In recent weeks, global markets have been buoyed by a strong rally in U.S. stocks, driven by optimism surrounding potential policy shifts following the Republican "red sweep" in the elections. The small-cap Russell 2000 Index notably surged, reflecting investor confidence in anticipated growth and deregulatory measures that could benefit smaller companies. In this context of heightened market activity and economic optimism, identifying high-growth tech stocks involves looking for companies with innovative solutions and robust business models that can capitalize on these favorable conditions to drive future expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Esprinet (BIT:PRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Esprinet S.p.A. is a company that, along with its subsidiaries, specializes in the wholesale distribution of IT products and consumer electronics across Italy, Spain, Portugal, and other parts of Europe, with a market capitalization of approximately €271.69 million.

Operations: The company generates revenue primarily from the distribution of IT products and consumer electronics, with significant contributions from Italy (€2.57 billion) and the Iberian Peninsula (€1.39 billion). It operates in a competitive market across various European regions, focusing on B2B channels.

Esprinet's recent pivot towards high-margin tech segments is evident from its R&D expenditure, which has strategically focused on enhancing product offerings in competitive markets. With a 4.9% forecasted annual revenue growth, surpassing the Italian market's 4.1%, and a significant earnings surge by 22.6% per year, the company is positioning itself robustly within tech sectors. This shift is underscored by their latest half-year results showing a rebound to EUR 3.25 million in net income from a previous loss, highlighting effective operational adjustments and cost management that are likely to sustain future growth trajectories in an evolving industry landscape.

- Navigate through the intricacies of Esprinet with our comprehensive health report here.

Review our historical performance report to gain insights into Esprinet's's past performance.

Wiit (BIT:WIIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wiit S.p.A. offers cloud services to businesses both in Italy and internationally, with a market cap of €528.04 million.

Operations: The company specializes in delivering cloud services to businesses across Italy and beyond. It operates with a market capitalization of €528.04 million, focusing on providing tailored cloud solutions for its clients.

Wiit S.p.A.'s recent earnings report underscores its robust position in the high-growth tech sector, with a notable increase in sales to EUR 112.19 million from EUR 95.6 million year-over-year and a jump in net income to EUR 10.19 million from EUR 6.78 million. This performance is highlighted by an earnings growth of 50.8% over the past year, significantly outpacing the IT industry's growth rate of 22.7%. Furthermore, Wiit is poised for continued expansion with revenue and earnings forecasted to grow at annual rates of 9.4% and 28.2%, respectively, both well above the Italian market averages. These figures are reflective of Wiit's strategic emphasis on R&D investment which has been pivotal in driving innovation and maintaining competitive advantage within its sector. The company's commitment to research and development not only fuels product advancements but also enhances operational efficiencies that contribute directly to its financial health—evidenced by a strong projection for return on equity at an impressive 45.3% in three years' time.

- Unlock comprehensive insights into our analysis of Wiit stock in this health report.

Gain insights into Wiit's past trends and performance with our Past report.

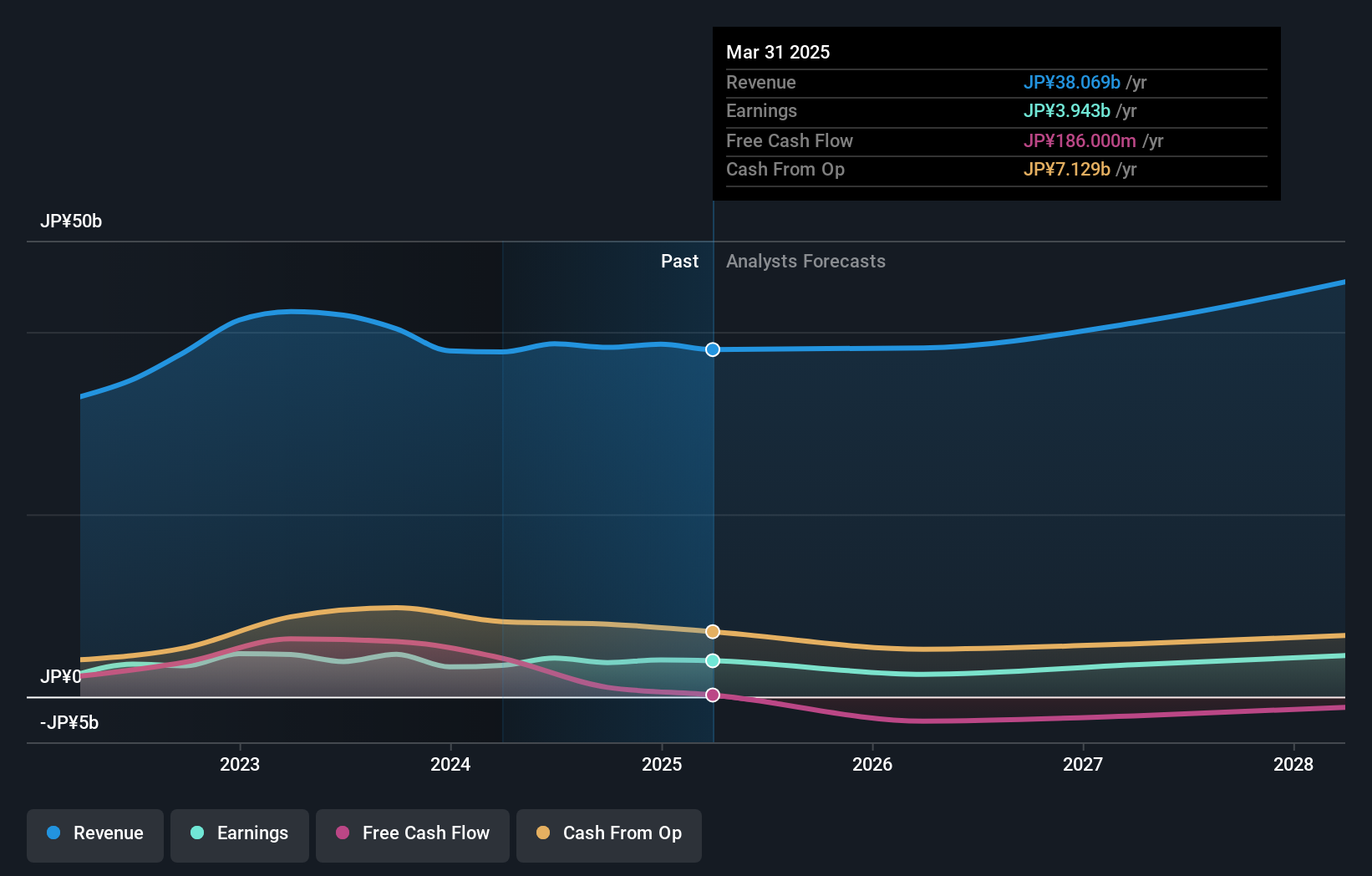

Enplas (TSE:6961)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Enplas Corporation is a company that produces and distributes semiconductor components, automobile parts, optical communication devices, and life science products both in Japan and globally, with a market cap of ¥50.59 billion.

Operations: The company's revenue is primarily driven by its Semiconductor Business, generating ¥16.25 billion, followed by the Energy Saving Solutions Business at ¥13.84 billion. The Digital Communication and Life Science segments contribute ¥5.64 billion and ¥2.58 billion respectively to the overall revenue stream.

Enplas Corporation, in its stride within the tech sector, reported a promising revenue growth of 7.9% per year, surpassing the Japanese market average of 4.2%. This growth is underpinned by strategic R&D investments which amounted to a significant portion of their expenses, reflecting a commitment to innovation and market competitiveness. Notably, earnings are expected to surge by 21.2% annually over the next three years, highlighting potential for substantial financial improvement and industry leadership despite recent challenges marked by a -19.7% earnings contraction over the past year compared to the electronic industry's average of -0.3%.

Turning Ideas Into Actions

- Explore the 1280 names from our High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wiit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:WIIT

Wiit

Provides cloud services for various businesses in Italy and internationally.

High growth potential with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026