- Italy

- /

- Oil and Gas

- /

- BIT:GSP

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in U.S. indexes and geopolitical uncertainties, investors are increasingly focused on the Federal Reserve's upcoming decisions regarding interest rates. Amidst these dynamics, dividend stocks continue to attract attention for their potential to provide steady income streams, especially in an environment where economic indicators like jobless claims and home sales are showing positive trends. In such a market climate, a good dividend stock is often characterized by its ability to maintain consistent payouts and demonstrate resilience against broader market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.77% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Gas Plus (BIT:GSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gas Plus S.p.A. is involved in the exploration and production of natural gas in Italy, with a market cap of approximately €106.75 million.

Operations: Gas Plus S.p.A.'s revenue segments include Retail (€41.35 million), Network & Transportation (€22.25 million), Exploration & Production - Italy (€48.19 million), and Exploration & Production - Foreign (€37.88 million).

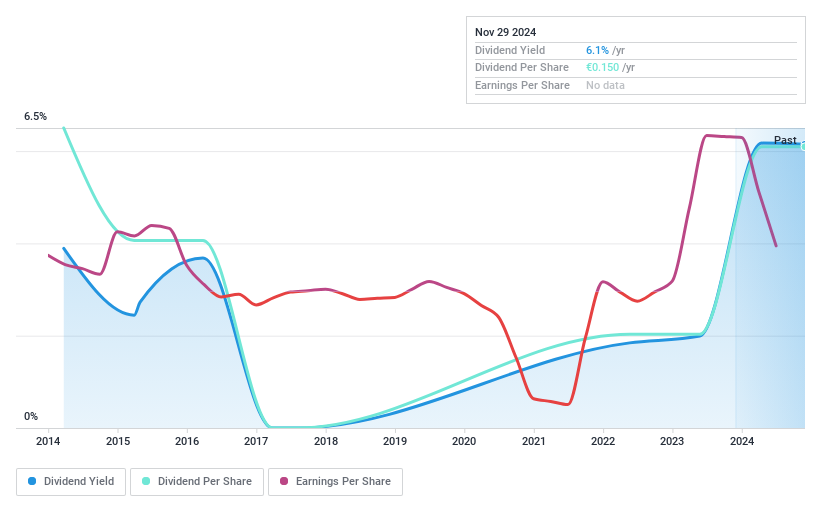

Dividend Yield: 6.1%

Gas Plus offers a dividend yield of 6.12%, placing it in the top 25% of dividend payers in the Italian market, with a payout ratio of 44.7% suggesting dividends are well covered by earnings and cash flows. However, its dividend history is unstable and volatile over the past decade. Recent financials show decreased revenue (EUR 65.7 million) and net income (EUR 5.29 million), potentially impacting future dividend stability.

- Click to explore a detailed breakdown of our findings in Gas Plus' dividend report.

- The valuation report we've compiled suggests that Gas Plus' current price could be inflated.

TTY Biopharm (TPEX:4105)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TTY Biopharm Company Limited, along with its subsidiaries, develops and sells pharmaceutical and chemical drugs in Taiwan and internationally, with a market cap of NT$18.42 billion.

Operations: TTY Biopharm's revenue is derived from its pharmaceutical and chemical drug operations both domestically in Taiwan and on an international scale.

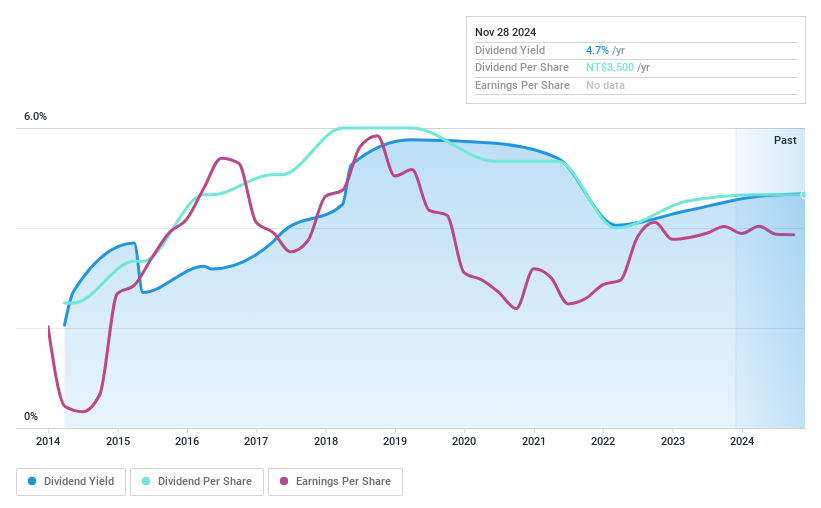

Dividend Yield: 4.7%

TTY Biopharm's dividend yield is 4.7%, ranking in the top 25% of Taiwan's market, with a payout ratio of 77.6%, indicating dividends are covered by earnings and cash flows despite a high cash payout ratio of 85.6%. However, its dividend history has been volatile over the past decade, with periods of significant annual drops, raising concerns about reliability. Recent financials show stable net income despite increased sales for Q3 and nine months ending September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of TTY Biopharm.

- Insights from our recent valuation report point to the potential undervaluation of TTY Biopharm shares in the market.

Globe Union Industrial (TWSE:9934)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Globe Union Industrial Corp. manufactures and sells plumbing products across Taiwan, the United States, China, Europe, and internationally with a market cap of NT$5.83 billion.

Operations: Globe Union Industrial Corp.'s revenue segments include NT$6.38 billion from the manufacture of faucets and sanitary equipment and NT$24.07 billion from their sales and service.

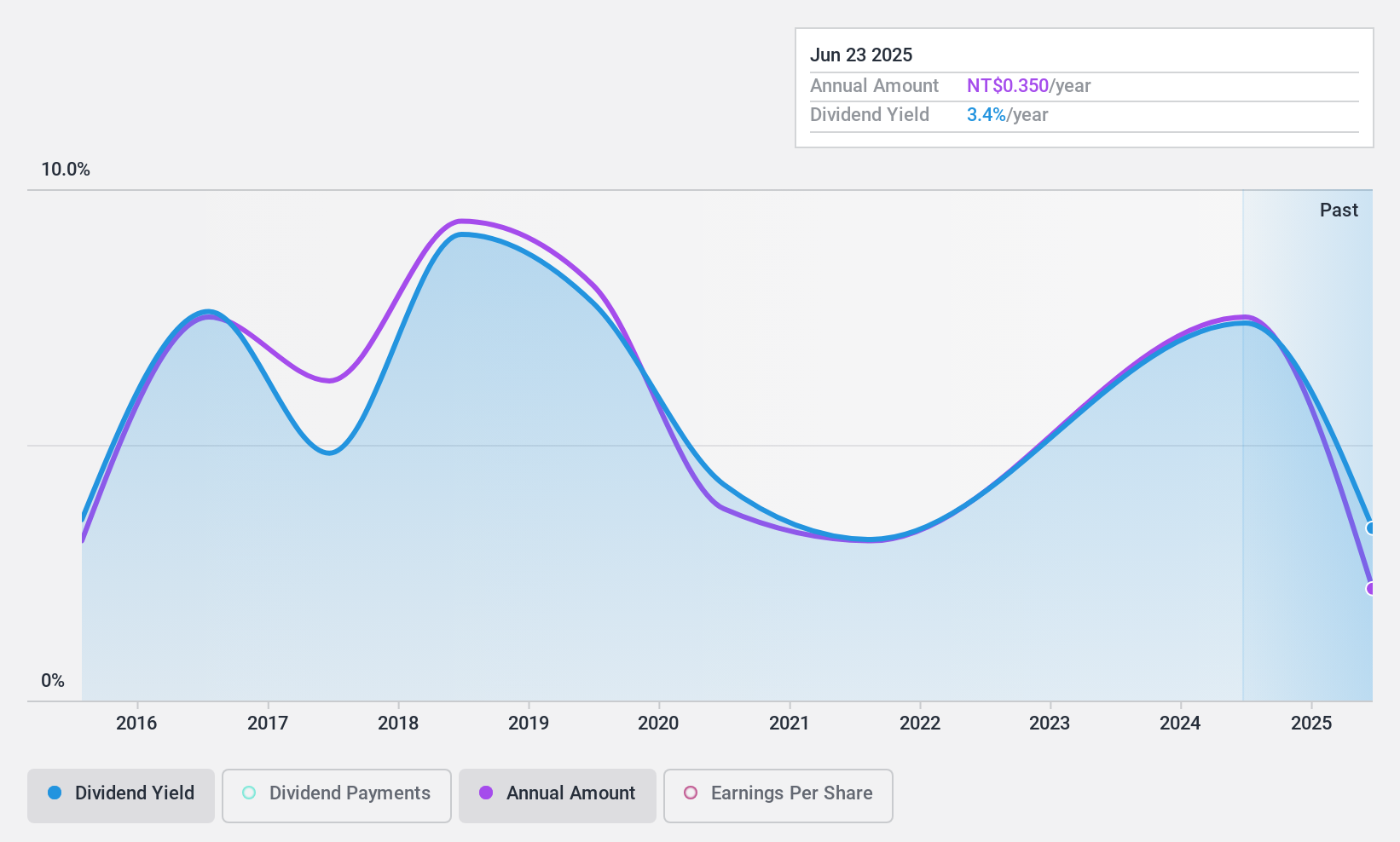

Dividend Yield: 8.2%

Globe Union Industrial's dividend yield of 8.22% places it in the top 25% of Taiwan's market, supported by a manageable cash payout ratio of 27.4%. Despite this, its dividend history has been unstable with significant volatility over the past decade. Recent earnings reports indicate a decline in net income for Q3 and nine months ending September 2024 compared to the previous year, which may impact future dividend sustainability amid executive changes with a new CFO appointment effective January 2025.

- Click here to discover the nuances of Globe Union Industrial with our detailed analytical dividend report.

- Our valuation report here indicates Globe Union Industrial may be undervalued.

Taking Advantage

- Explore the 1957 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GSP

Gas Plus

Engages in the exploration and production of natural gas in Italy.

Adequate balance sheet average dividend payer.