- Italy

- /

- Diversified Financial

- /

- BIT:NEXI

Does Nexi's (BIT:NEXI) Deal Pause Hint at Shifting Priorities for Payments Growth?

Reviewed by Sasha Jovanovic

- Nexi recently announced it has ended its agreement to acquire Banco Sabadell’s payment subsidiary Paycomet, leaving the door open to future negotiations under revised terms more reflective of today's market conditions.

- This pause comes amid a broader shift in the European banking and fintech landscape, highlighting increasing deal uncertainty and evolving partnership priorities in payments.

- We'll examine how Nexi's updated guidance on profit margins and a more cautious management tone after Q3 results could alter its investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nexi Investment Narrative Recap

To be a Nexi shareholder, you have to believe in the acceleration of digital payments and e-commerce across Europe, supported by Nexi’s push for cross-selling digital solutions, margin expansion and continued cash generation, even amid contract pressures and partnership setbacks. The recent exit from the Sabadell Paycomet deal is not material to the short-term catalyst, which remains the realization of cost synergies and stabilization in bank contract renewals; however, it underscores the persistent risk from revenue headwinds tied to ongoing renegotiations and loss of key partner volumes.

One announcement that stands out is Nexi’s recent guidance update confirming low-to-mid-single-digit revenue growth for 2025, even as merchant book impacts and contract negotiations weigh on near-term results. This cautious outlook, paired with the management’s more muted tone following Q3 earnings, offers investors a direct read-through to the business’s challenge of offsetting the structural revenue declines expected from bank partner attrition and pricing concessions.

By contrast, investors should be aware that the risk from structural shifts in bank distribution contracts could accelerate if...

Read the full narrative on Nexi (it's free!)

Nexi's narrative projects €4.1 billion revenue and €813.9 million earnings by 2028. This requires a 13.7% annual revenue decline and a €509.1 million earnings increase from €304.8 million today.

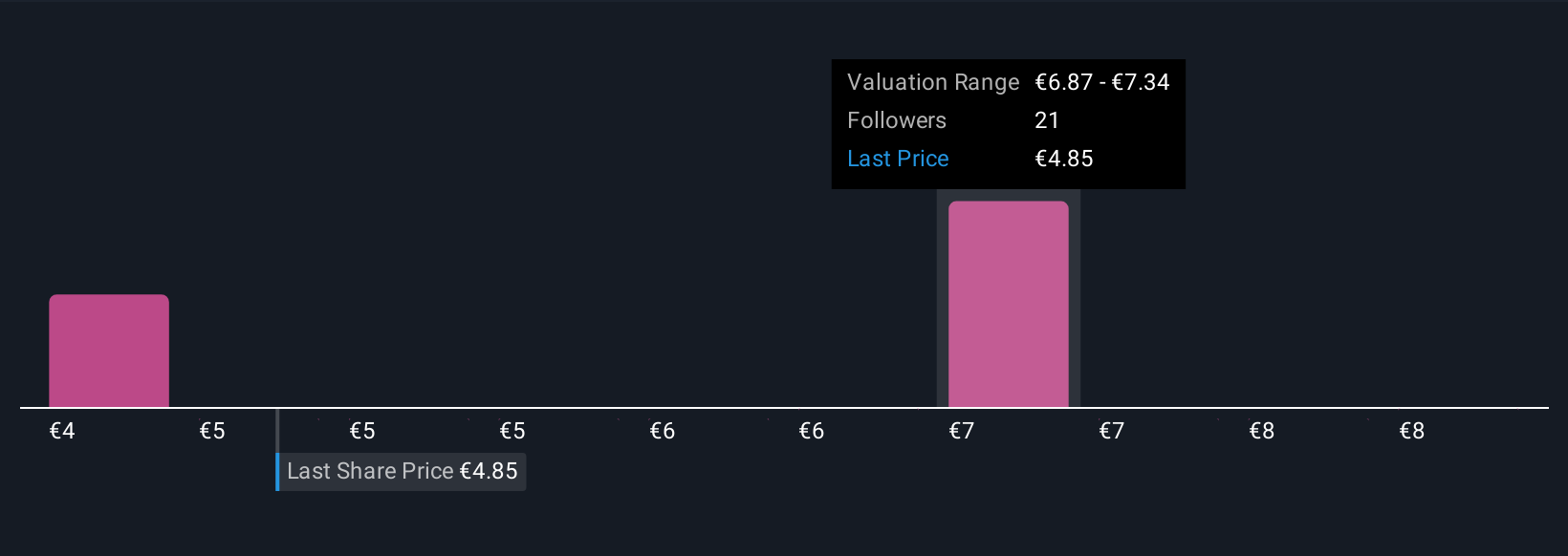

Uncover how Nexi's forecasts yield a €6.47 fair value, a 62% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributors offer five fair value estimates for Nexi ranging from €3.57 to €8.75 per share. In a market shaped by contract renegotiations and ongoing regional revenue pressures, it is clear there are sharply different viewpoints on Nexi’s future, explore these diverse perspectives for a fuller view of what may drive the stock’s performance.

Explore 5 other fair value estimates on Nexi - why the stock might be worth over 2x more than the current price!

Build Your Own Nexi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nexi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nexi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nexi's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NEXI

Nexi

Provides electronic money and payment services to banks, small and medium-sized enterprises, large international corporations, institutions, and public administrations in Italy, Nordics and Baltics, Germany, Austria, Switzerland, Poland, Southeast Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives