Seri Industrial S.p.A. (BIT:SERI) Soars 27% But It's A Story Of Risk Vs Reward

Seri Industrial S.p.A. (BIT:SERI) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

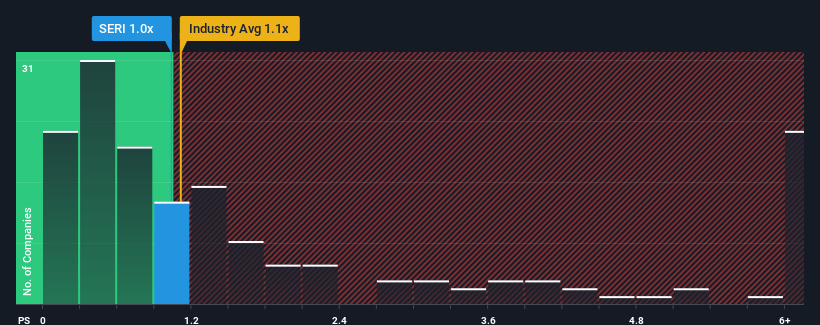

Even after such a large jump in price, there still wouldn't be many who think Seri Industrial's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Italy's Chemicals industry is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Seri Industrial

What Does Seri Industrial's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Seri Industrial has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Seri Industrial's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Seri Industrial?

Seri Industrial's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 40% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 28% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 1.3%, which is noticeably less attractive.

In light of this, it's curious that Seri Industrial's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Seri Industrial's P/S

Seri Industrial appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Seri Industrial's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Seri Industrial (2 make us uncomfortable) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:SERI

Seri Industrial

Through its subsidiaries, engages in the production and recycling of plastic materials for battery, automotive, hydro-thermo-sanitary, civil, and shipbuilding markets.

Slight risk and slightly overvalued.

Market Insights

Community Narratives