As global markets grapple with the Federal Reserve's cautious stance on future rate cuts and political uncertainties, investors are seeking alternative opportunities amid broad-based declines in major indices. Penny stocks, often associated with smaller or newer companies, continue to capture interest for their potential growth at lower price points. While the term may seem outdated, these stocks offer a unique blend of affordability and opportunity when supported by strong financials, making them a compelling area for exploration.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,839 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Pattern (BIT:PTR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pattern S.p.A. specializes in the engineering and production of luxury fashion products for both women and men in Italy, with a market capitalization of €69.76 million.

Operations: The company's revenue is primarily derived from Italy (€53.85 million), followed by the European Union (€43.28 million) and Non-European Countries (€36.72 million).

Market Cap: €69.76M

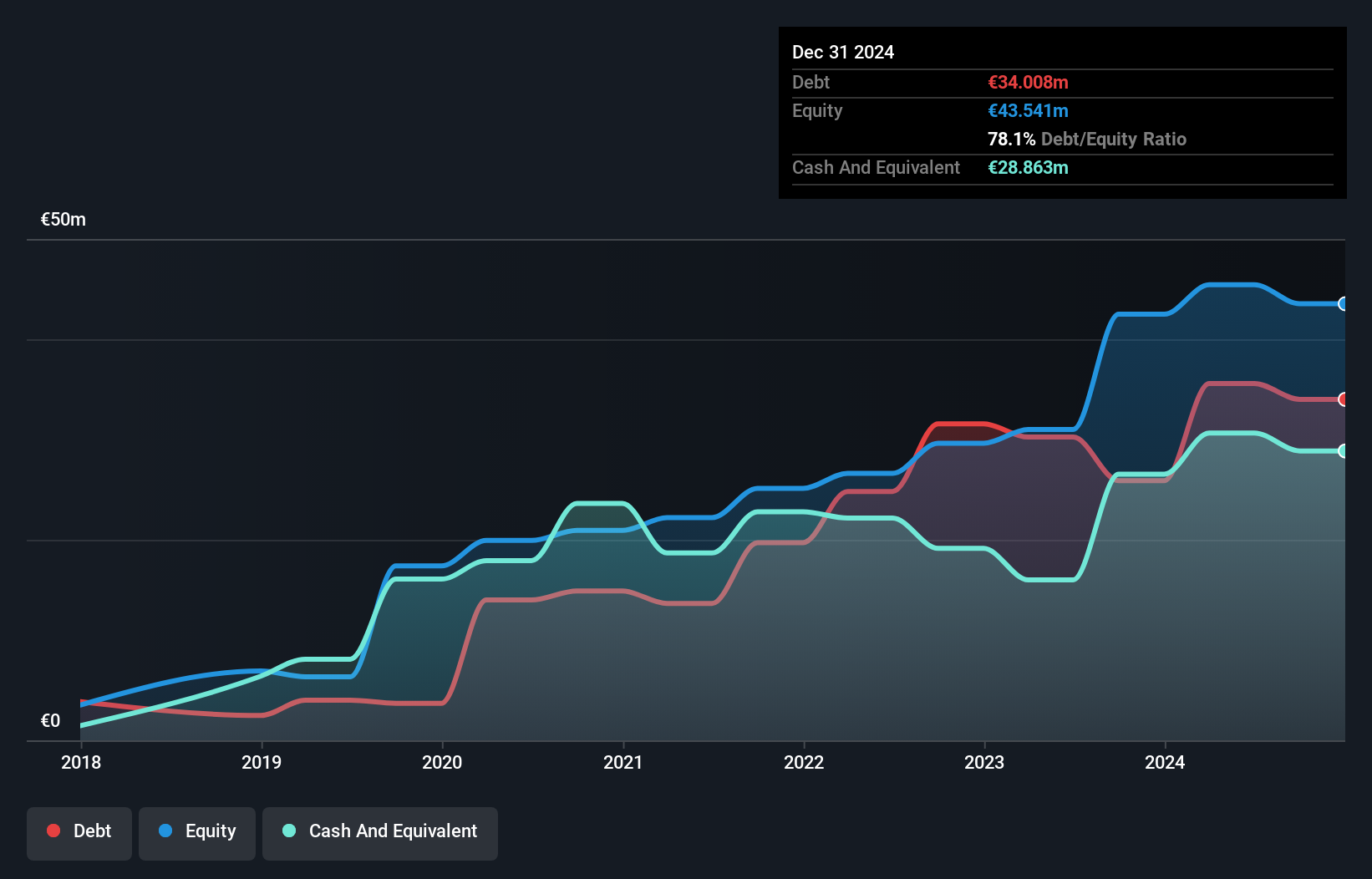

Pattern S.p.A. has demonstrated impressive financial performance, with earnings growth of 780.2% over the past year, significantly outpacing the luxury industry average. Despite a large one-off gain impacting recent results, its Return on Equity stands at an outstanding 51.3%. The company's debt management is robust, with interest payments well covered by EBIT and a satisfactory net debt to equity ratio of 10.9%. While revenue is expected to grow annually by 10.41%, earnings are forecasted to decline over the next three years. Analysts agree on potential stock price appreciation despite these challenges.

- Click here to discover the nuances of Pattern with our detailed analytical financial health report.

- Examine Pattern's earnings growth report to understand how analysts expect it to perform.

Marlin Global (NZSE:MLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marlin Global Limited is an investment company with a market cap of NZ$202.52 million.

Operations: The company generates revenue of NZ$42.79 million from its international financial investment segment.

Market Cap: NZ$202.52M

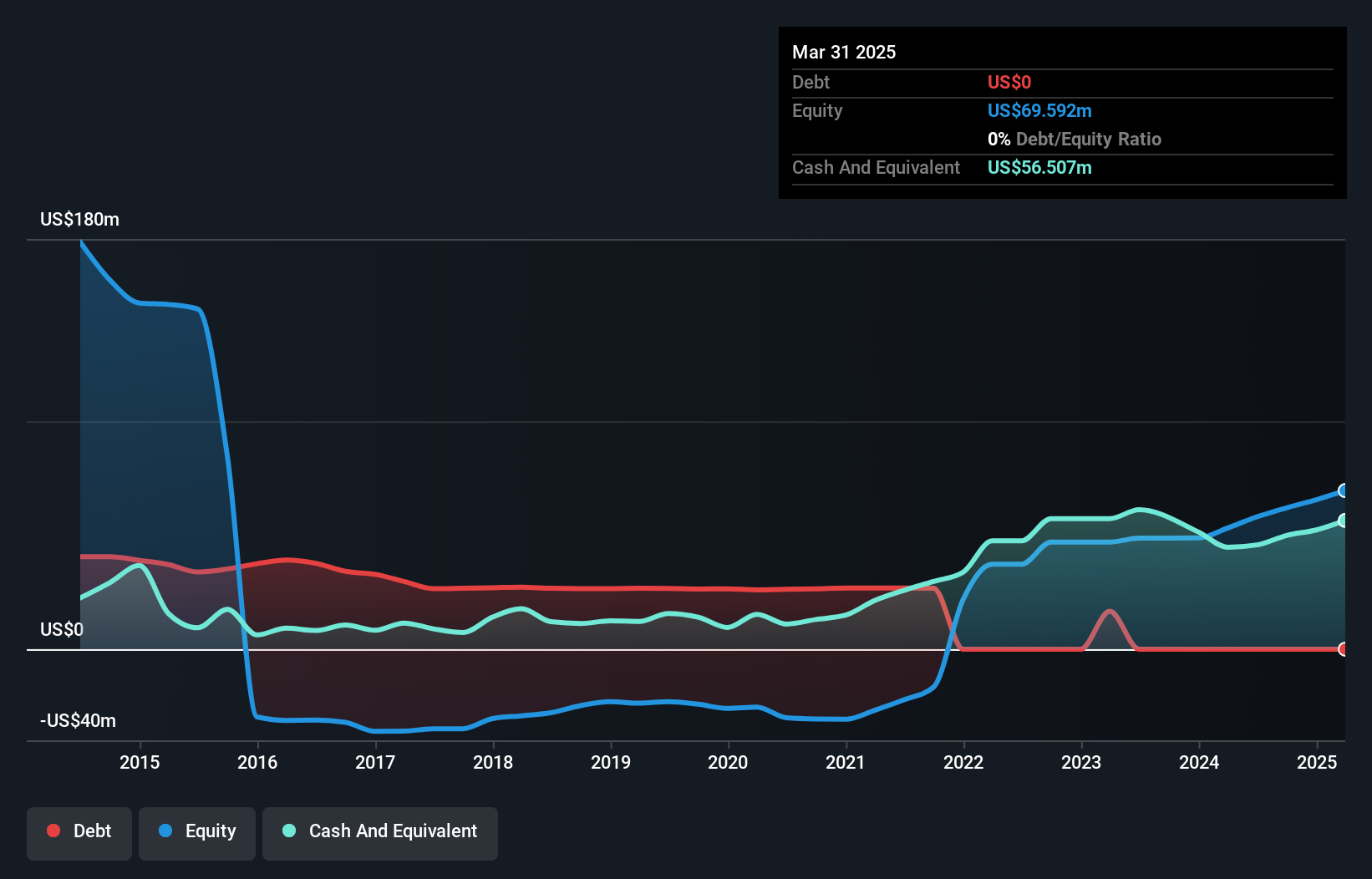

Marlin Global Limited has shown a strong earnings growth of 57.6% over the past year, surpassing its five-year average decline of 10.8% annually and outperforming the broader Capital Markets industry growth. The company operates debt-free with no long-term liabilities, enhancing financial stability. However, despite high-quality earnings and a current net profit margin improvement to 86.9%, its Return on Equity remains low at 16.7%. Additionally, Marlin Global's dividend yield of 8.34% is not well-supported by free cash flows, raising sustainability concerns amidst its undervaluation against estimated fair value by 61.4%.

- Dive into the specifics of Marlin Global here with our thorough balance sheet health report.

- Gain insights into Marlin Global's past trends and performance with our report on the company's historical track record.

RH PetroGas (SGX:T13)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RH PetroGas Limited is an investment holding company involved in the exploration, development, and production of oil and gas resources in Indonesia, with a market cap of SGD134.46 million.

Operations: The company generates revenue from its oil and gas operations amounting to $98.10 million.

Market Cap: SGD134.46M

RH PetroGas Limited has demonstrated a significant earnings growth of 34.1% over the past year, outpacing the Oil and Gas industry average. Despite this, earnings are projected to decline by an average of 25.9% annually over the next three years. The company maintains a solid financial position with no debt and sufficient short-term assets to cover liabilities. Recent leadership changes include appointing Mr. Ferry Hakim as President Director in Indonesia, potentially strengthening its management team despite an inexperienced board overall. While trading significantly below fair value estimates, RH PetroGas's share price remains highly volatile.

- Get an in-depth perspective on RH PetroGas' performance by reading our balance sheet health report here.

- Gain insights into RH PetroGas' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Discover the full array of 5,839 Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PTR

Pattern

Engages in the engineering and production of luxury goods in Italy, rest of the European Union, and internationally.

Undervalued with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.