- Italy

- /

- Energy Services

- /

- BIT:SPM

Imagine Owning Saipem (BIT:SPM) And Taking A 96% Loss Square On The Chin

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. To wit, the Saipem S.p.A. (BIT:SPM) share price managed to fall 96% over five long years. That's not a lot of fun for true believers. Even worse, it's down 13% in about a month, which isn't fun at all.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Saipem

Because Saipem made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

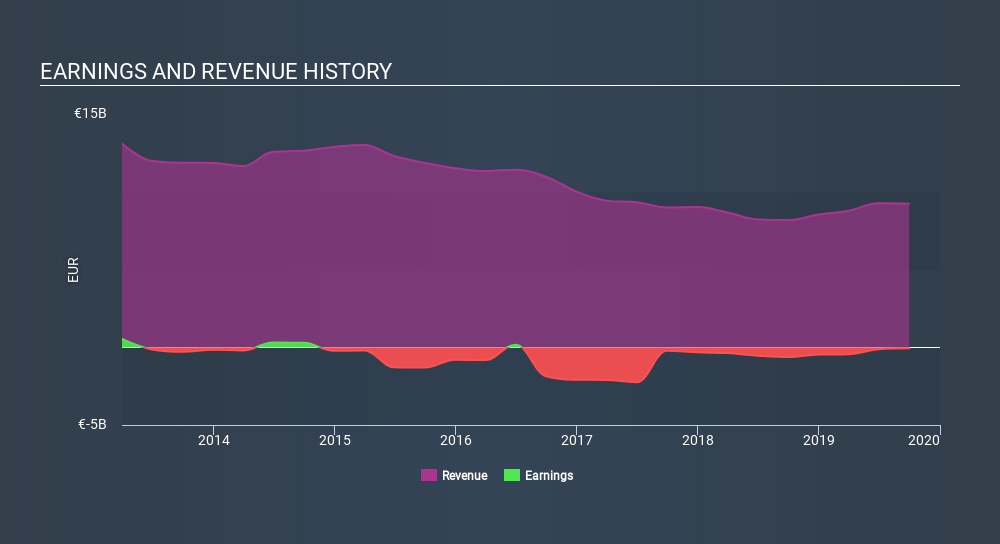

Over half a decade Saipem reduced its trailing twelve month revenue by 9.5% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 47% per year in that period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Saipem is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Saipem stock, you should check out this free report showing analyst consensus estimates for future profits.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Saipem's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Saipem shareholders, and that cash payout explains why its total shareholder loss of 67%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Saipem shareholders are down 9.7% for the year, but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 20% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You could get a better understanding of Saipem's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Saipem may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:SPM

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion