- Italy

- /

- Capital Markets

- /

- BIT:AZM

What Does Azimut Holding's (BIT:AZM) Recent Earnings Dip Reveal About Its Profitability Playbook?

Reviewed by Sasha Jovanovic

- Azimut Holding S.p.A. recently reported earnings for the nine months ended September 30, 2025, with net income of €386.16 million, down from €437.66 million in the same period last year.

- This decline marks a shift in the company's earnings trajectory, which investors may closely monitor for signals about future profitability trends and operational effectiveness.

- We will examine how this lower net income impacts Azimut Holding’s investment narrative and expectations for earnings resilience going forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Azimut Holding Investment Narrative Recap

To be a shareholder in Azimut Holding, you need confidence in the company’s ability to manage through cyclical earnings volatility while capitalizing on its global expansion and digital initiatives. The recent decline in nine-month net income signals a potential short-term hurdle, but it does not materially alter the primary catalyst: sustained growth in assets under management through resilient inflows. However, it does amplify concerns over margin pressure in a changing asset management landscape.

Among the latest company announcements, Azimut's reaffirmed 2025 net inflows target of €10 billion stands out. This is particularly relevant given the recent earnings softness, as future success hinges on the firm’s capacity to consistently attract client assets and offset industry headwinds through scale and international growth.

In contrast, investors should also be alert to risks stemming from intensifying industry-wide fee compression and the potential impact if client price sensitivity continues to rise...

Read the full narrative on Azimut Holding (it's free!)

Azimut Holding's narrative projects €1.4 billion in revenue and €513.6 million in earnings by 2028. This implies a -0.2% annual revenue decline and a €28.3 million earnings increase from €485.3 million currently.

Uncover how Azimut Holding's forecasts yield a €36.76 fair value, in line with its current price.

Exploring Other Perspectives

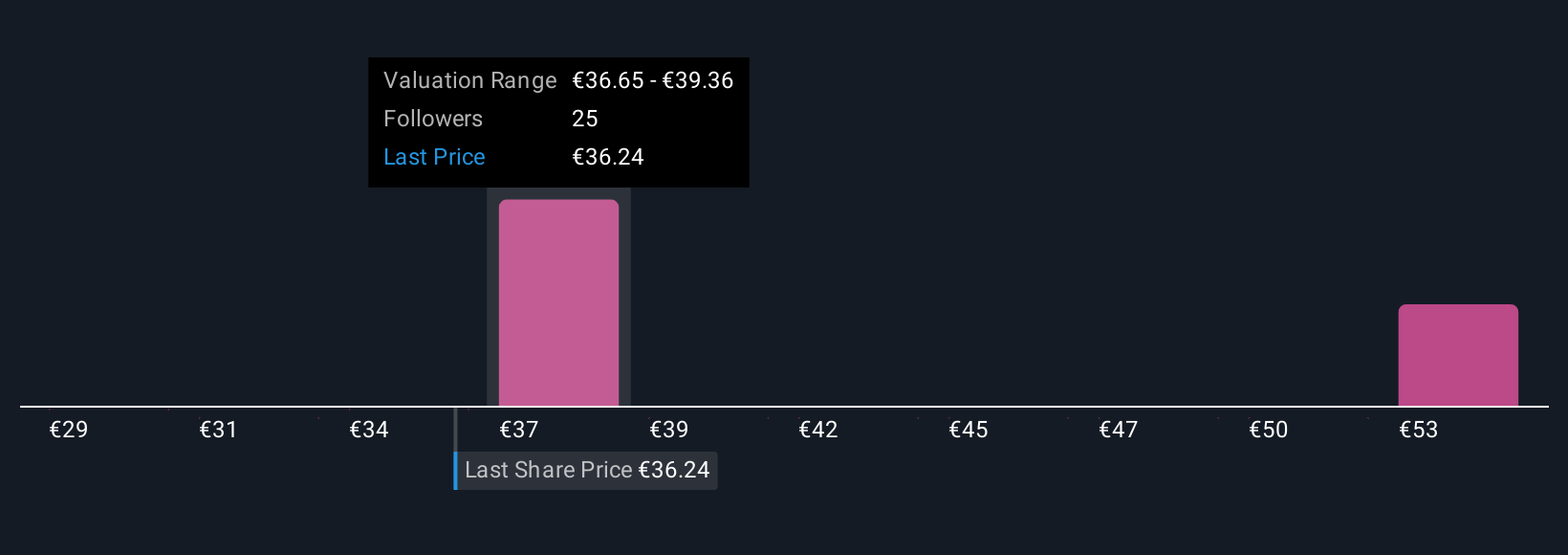

Four Simply Wall St Community members provided fair value estimates for Azimut Holding, spanning from €28.55 to €55.38 per share. While recurring revenue and inflows feature in many discussions, you’ll find wide-ranging opinions on the company’s resilience and the potential outcomes if earnings pressures persist.

Explore 4 other fair value estimates on Azimut Holding - why the stock might be worth 21% less than the current price!

Build Your Own Azimut Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Azimut Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Azimut Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Azimut Holding's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:AZM

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives