These Analysts Think Grifal S.p.A.'s (BIT:GRAL) Earnings Are Under Threat

Market forces rained on the parade of Grifal S.p.A. (BIT:GRAL) shareholders today, when the analysts downgraded their forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

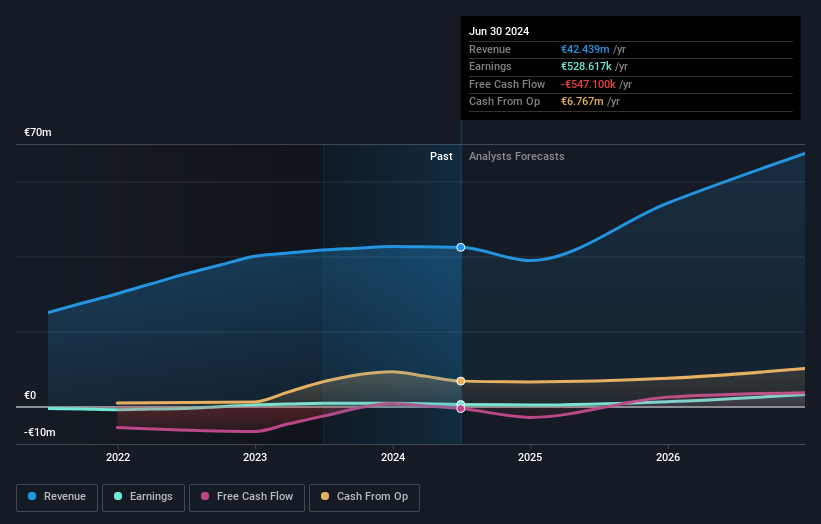

Following the latest downgrade, the current consensus, from the two analysts covering Grifal, is for revenues of €39m in 2024, which would reflect an uncomfortable 8.3% reduction in Grifal's sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of €46m in 2024. The consensus view seems to have become more pessimistic on Grifal, noting the substantial drop in revenue estimates in this update.

See our latest analysis for Grifal

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 16% annualised revenue decline to the end of 2024. That is a notable change from historical growth of 19% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 4.0% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Grifal is expected to lag the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Grifal this year. They also expect company revenue to perform worse than the wider market. Given the serious cut to this year's outlook, it's clear that analysts have turned more bearish on Grifal, and we wouldn't blame shareholders for feeling a little more cautious themselves.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Grifal's financials, such as its declining profit margins. Learn more, and discover the 2 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:GRAL

Grifal

Provides packaging solutions in Italy, rest of Europe, and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success