- Italy

- /

- Hospitality

- /

- BIT:ART

Investors Still Aren't Entirely Convinced By Deodato.Gallery S.p.A.'s (BIT:ART) Revenues Despite 27% Price Jump

Deodato.Gallery S.p.A. (BIT:ART) shareholders have had their patience rewarded with a 27% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.6% over the last year.

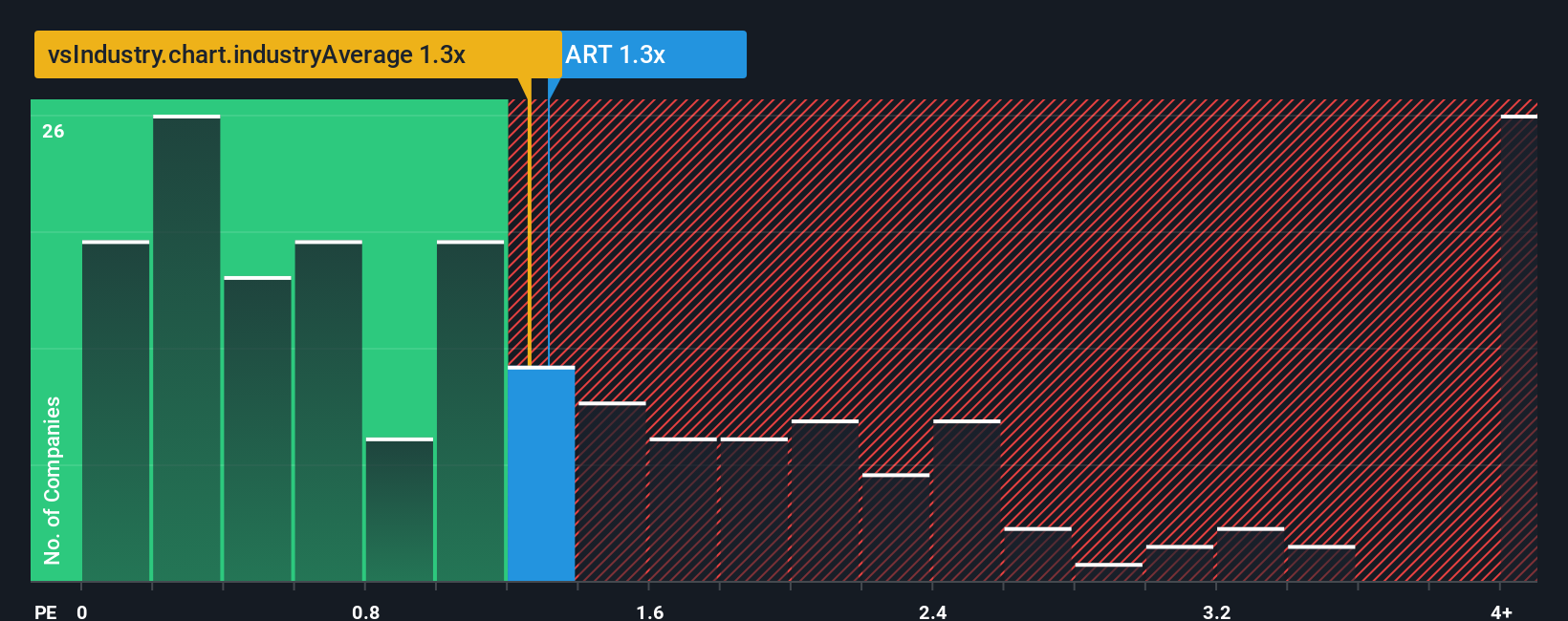

Even after such a large jump in price, it's still not a stretch to say that Deodato.Gallery's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Italy, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Deodato.Gallery

How Deodato.Gallery Has Been Performing

Deodato.Gallery hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Deodato.Gallery's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Deodato.Gallery's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 47% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 11% each year during the coming three years according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.9% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Deodato.Gallery's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Deodato.Gallery's P/S?

Its shares have lifted substantially and now Deodato.Gallery's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Deodato.Gallery's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Deodato.Gallery (1 is a bit concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ART

Deodato.Gallery

Operates in the contemporary art market with a focus on the street art and pop art segment.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives