Aquafil (BIT:ECNL investor three-year losses grow to 66% as the stock sheds €17m this past week

While not a mind-blowing move, it is good to see that the Aquafil S.p.A. (BIT:ECNL) share price has gained 25% in the last three months. But that is small recompense for the exasperating returns over three years. Tragically, the share price declined 71% in that time. Some might say the recent bounce is to be expected after such a bad drop. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Since Aquafil has shed €17m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

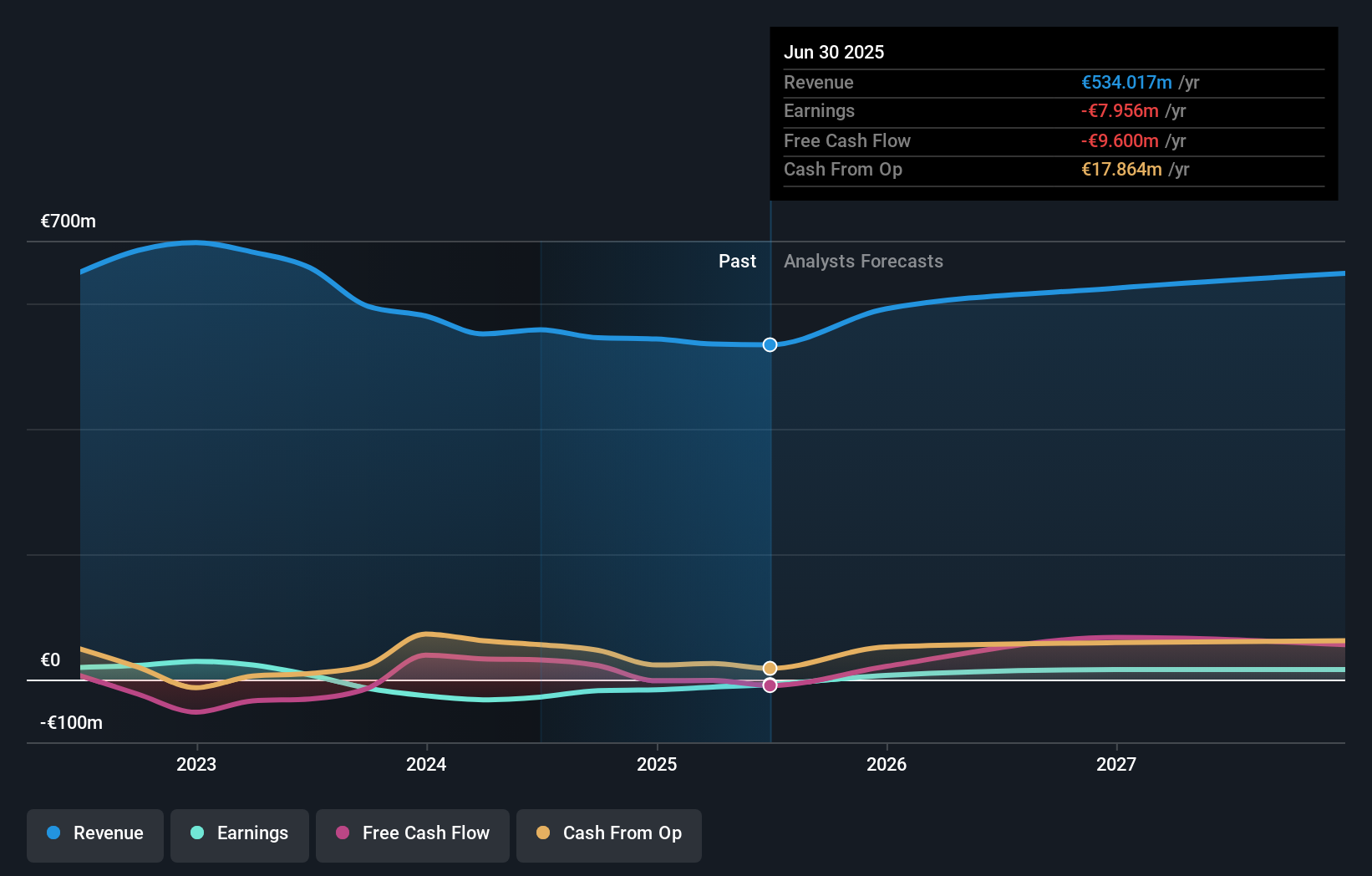

Because Aquafil made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Aquafil saw its revenue shrink by 9.9% per year. That is not a good result. The share price fall of 19% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Aquafil stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Aquafil's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Aquafil's TSR, which was a 66% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Aquafil shareholders gained a total return of 4.7% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 7% per year, over five years. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Aquafil , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ECNL

Aquafil

Engages in the production, reprocessing, and sale of polyamide 6 fibers and polymers in Europe, the Middle East, Africa, Asia, Oceania, and the United States.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives