Datrix S.p.A.'s (BIT:DATA) 28% Share Price Surge Not Quite Adding Up

The Datrix S.p.A. (BIT:DATA) share price has done very well over the last month, posting an excellent gain of 28%. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

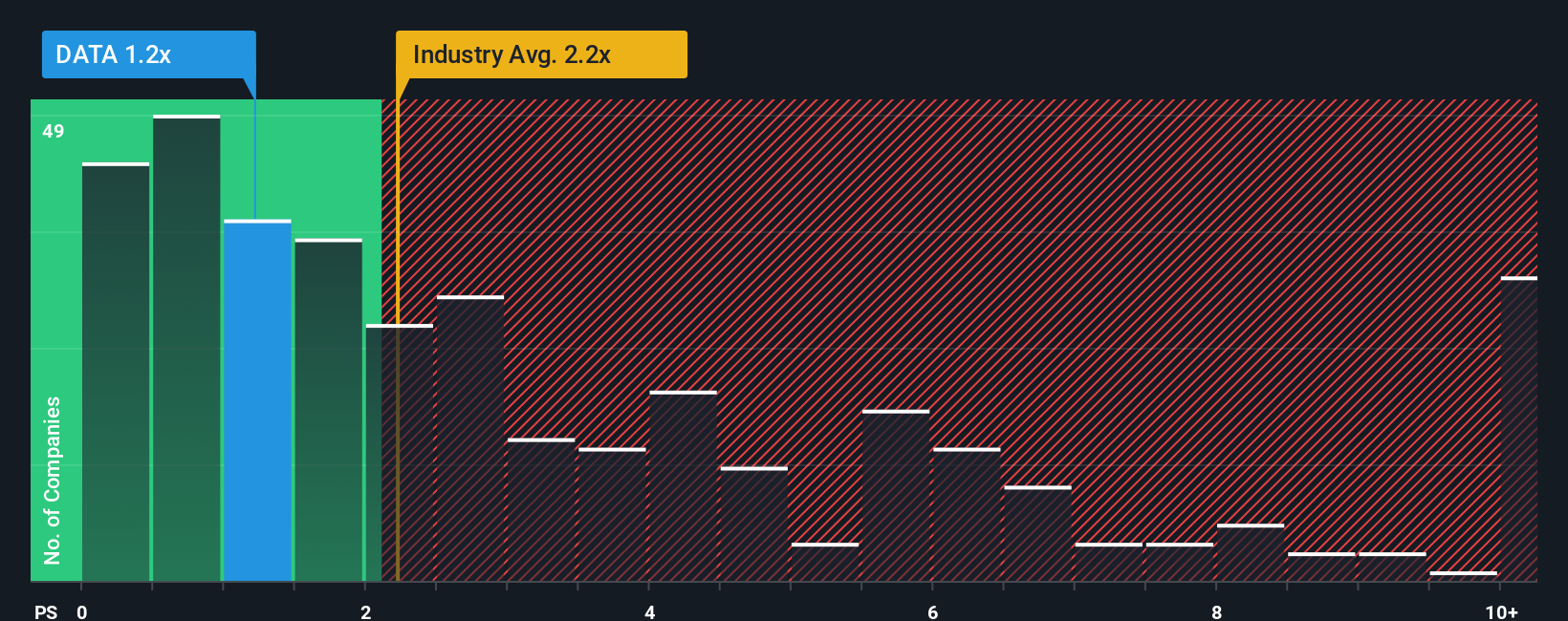

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Datrix's P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Software industry in Italy is also close to 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Datrix

What Does Datrix's P/S Mean For Shareholders?

Revenue has risen firmly for Datrix recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on Datrix will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Datrix, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Datrix's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Datrix's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. Pleasingly, revenue has also lifted 56% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 45% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it interesting that Datrix is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now Datrix's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Datrix revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Plus, you should also learn about these 3 warning signs we've spotted with Datrix (including 1 which can't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:DATA

Datrix

Engages in developing artificial intelligence based solutions of augmented analytics and machine learning.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

UnitedHealth Stock: Why Scale, Data, and Integration Still Matter in U.S. Healthcare

Unique One, Retail Sector, but Short Time Investmentnya Almost 2,5 kali Persediaan

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion