- Italy

- /

- Diversified Financial

- /

- BIT:PST

How Poste Stock Shapes Up After Posting Record 2024 Profits

Reviewed by Simply Wall St

If you are eyeing Poste Italiane and wondering whether now is the time to get in, hold tight—there is plenty to chew on. The stock has had an impressive run lately, climbing 1.7% over the past week, though it dipped slightly at 0.6% over the last 30 days. If you stretch your view out, things really start to get interesting: year to date, Poste Italiane has soared nearly 46%, while over the past twelve months it has delivered a staggering 69.7%. Even more striking, those who held on over the last five years have seen their investment multiply more than threefold, with a gain of 252.3%.

So what is behind this momentum? Aside from the pandemic-era bounce-backs and shifting investor sentiment, Poste Italiane has benefited from the broader re-rating of European financials and the growing appetite for stable dividend plays. Its diversified business model, spanning logistics, insurance, banking, and postal services, has further helped cement investor confidence. That said, not every rise signals a bargain, so naturally the next question is whether Poste Italiane is still undervalued, or if the easy gains are behind us.

On a commonly used valuation scorecard, Poste Italiane scores 3 out of 6, meaning it is undervalued in half of the major checks. That places it in an intriguing spot for value hunters who also care about growth potential.

If you are ready to dig deeper, here is a breakdown of how that valuation score adds up using popular methods, before exploring a perspective that could give you an even clearer view of Poste Italiane’s true worth.

Poste Italiane delivered 69.7% returns over the last year. See how this stacks up to the rest of the Insurance industry.Approach 1: Poste Italiane Excess Returns Analysis

The Excess Returns model estimates a company's value based on its ability to generate profits above its cost of capital, focusing on return on equity rather than projected cash flows. It evaluates whether Poste Italiane’s investments are delivering solid returns for shareholders beyond the required rate of return.

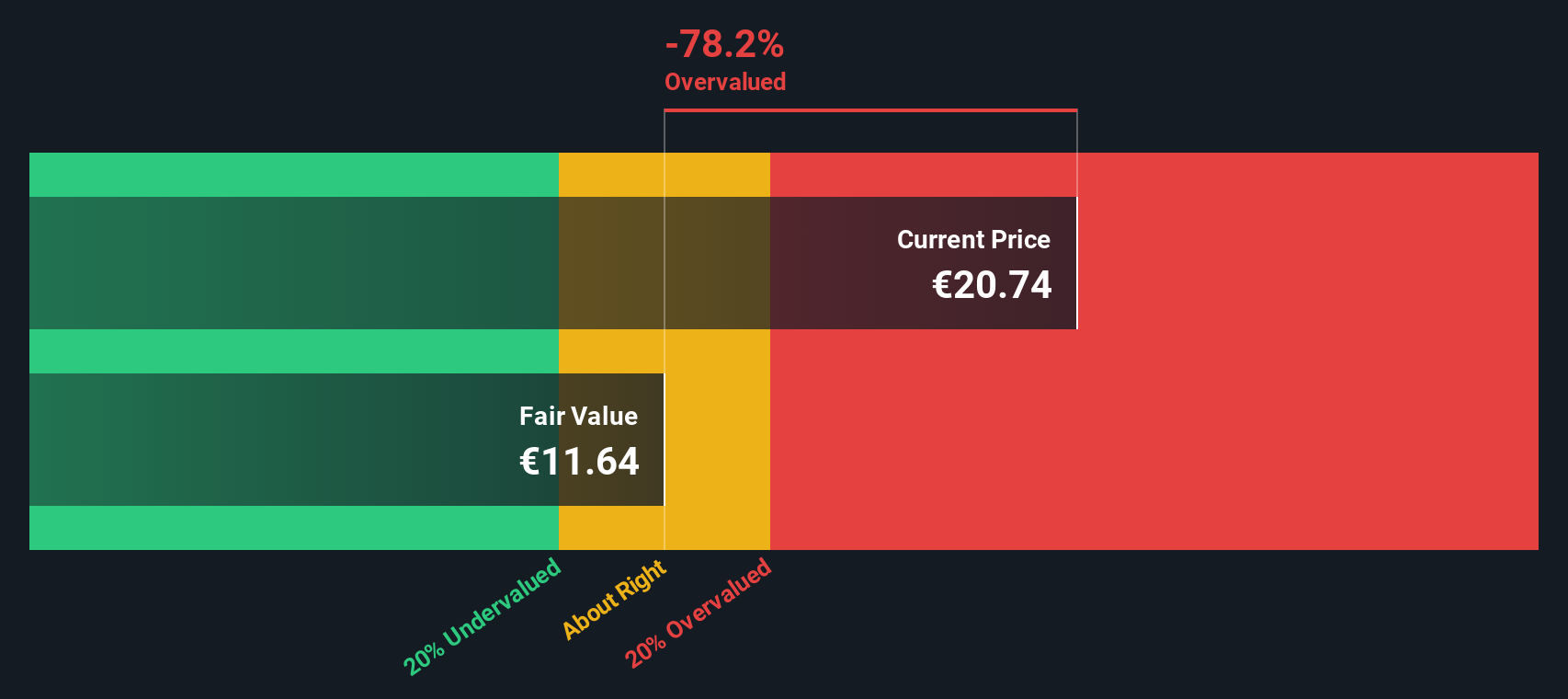

For Poste Italiane, the figures are impressive. The recent average Return on Equity (ROE) stands at 19.42%, with analysts projecting a stable EPS of €2.03 per share and a stable Book Value of €10.46 per share. The company’s Book Value is currently €9.20 per share, and its estimated Cost of Equity is €1.61 per share. This results in annual Excess Returns of €0.42 per share, a healthy margin over the cost of capital, based on sources from 11 and 12 analysts respectively.

According to the Excess Returns model, Poste Italiane’s intrinsic value is €13.80 per share. Compared to the actual share price, the stock is trading at about a 45.4% premium. This suggests it is more than fairly priced right now and may even be overvalued, despite strong operational metrics.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Poste Italiane.

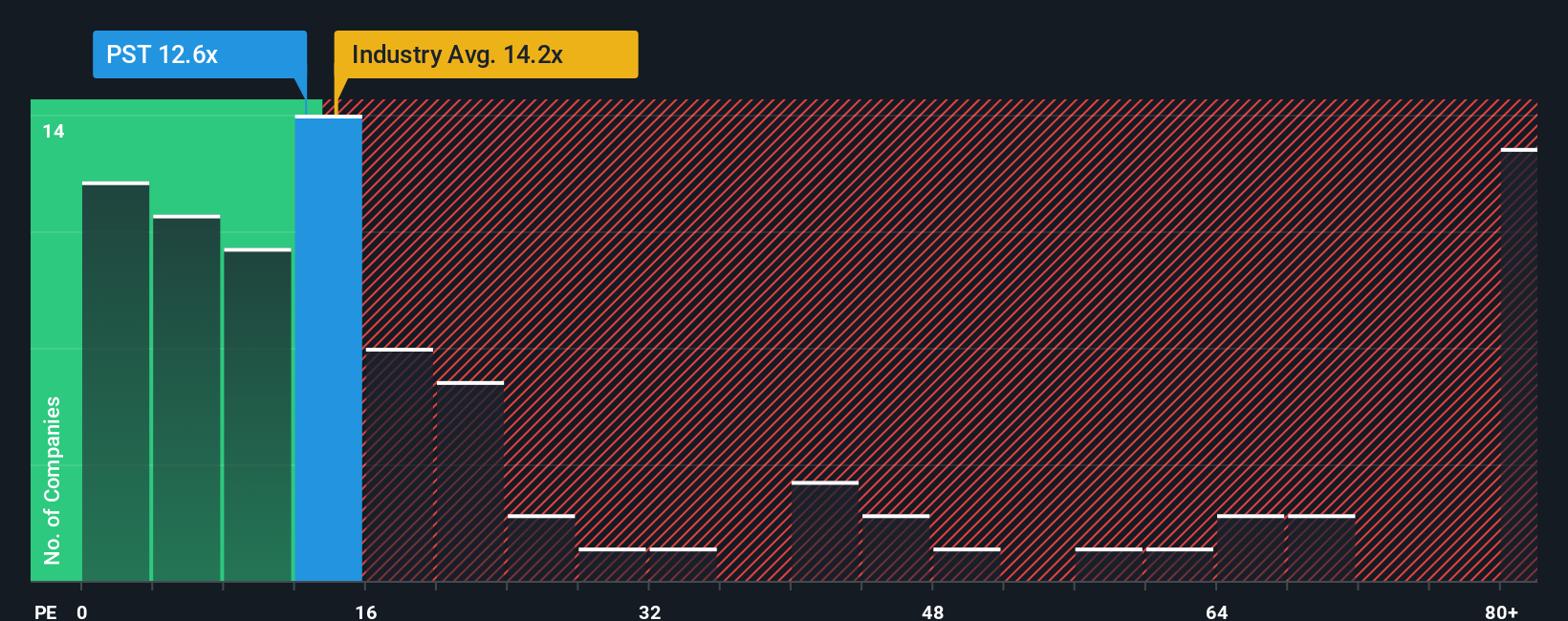

Approach 2: Poste Italiane Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is a go-to valuation tool for profitable companies like Poste Italiane because it tells investors how much they are paying for every euro of earnings today. A lower PE can signal a bargain, while a higher number might hint at growth optimism or premium quality. However, what counts as “fair” depends on factors like how quickly the company is expected to grow and the risks it faces. Fast-growing, low-risk companies usually get higher PEs, while riskier or slower-growing firms earn a discount.

Right now, Poste Italiane trades at a PE of 12.2x. For context, the average PE across the Insurance industry is roughly 12.2x, while its peer group averages a higher 14.5x. On the surface, Poste Italiane may look like it is valued attractively relative to similar companies.

But it is important to dig a layer deeper. Simply Wall St’s proprietary Fair Ratio, based on Poste Italiane’s earnings growth prospects, profit margins, industry, risk profile, and size, puts a fair multiple at 13.5x. Unlike a simple industry comparison, the Fair Ratio personalizes the benchmark and provides a clearer view of whether the stock’s price is justified. Poste Italiane’s current PE is just about in line with the fair value suggested by this deeper analysis, meaning investors are paying a reasonable price for its earnings given its outlook and risk.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Poste Italiane Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story investors connect to the numbers. It is your view on Poste Italiane’s future, where you estimate how revenue, earnings, and margins might change, then see what that means for the company’s fair value.

Unlike traditional ratios, Narratives link a company’s bigger story, such as major business shifts, risks, or exciting new opportunities, directly to a financial forecast and target price. On Simply Wall St’s Community page (where millions share insights), Narratives make this process approachable for any investor, offering clear, dynamic updates as new data or news emerges so your fair value view stays fresh.

With Narratives, you can better decide when to buy, sell, or hold by comparing your calculated fair value with today’s actual price. For Poste Italiane, some investors are highly optimistic, suggesting a potential fair value above €21 based on rapid digital growth and resilient insurance profits, while more cautious investors see risks from falling mail volumes and regulatory costs, setting their fair value closer to €16.5. Narratives empower you to choose and update the story you believe in, putting smarter investment decisions at your fingertips.

Do you think there's more to the story for Poste Italiane? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PST

Poste Italiane

Provides postal, logistics, and financial and insurance products and services in Italy.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives