Campari (BIT:CPR): Assessing Valuation After Q3 Beat and Analyst Upgrade Highlight Growth Potential

Reviewed by Simply Wall St

Davide Campari-Milano (BIT:CPR) drew investors’ attention after posting its third-quarter results. Organic sales growth outpaced consensus expectations in several regions, and the company maintained its full-year 2025 outlook.

See our latest analysis for Davide Campari-Milano.

Campari’s latest quarterly update sparked renewed interest, especially after an analyst upgrade emphasized its resilience in challenging core markets. While the most recent 7-day share price return of 3.7% suggests regained momentum, the stock remains down 3.9% on a one-year total shareholder return basis. This reflects the lingering effects of earlier headwinds, even as sentiment appears to improve.

If you’re watching how key players adapt to shifting industry trends, now’s a smart time to discover fast growing stocks with high insider ownership.

So with Campari outperforming forecasts yet still trading at a discount to analyst price targets, is there room for upside here? Or is the market already factoring in all the company’s growth potential?

Most Popular Narrative: 12.9% Undervalued

Davide Campari-Milano’s closing price of €5.89 sits noticeably below the narrative’s fair value estimate. A narrow gap to the consensus price target suggests there may be room for re-rating, but the assumptions behind this valuation are worth a closer look.

Ongoing global expansion, with more than 13 markets delivering double-digit growth and opportunities in the U.S., APAC, and EMEA, positions Campari to benefit from rising disposable income and premiumization in emerging and urban markets. This supports diversified revenue growth.

What makes this valuation tick? The narrative hinges on transformative international growth and bold bets on margin expansion. But what exactly is powering these ambitious projections? Could one surprise number flip the whole story on its head? Find out by diving into the full narrative details.

Result: Fair Value of €6.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures or currency fluctuations could impede Campari’s growth. This highlights the need to closely watch these evolving risks.

Find out about the key risks to this Davide Campari-Milano narrative.

Another View: Multiples Tell a Different Story

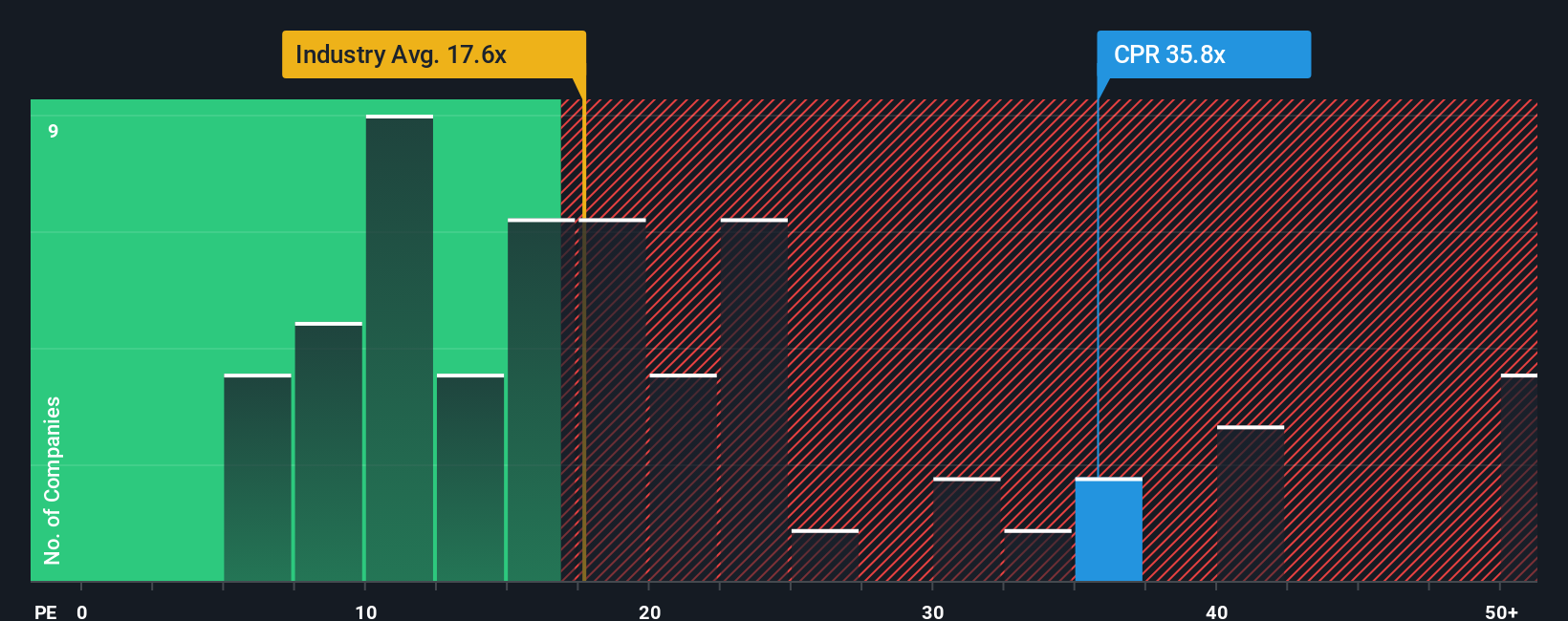

Looking at valuation through a different lens raises questions. Campari’s current price-to-earnings ratio stands at 39.8x, which is much higher than both the European Beverage industry average of 16.4x and its peer group at 24.9x. Even the fair ratio sits lower, at 26.6x. This suggests the market is pricing in a lot of optimism, and perhaps more than its fundamentals justify. Does this premium suggest hidden risks, or does it signal confidence that growth can defy expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Davide Campari-Milano Narrative

If you want a fresh perspective or prefer digging into the facts for yourself, you can assemble your own narrative in just a few minutes, start to finish. Do it your way

A great starting point for your Davide Campari-Milano research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines. Give yourself an edge by scanning other high-conviction opportunities where market shifts could mean serious upside potential.

- Boost your income stream by targeting reliable yields through these 18 dividend stocks with yields > 3%, which offers attractive returns above 3%.

- Capitalize on next-level disruption by tapping into these 27 AI penny stocks, central to innovation in artificial intelligence and automation.

- Ride the wave of emerging tech trends with these 82 cryptocurrency and blockchain stocks, advancing developments in blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CPR

Davide Campari-Milano

Davide Campari-Milano N.V., together with its subsidiaries, markets and distributes alcoholic and non-alcoholic beverages in the Americas, the Middle East, Africa, Europe, and the Asia-Pacific.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives