Geox (BIT:GEO investor three-year losses grow to 57% as the stock sheds €13m this past week

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Geox S.p.A. (BIT:GEO) shareholders. Unfortunately, they have held through a 60% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 48% lower in that time. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days.

Since Geox has shed €13m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Given that Geox didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Geox saw its revenue grow by 1.5% per year, compound. That's not a very high growth rate considering it doesn't make profits. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 17% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

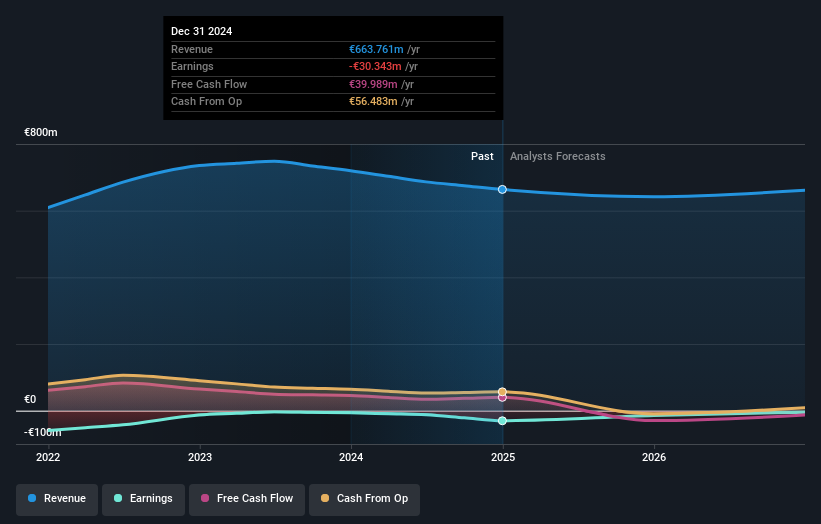

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We've already covered Geox's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Geox shareholders, and that cash payout explains why its total shareholder loss of 57%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Investors in Geox had a tough year, with a total loss of 44%, against a market gain of about 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Geox .

But note: Geox may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:GEO

Geox

Geox S.p.A. creates, produces, promotes, and distributes footwear and apparel to retailers and end consumers in Italy, Europe, North America, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives