Industry Analysts Just Upgraded Their Relatech S.p.A. (BIT:RLT) Revenue Forecasts By 10%

Shareholders in Relatech S.p.A. (BIT:RLT) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts have sharply increased their revenue numbers, with a view that Relatech will make substantially more sales than they'd previously expected. The market seems to be pricing in some improvement in the business too, with the stock up 5.2% over the past week, closing at €2.65. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

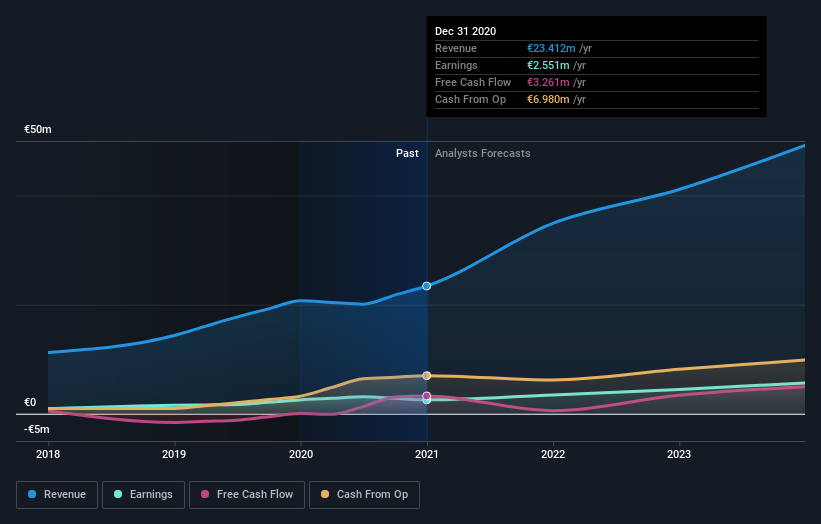

After the upgrade, the two analysts covering Relatech are now predicting revenues of €35m in 2021. If met, this would reflect a sizeable 49% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing €32m of revenue in 2021. It looks like there's been a clear increase in optimism around Relatech, given the nice gain to revenue forecasts.

View our latest analysis for Relatech

We'd point out that there was no major changes to their price target of €4.06, suggesting the latest estimates were not enough to shift their view on the value of the business. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Relatech analyst has a price target of €4.21 per share, while the most pessimistic values it at €3.90. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Relatech is an easy business to forecast or the underlying assumptions are obvious.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Relatech's past performance and to peers in the same industry. The analysts are definitely expecting Relatech's growth to accelerate, with the forecast 49% annualised growth to the end of 2021 ranking favourably alongside historical growth of 22% per annum over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 17% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Relatech is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts lifted their revenue estimates for this year. They're also forecasting more rapid revenue growth than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Relatech.

Looking for more information? We have analyst estimates for Relatech going out to 2023, and you can see them free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

When trading Relatech or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:RLT

Relatech

A digital enabler solution know-how company, provides various digital solutions in Milan and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives