The European market has recently experienced a downturn, with major indices like the STOXX Europe 600 Index declining amid concerns over inflated AI stock valuations and shifting expectations around U.S. interest rates. Despite these challenges, opportunities remain for investors who explore beyond the well-trodden paths of large-cap stocks. Penny stocks, though often seen as a relic of past market trends, continue to offer potential value and growth when backed by solid financials. In this article, we will explore three European penny stocks that stand out for their financial resilience and growth potential in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.076 | €1.41B | ✅ 5 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €83.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €232.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.12 | €66.18M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.33 | €382.71M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.85 | €75.08M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.20 | €304.09M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.08 | €8.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.858 | €28.73M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 276 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Gentili Mosconi (BIT:GM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gentili Mosconi S.p.A. manufactures and sells printed and dyed fabrics in Italy, the rest of the European Union, and internationally, with a market cap of €60 million.

Operations: The company's revenue is primarily derived from Fabrics (€20.09 million), Fashion Textile Accessories (€17.40 million), and Printing and Dyeing Processes of Fabrics (€3.23 million), with additional contributions from Home Textile Accessories (€0.98 million).

Market Cap: €60M

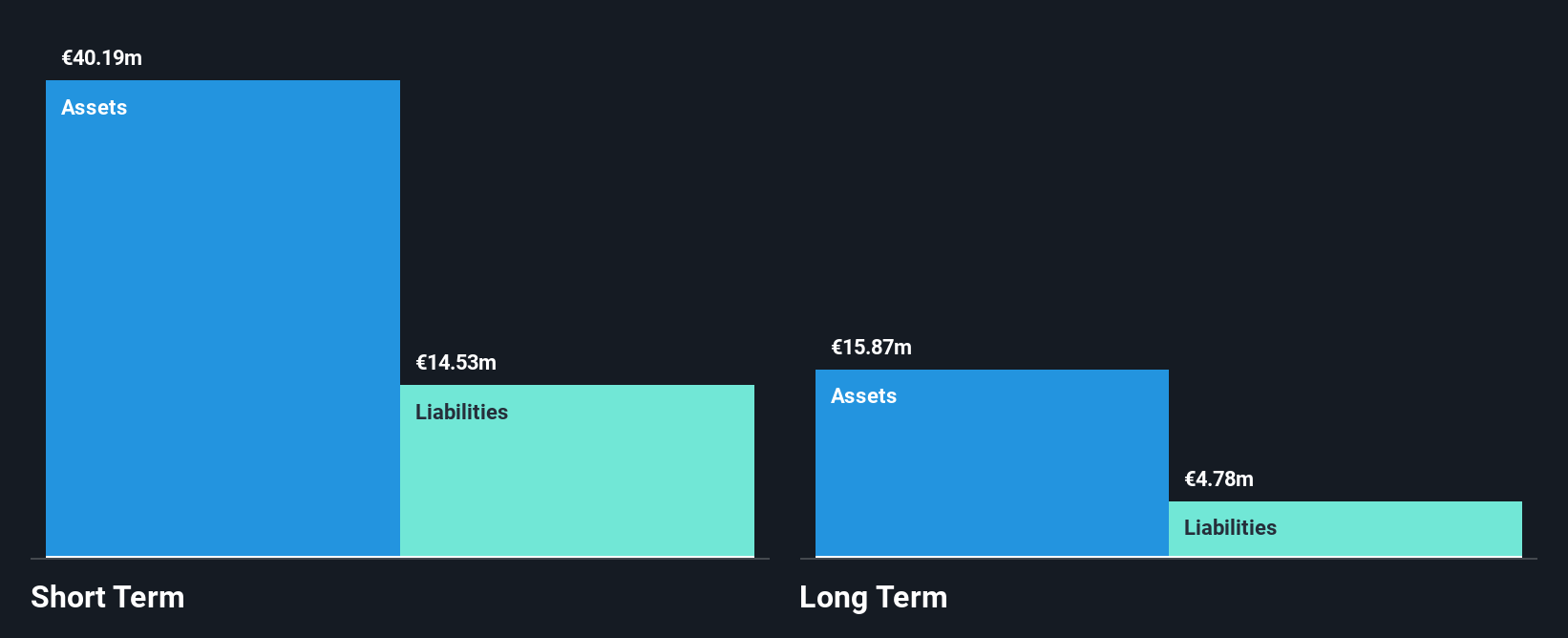

Gentili Mosconi S.p.A. has shown resilience with revenues of €24.71 million for the half-year ending June 2025, despite a net loss of €0.398 million compared to a profit last year. The company benefits from strong short-term asset coverage over liabilities and maintains more cash than its total debt, suggesting financial prudence. However, its dividend yield is not well-supported by earnings or free cash flow due to current unprofitability and negative return on equity (-3.08%). While trading significantly below estimated fair value, Gentili Mosconi's forecasted earnings growth of 80.42% per year offers potential upside for investors mindful of risks associated with penny stocks.

- Click to explore a detailed breakdown of our findings in Gentili Mosconi's financial health report.

- Review our growth performance report to gain insights into Gentili Mosconi's future.

NX Filtration (ENXTAM:NXFIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NX Filtration N.V. is a company that develops, produces, and sells hollow fiber membrane modules across the Netherlands, Europe, North America, Asia, and internationally with a market cap of €157.04 million.

Operations: The company's revenue is derived from two primary segments: Clean Municipal Water, generating €3.85 million, and Sustainable Industrial Water, contributing €6.71 million.

Market Cap: €157.04M

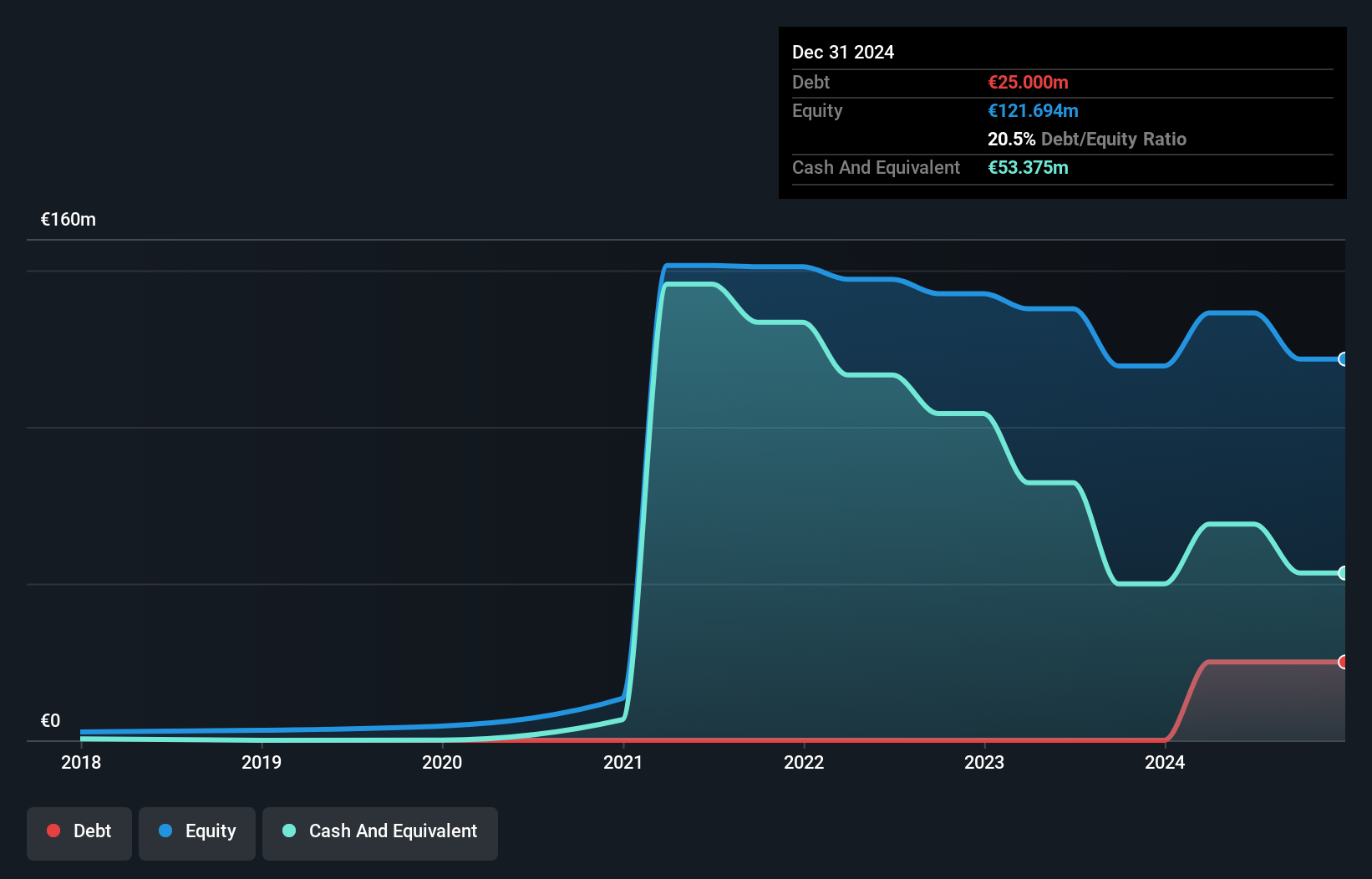

NX Filtration N.V., with a market cap of €157.04 million, operates in the hollow fiber membrane industry and generates revenue from Clean Municipal Water (€3.85M) and Sustainable Industrial Water (€6.71M). Despite being unprofitable with a negative return on equity (-25.24%), it maintains strong financial health, having more cash than debt and sufficient short-term assets to cover liabilities. The company has not experienced significant shareholder dilution recently but was removed from the S&P Global BMI Index in September 2025. Revenue is expected to grow substantially at 51.59% annually, although profitability remains elusive for the next three years.

- Click here to discover the nuances of NX Filtration with our detailed analytical financial health report.

- Learn about NX Filtration's future growth trajectory here.

Anora Group Oyj (HLSE:ANORA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anora Group Oyj is involved in the production, importation, marketing, distribution, and sale of alcoholic beverages across Finland, Europe, and internationally with a market cap of €245.90 million.

Operations: Anora Group Oyj generates revenue through three main segments: Wine (€310.3 million), Spirits (€218.2 million), and Industrial (€226.2 million).

Market Cap: €245.9M

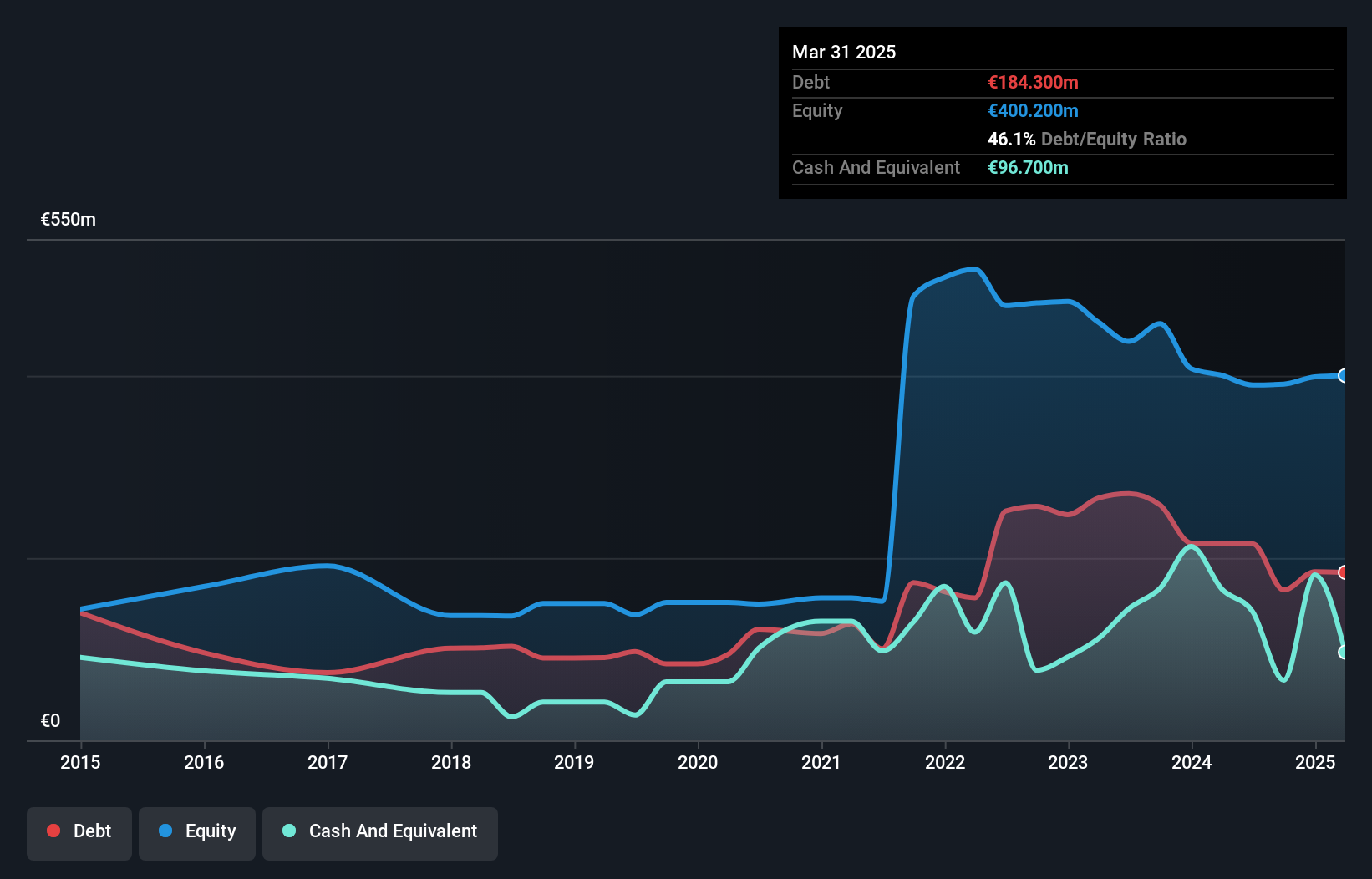

Anora Group Oyj, with a market cap of €245.90 million, has achieved profitability this year despite a decline in earnings over the past five years. The company's financial health is solid, with short-term assets exceeding both short and long-term liabilities. However, its dividend yield of 6.04% is not well-covered by earnings. Recent executive changes include Anna Möller's appointment to lead the Wine segment following Janne Halttunen's departure. Anora plans organizational restructuring to enhance efficiency and reduce costs by approximately €7 million in 2026 as part of its strategic Fit & Fix initiative for performance improvement and growth focus from 2026 onwards.

- Jump into the full analysis health report here for a deeper understanding of Anora Group Oyj.

- Examine Anora Group Oyj's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Dive into all 276 of the European Penny Stocks we have identified here.

- Searching for a Fresh Perspective? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GM

Gentili Mosconi

Manufactures and sells printed and dyed fabrics in Italy, rest of European Union countries, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success