Further weakness as Salvatore Ferragamo (BIT:SFER) drops 3.7% this week, taking three-year losses to 53%

It is a pleasure to report that the Salvatore Ferragamo S.p.A. (BIT:SFER) is up 50% in the last quarter. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 54%. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

Since Salvatore Ferragamo has shed €45m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Given that Salvatore Ferragamo didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Salvatore Ferragamo's revenue dropped 9.0% per year. That is not a good result. The share price decline of 16% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

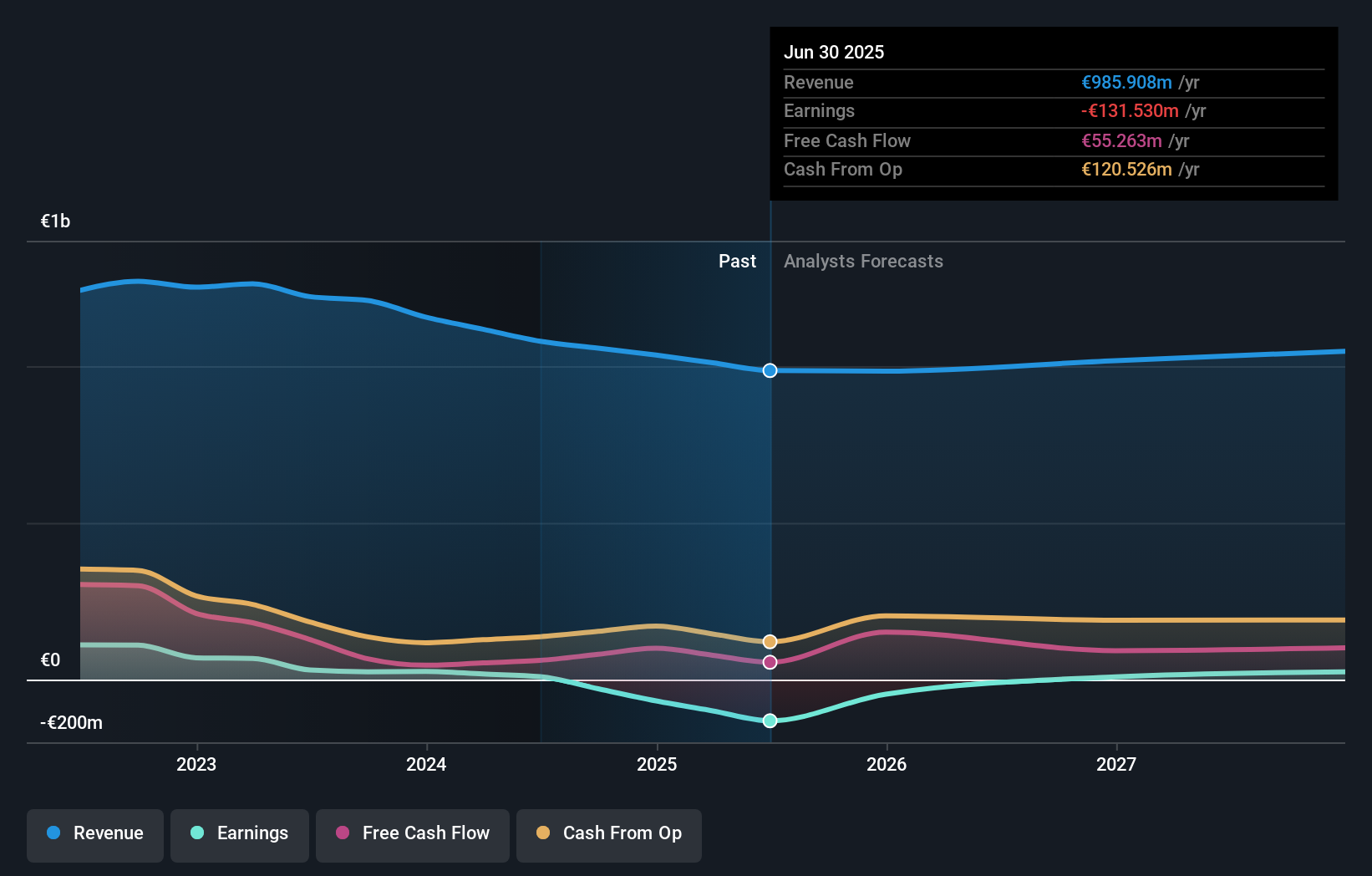

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Salvatore Ferragamo is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Salvatore Ferragamo in this interactive graph of future profit estimates.

A Different Perspective

Salvatore Ferragamo shareholders are up 13% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 7% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Salvatore Ferragamo better, we need to consider many other factors. Even so, be aware that Salvatore Ferragamo is showing 1 warning sign in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:SFER

Salvatore Ferragamo

Through its subsidiaries, creates, produces, and sells luxury goods for men and women in Europe, North America, Japan, the Asia Pacific, and Central and South America.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives