As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are closely watching shifts in sector performances and regulatory changes. In this context, penny stocks—smaller or newer companies often overlooked by mainstream investors—continue to present intriguing opportunities. Despite being considered a niche market, these stocks can offer substantial growth potential when backed by strong financial health. Let's examine three penny stocks that may combine balance sheet resilience with promising prospects for long-term gains.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.23 | MYR346.22M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$68.57M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$146.79M | ★★★★☆☆ |

| CSE Global (SGX:544) | SGD0.43 | SGD303.74M | ★★★★★☆ |

Click here to see the full list of 5,803 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Caltagirone Editore (BIT:CED)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Caltagirone Editore SpA is a company that publishes newspapers in Italy with a market capitalization of €148.44 million.

Operations: The company generates revenue primarily from its publishing and advertising activities, totaling €112.89 million.

Market Cap: €148.44M

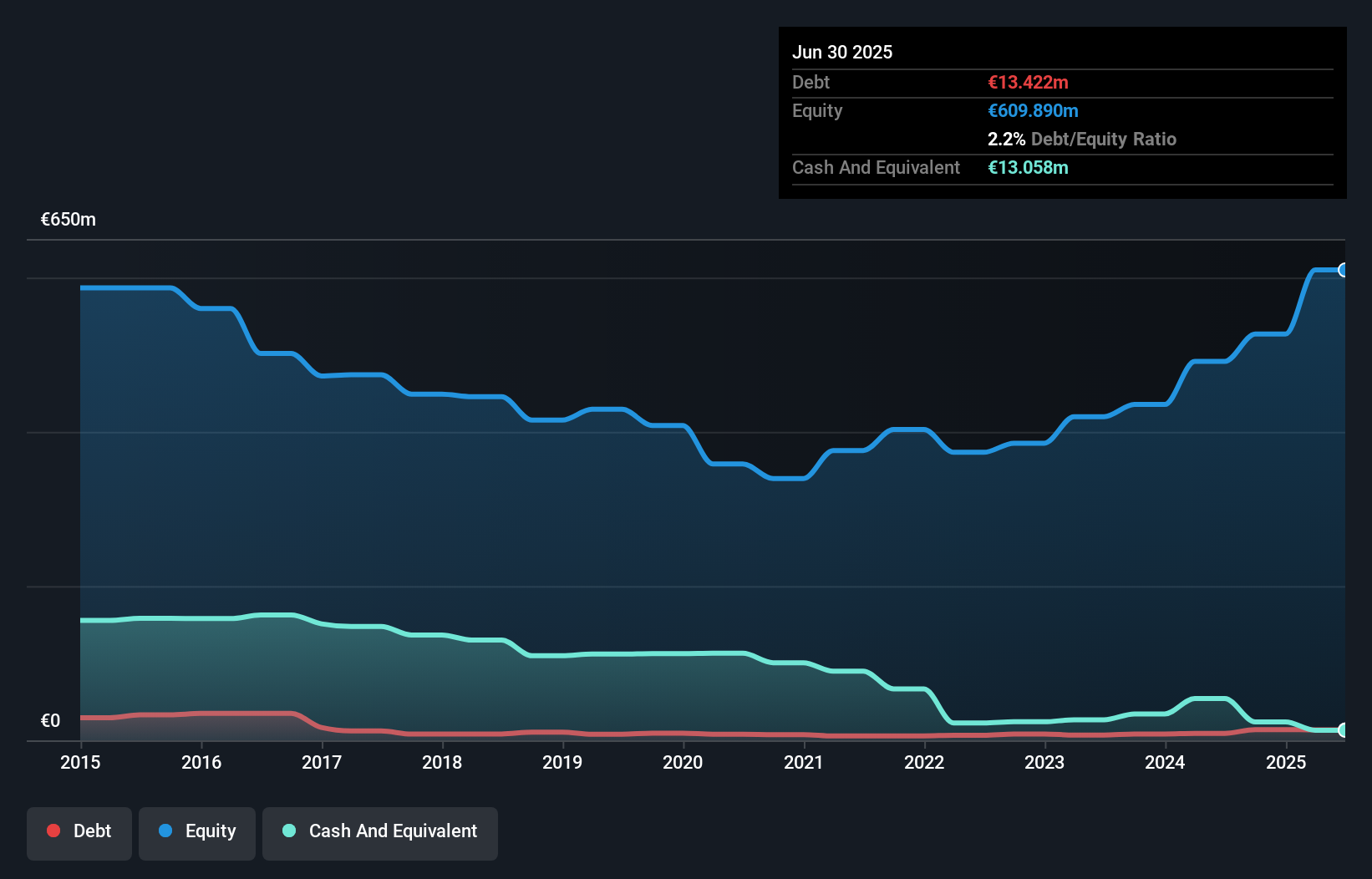

Caltagirone Editore SpA has demonstrated significant earnings growth, with a 94.9% increase over the past year, surpassing both its historical average and the media industry standard. The company trades at a substantial discount to estimated fair value, suggesting potential upside. Financially robust, it boasts more cash than debt and covers both short- and long-term liabilities with ease. Despite low return on equity at 3.2%, profit margins have improved significantly from last year. Recent stability in weekly volatility adds to its appeal as an investment opportunity in the penny stock space without shareholder dilution concerns recently noted.

- Click here and access our complete financial health analysis report to understand the dynamics of Caltagirone Editore.

- Evaluate Caltagirone Editore's historical performance by accessing our past performance report.

Ruifeng Power Group (SEHK:2025)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ruifeng Power Group Company Limited is an investment holding company involved in the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China, with a market cap of HK$944 million.

Operations: The company's revenue is primarily derived from Cylinder Blocks at CN¥644.44 million, followed by Cylinder Heads at CN¥154.71 million, and Ancillary Cylinder Block Components and Others contributing CN¥8.38 million.

Market Cap: HK$944M

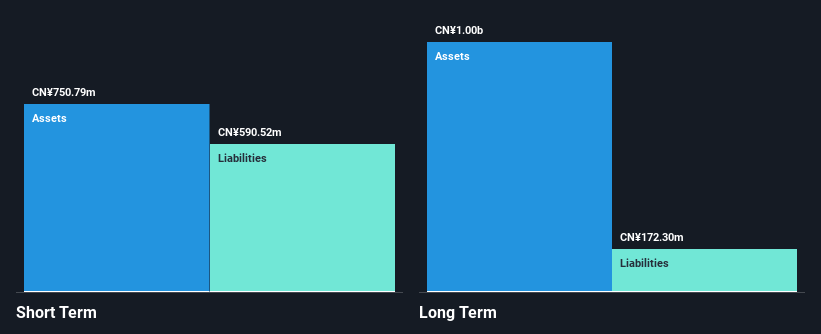

Ruifeng Power Group's financials reveal a mixed picture for potential investors in the penny stock arena. The company reported sales of CN¥430.97 million for the first half of 2024, with net income rising slightly to CN¥14.06 million from last year. However, profit margins have decreased to 1.7%, and earnings growth has been negative over the past year, underperforming industry averages. Despite this, Ruifeng maintains a satisfactory net debt to equity ratio of 23.6% and covers its short-term liabilities with assets totaling CN¥750.8 million, though interest coverage remains weak at 2.8 times EBIT.

- Dive into the specifics of Ruifeng Power Group here with our thorough balance sheet health report.

- Assess Ruifeng Power Group's previous results with our detailed historical performance reports.

CNNC Hua Yuan Titanium Dioxide (SZSE:002145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CNNC Hua Yuan Titanium Dioxide Co., Ltd is involved in the production and sale of rutile titanium dioxide in China, with a market cap of CN¥17.03 billion.

Operations: There are no specific revenue segments reported for the company.

Market Cap: CN¥17.03B

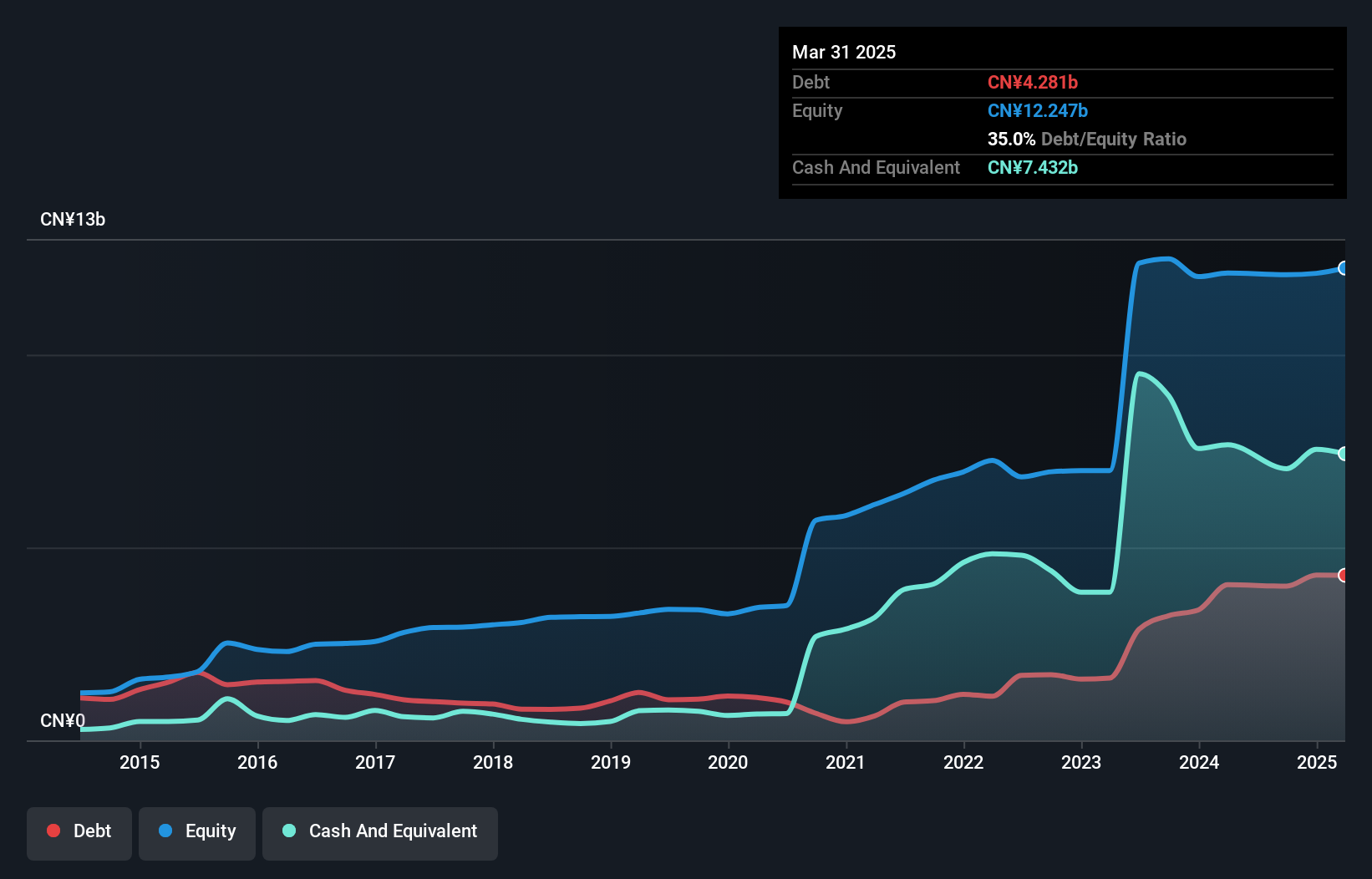

CNNC Hua Yuan Titanium Dioxide's recent financial performance shows promising growth, with sales reaching CN¥5.15 billion for the first nine months of 2024, up from CN¥3.59 billion the previous year. Earnings grew by a significant 47.8%, although this includes a large one-off gain of CN¥121.8 million, which may not be sustainable long-term. The company's short-term assets comfortably exceed its liabilities, and it has more cash than total debt; however, negative operating cash flow raises concerns about debt coverage. Despite a low return on equity of 4.4%, profit margins have improved to 8.2% from last year's figures.

- Jump into the full analysis health report here for a deeper understanding of CNNC Hua Yuan Titanium Dioxide.

- Review our historical performance report to gain insights into CNNC Hua Yuan Titanium Dioxide's track record.

Summing It All Up

- Access the full spectrum of 5,803 Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002145

CNNC Hua Yuan Titanium Dioxide

Engages in the production and sale of rutile titanium dioxide in China.

Adequate balance sheet with acceptable track record.