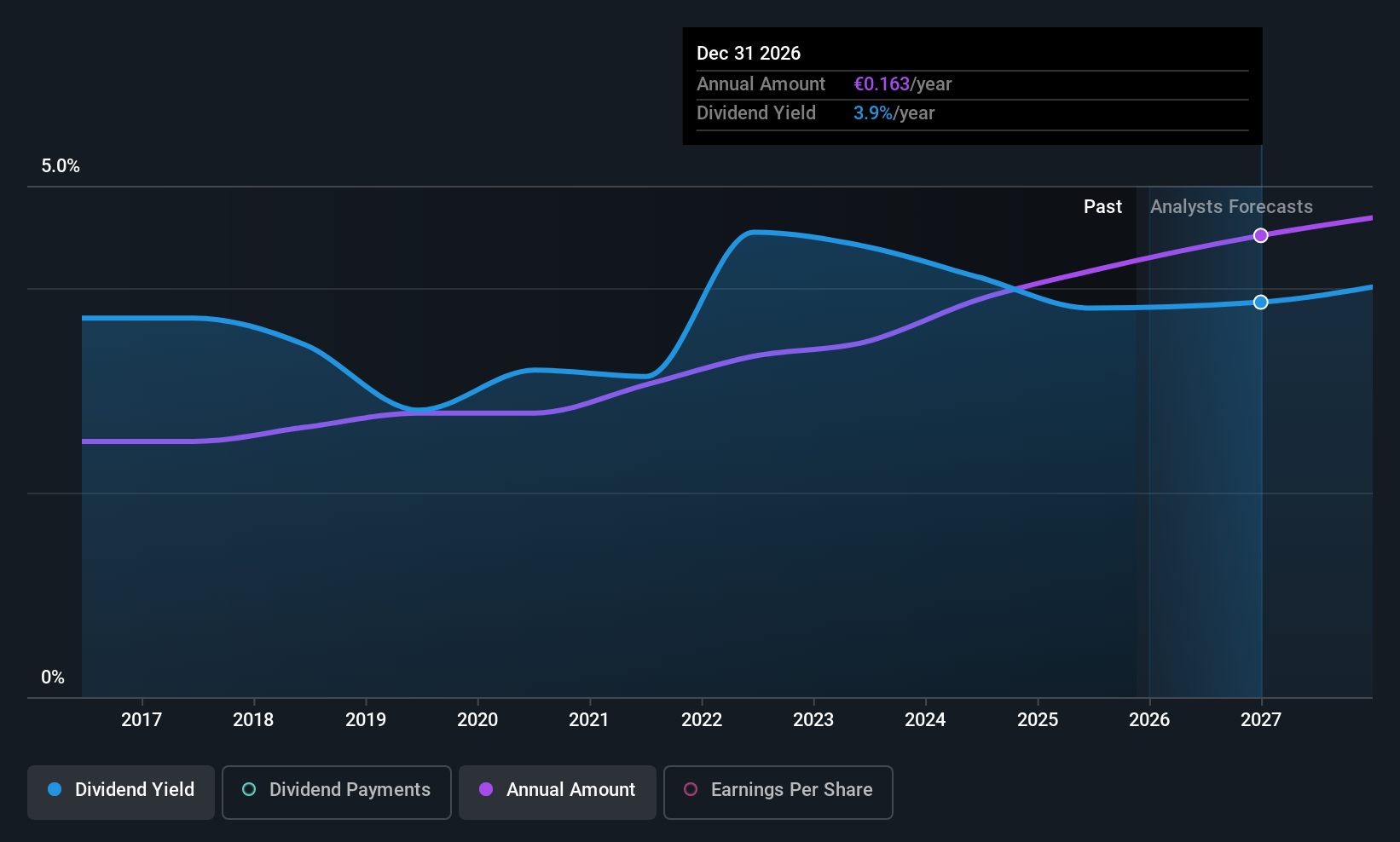

Hera (BIT:HER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hera S.p.A. is a multi-utility company operating in waste management, water services, and energy sectors in Italy, with a market cap of €6.02 billion.

Operations: Hera S.p.A. generates revenue from various segments, including €6.22 billion from gas, €4.83 billion from electricity, €1.28 billion from the water cycle, and €1.71 billion from waste management services in Italy.

Dividend Yield: 3.7%

Hera's dividends have been stable and reliable over the past decade, with consistent growth and minimal volatility. However, the dividend yield of 3.66% is lower than the top Italian market payers. While earnings cover the dividend well with a payout ratio of 43.2%, free cash flow coverage is inadequate due to a high cash payout ratio of 111.8%. The stock trades at a favorable price-to-earnings ratio compared to the broader Italian market, despite its high debt level. Recent earnings show moderate growth in sales and net income for nine months ending September 2025, indicating ongoing operational strength.

- Dive into the specifics of Hera here with our thorough dividend report.

- According our valuation report, there's an indication that Hera's share price might be on the cheaper side.

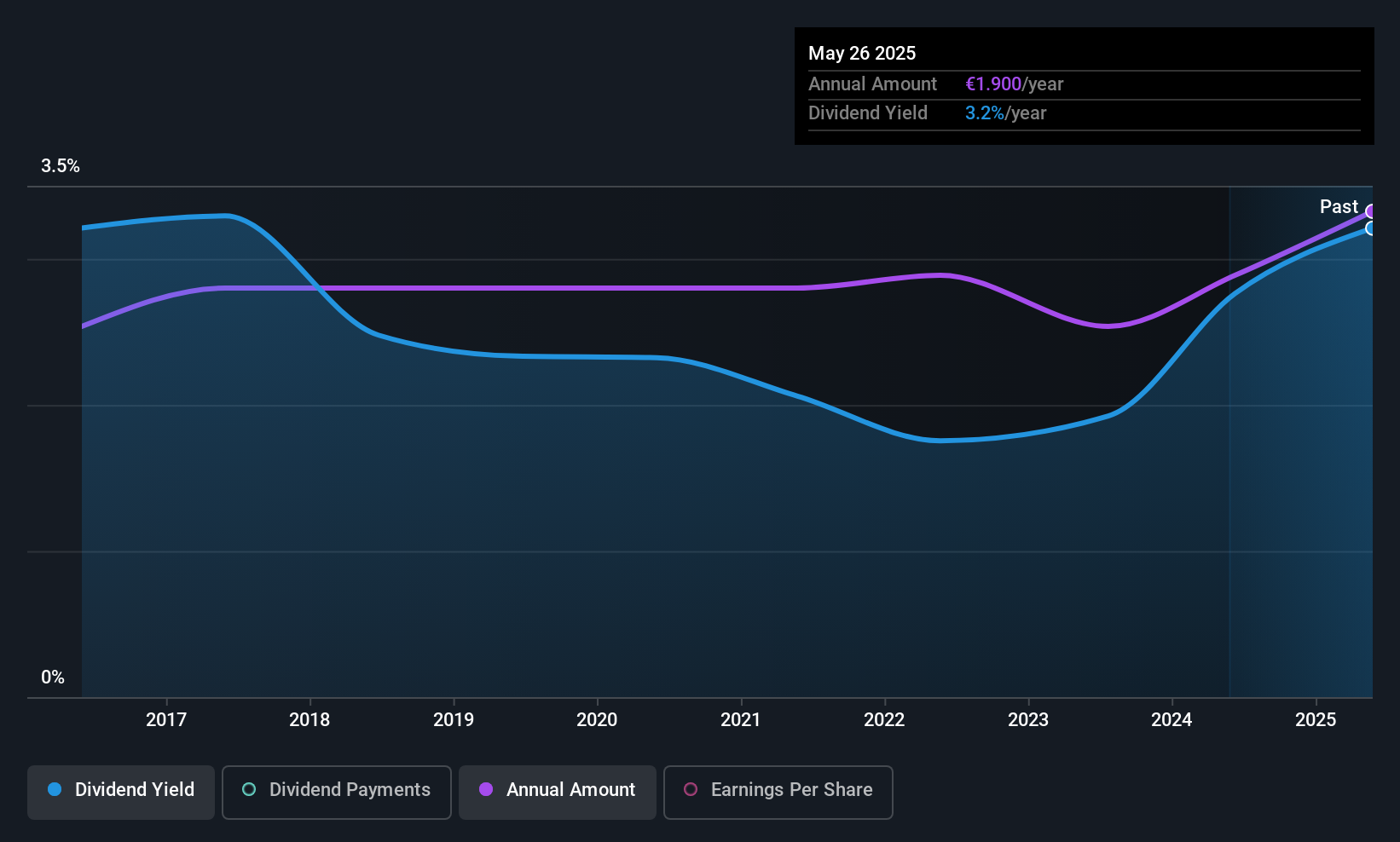

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Südwestdeutsche Salzwerke AG, with a market cap of €640.96 million, operates in the mining, production, and sale of salt across Germany, the European Union, and international markets.

Operations: Südwestdeutsche Salzwerke AG generates revenue primarily from its Salt segment (€280.27 million) and Waste Management segment (€65.48 million).

Dividend Yield: 3.1%

Südwestdeutsche Salzwerke has maintained stable and reliable dividend payments over the past decade, with consistent growth. However, its current yield of 3.11% is below the top German market payers. The payout ratio of 66.6% suggests earnings cover dividends, but a high cash payout ratio of 125.8% indicates insufficient free cash flow coverage, raising concerns about sustainability despite recent stability in share price volatility over three months ending November 2025.

- Click here to discover the nuances of Südwestdeutsche Salzwerke with our detailed analytical dividend report.

- Our expertly prepared valuation report Südwestdeutsche Salzwerke implies its share price may be too high.

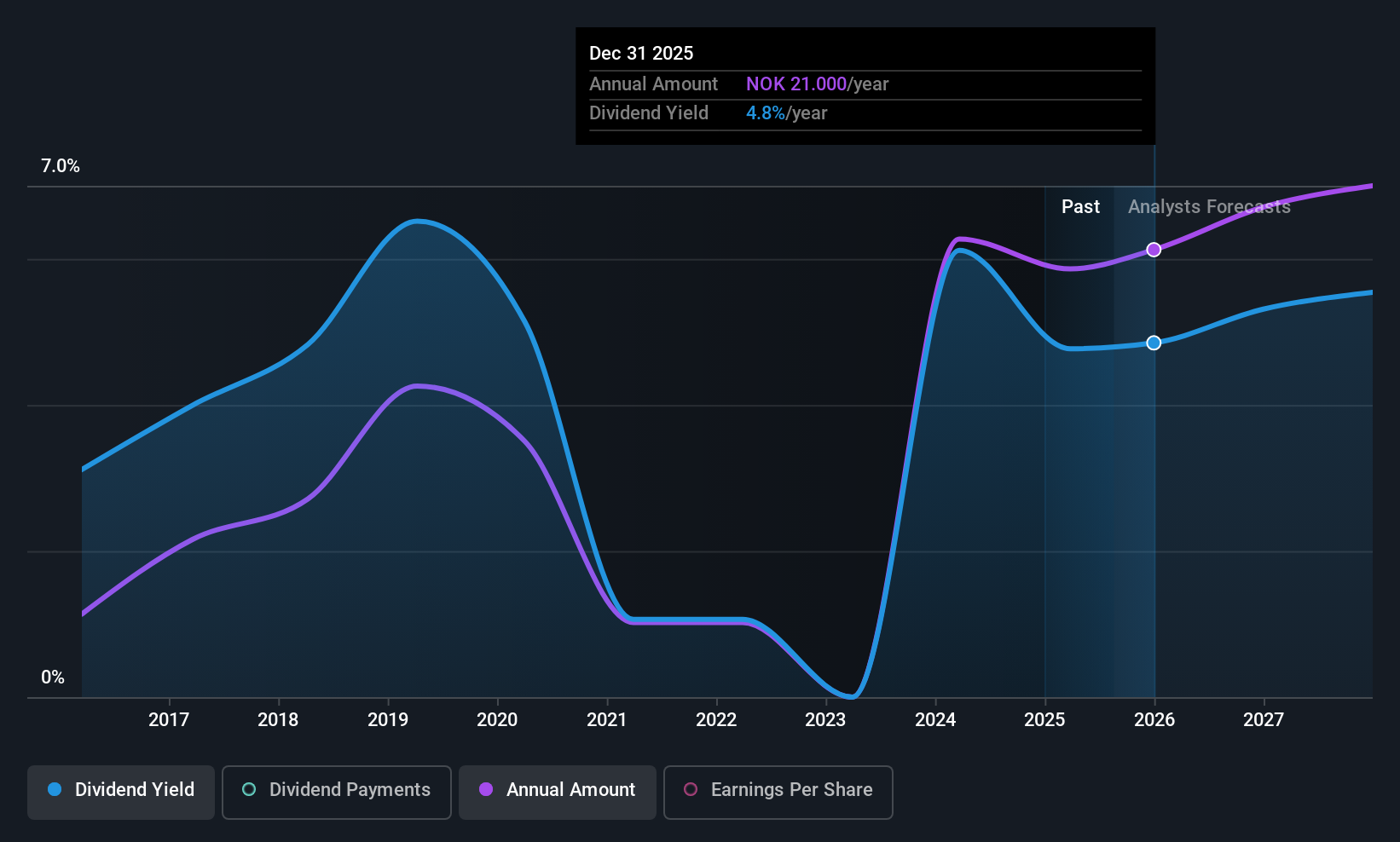

SpareBank 1 Østfold Akershus (OB:SOAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpareBank 1 Østfold Akershus is a Norwegian savings bank offering a range of banking products and services, with a market cap of NOK5.51 billion.

Operations: SpareBank 1 Østfold Akershus generates revenue through its diverse portfolio of banking products and services in Norway.

Dividend Yield: 4.5%

SpareBank 1 Østfold Akershus's dividend payments have increased over the past decade, though they remain volatile and below top-tier yields in Norway. Despite trading at a significant discount to estimated fair value, its dividends are well-covered by earnings with a payout ratio of 41.8%, forecasted to rise to 56% in three years. Recent earnings showed slight growth in net interest income but a decline in net income, which may impact future dividend stability.

- Get an in-depth perspective on SpareBank 1 Østfold Akershus' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of SpareBank 1 Østfold Akershus shares in the market.

Key Takeaways

- Take a closer look at our Top European Dividend Stocks list of 228 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:SSH

Südwestdeutsche Salzwerke

Südwestdeutsche Salzwerke AG, together with its subsidiaries, mines, produces, and sells salt in Germany, the European Union, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives