Is Reply (BIT:REY) Reset Creating A Fresh Opportunity After Sharp One Year Share Price Fall

- If you are wondering whether Reply shares offer genuine value at today's price, you are not alone. This article will walk through how the current market view stacks up against a more fundamentals based view of the company.

- The stock last closed at €93.55, with returns of 4.6% decline over 7 days, 16.8% decline over 30 days, 15.6% decline year to date, 42.4% decline over 1 year, 20.3% decline over 3 years, and 6.8% decline over 5 years. Many investors may see this as a reset in expectations or a possible opening for fresh research.

- Recent coverage has focused on Reply as a listed Italian software and IT services group, with attention on how its share price now compares with sector peers and with market benchmarks. That context helps frame whether the current valuation reflects lasting concerns or simply a change in risk appetite around technology and consulting focused names.

- On our checks, Reply scores a 5 out of 6 valuation score, which suggests the stock screens as undervalued across most of the metrics we use. Next we will look at the main valuation approaches behind that number and finish with a different way of thinking about value that can round out the picture.

Find out why Reply's -42.4% return over the last year is lagging behind its peers.

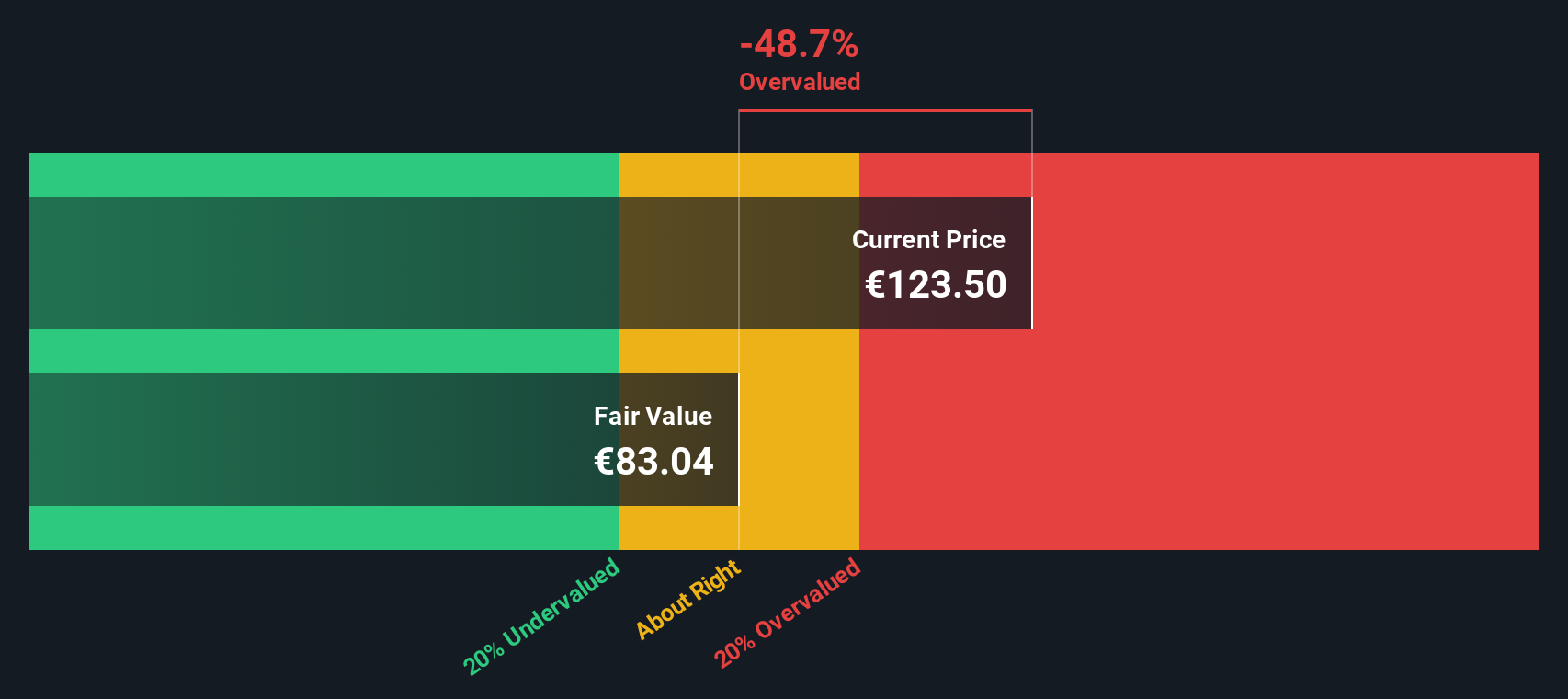

Approach 1: Reply Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth by projecting its future cash flows and then discounting them back to today using a required rate of return. It is essentially asking what those future euros are worth in present terms.

For Reply, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month Free Cash Flow is about €319.3 million. Analysts provide explicit estimates for the next few years, and projections out to 2035, including a Free Cash Flow figure of €331 million in 2030, are extrapolated by Simply Wall St using those inputs.

When all those future cash flows are discounted back, the model arrives at an estimated intrinsic value of €96.55 per share. Compared with the recent share price of €93.55, the DCF implies Reply trades at about a 3.1% discount. This is a relatively small gap and suggests the current price is close to this cash flow based estimate.

Result: ABOUT RIGHT

Reply is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

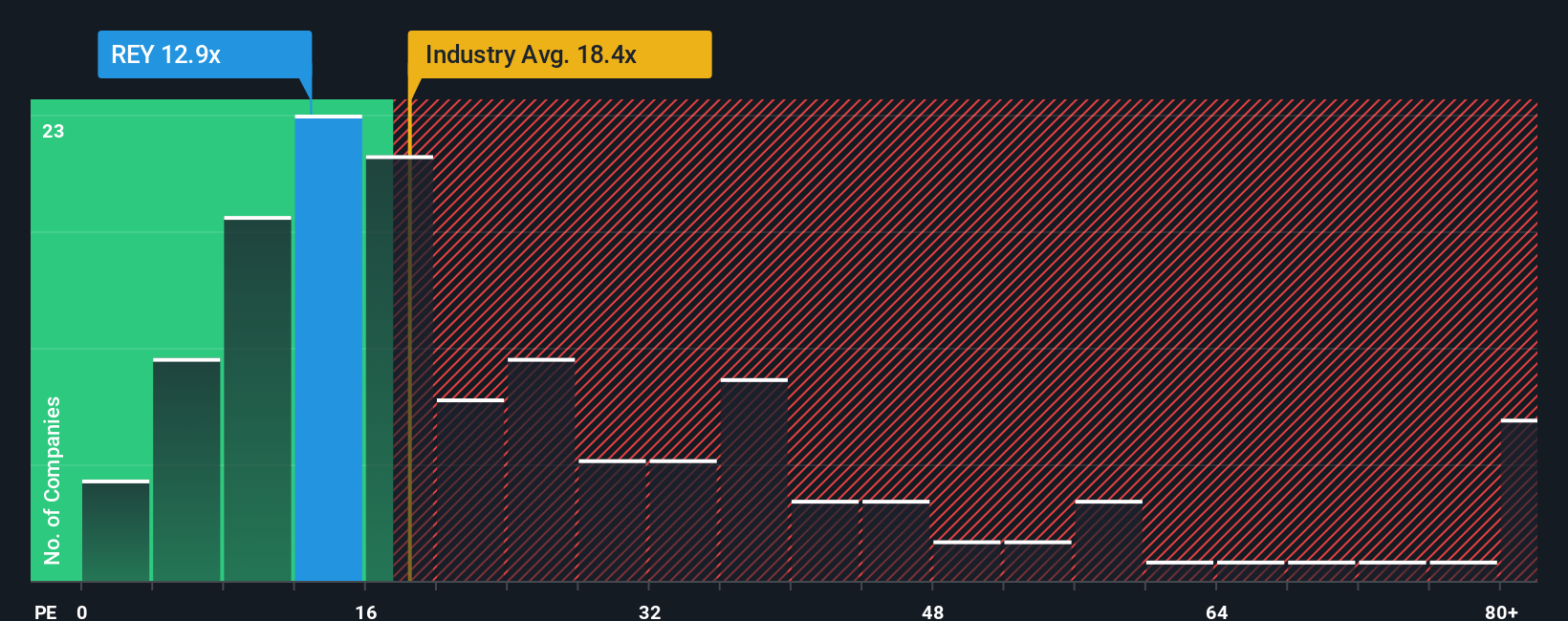

Approach 2: Reply Price vs Earnings

For a profitable company like Reply, the P/E ratio is a useful way to connect what you pay per share with the earnings the business is generating today. You can think of it as how many euros investors are currently willing to pay for each euro of annual earnings.

What counts as a normal P/E tends to reflect two things: how fast earnings are expected to grow and how much risk investors see in those earnings. Higher growth or lower perceived risk usually supports a higher P/E, while slower growth or higher risk tends to pull it down.

Reply currently trades on a P/E of about 13.25x. That sits below both the wider IT industry average of roughly 19.22x and a peer group average of 24.19x. Simply Wall St also calculates a Fair Ratio of 23.63x for Reply, which is the P/E level that would be consistent with factors such as its earnings profile, industry, profit margin, market value and risk characteristics.

This Fair Ratio aims to be more tailored than a simple peer or industry comparison because it folds in multiple company specific drivers rather than just lining Reply up against broad averages.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 102 top founder-led companies.

Upgrade Your Decision Making: Choose your Reply Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which let you attach a clear story about Reply to the numbers you use for fair value, future revenue, earnings and margins.

A Narrative connects three pieces in one place: your view of Reply’s business story, a financial forecast that flows from that view, and the fair value that forecast implies.

On Simply Wall St’s Community page, Narratives are set up so you can quickly compare a fair value from your story with the current market price and consider whether that gap suggests a possible buy, sell, or hold decision for your own situation.

Because Narratives update when new information such as news, earnings or guidance is added to the platform, your view of Reply can stay aligned with what is happening without you rebuilding a model from scratch.

For example, one Reply Narrative might assume a higher fair value based on confident long term demand for its IT services, while another might set a lower fair value if the author is more cautious about future consulting budgets, and both sit side by side for you to compare.

Do you think there's more to the story for Reply? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:REY

Reply

Provides consulting, system integration, and digital services based on communication channels and digital media in Italy and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

UnitedHealth Group's Future Revenue Grows by 3.59%: What Will It Mean?

Why EnSilica is Worth Possibly 13x its Current Price

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.