- Italy

- /

- Specialty Stores

- /

- BIT:BAN

Does BasicNet (BIT:BAN) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, BasicNet S.p.A. (BIT:BAN) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for BasicNet

How Much Debt Does BasicNet Carry?

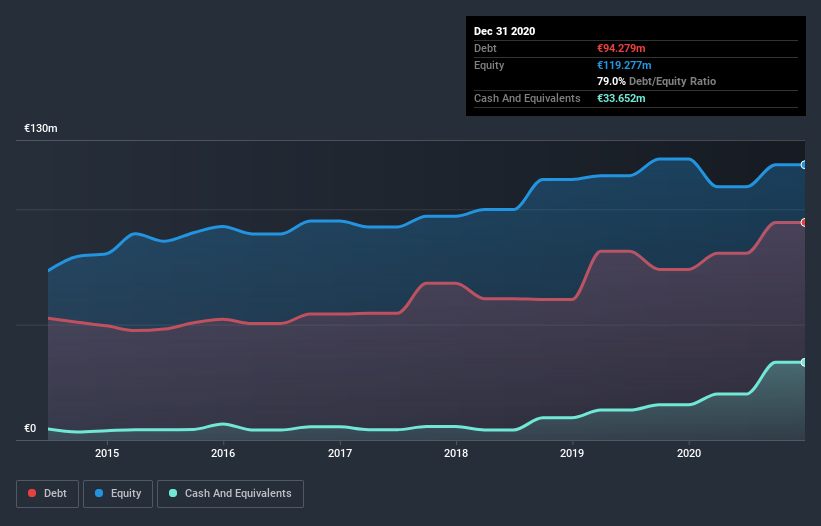

The image below, which you can click on for greater detail, shows that at December 2020 BasicNet had debt of €94.3m, up from €73.9m in one year. On the flip side, it has €33.7m in cash leading to net debt of about €60.6m.

A Look At BasicNet's Liabilities

The latest balance sheet data shows that BasicNet had liabilities of €129.6m due within a year, and liabilities of €73.2m falling due after that. Offsetting this, it had €33.7m in cash and €59.1m in receivables that were due within 12 months. So its liabilities total €110.0m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since BasicNet has a market capitalization of €218.5m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

BasicNet has a rather high debt to EBITDA ratio of 7.5 which suggests a meaningful debt load. But the good news is that it boasts fairly comforting interest cover of 3.1 times, suggesting it can responsibly service its obligations. Even worse, BasicNet saw its EBIT tank 86% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is BasicNet's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, BasicNet actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On the face of it, BasicNet's net debt to EBITDA left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making BasicNet stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for BasicNet that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade BasicNet, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BasicNet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:BAN

BasicNet

Operates in the sports and casual clothing, footwear, and accessories sectors in Europe, the Americas, Asia, Oceania, the Middle East, and Africa.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

TLX... a Market's Overreaction or a Falling Knife?

Rally in sustainable practices over value recyclable metal stock

Regeneron Pharmaceuticals Inc. (REGN): The Biotech Stalwart – Defensive Growth Amid Biosimilar Headwinds in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Nu holdings will continue to disrupt the South American banking market

Trending Discussion