- Italy

- /

- Specialty Stores

- /

- BIT:BAN

BasicNet's (BIT:BAN) Dividend Will Be Increased To €0.16

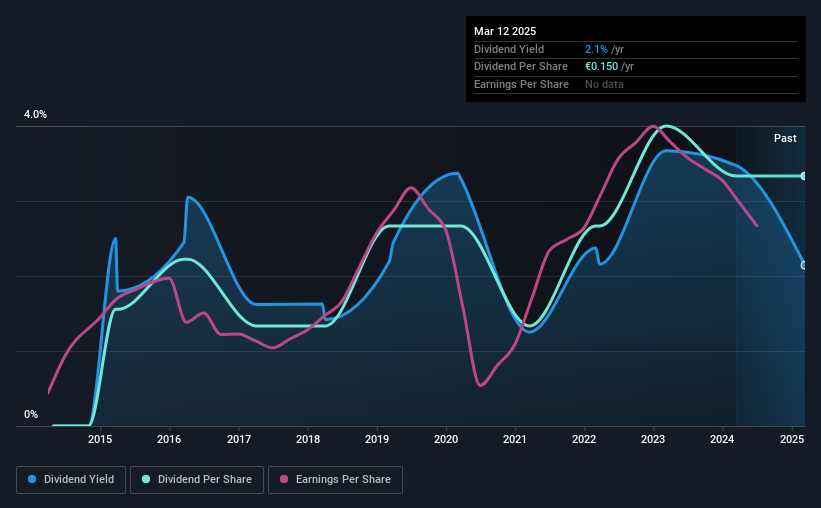

BasicNet S.p.A.'s (BIT:BAN) periodic dividend will be increasing on the 30th of April to €0.16, with investors receiving 6.7% more than last year's €0.15. This makes the dividend yield about the same as the industry average at 2.1%.

View our latest analysis for BasicNet

BasicNet's Projected Earnings Seem Likely To Cover Future Distributions

We aren't too impressed by dividend yields unless they can be sustained over time. However, prior to this announcement, BasicNet's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Unless the company can turn things around, EPS could fall by 3.3% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could be 45%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2015, the annual payment back then was €0.07, compared to the most recent full-year payment of €0.15. This means that it has been growing its distributions at 7.9% per annum over that time. A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though BasicNet's EPS has declined at around 3.3% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 4 warning signs for BasicNet that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if BasicNet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BAN

BasicNet

Operates in the sports and casual clothing, footwear, and accessories sectors in Europe, the Americas, Asia, Oceania, the Middle East, and Africa.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

The NVIDIA Phenomenon

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Nu holdings will continue to disrupt the South American banking market

Trending Discussion