- Italy

- /

- Professional Services

- /

- BIT:CIRC

If You Had Bought Circle (BIT:CIRC) Stock A Year Ago, You'd Be Sitting On A 12% Loss, Today

It's easy to feel disappointed if you buy a stock that goes down. But sometimes broader market conditions have more of an impact on prices than the actual business performance. Over the year the Circle S.p.A. (BIT:CIRC) share price fell 12%. However, that's better than the market's overall decline of 18%. Circle may have better days ahead, of course; we've only looked at a one year period. There was little comfort for shareholders in the last week as the price declined a further 3.5%.

View our latest analysis for Circle

Because Circle made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Circle saw its revenue grow by 20%. That's definitely a respectable growth rate. While the share price drop of 12% over twelve months certainly won't delight holders, it's not bad in a weak market. We'd venture the revenue growth helped inspire some faith from holders. So growth investors might like to put this one on the watchlist to see if revenue keeps trending in the right direction.

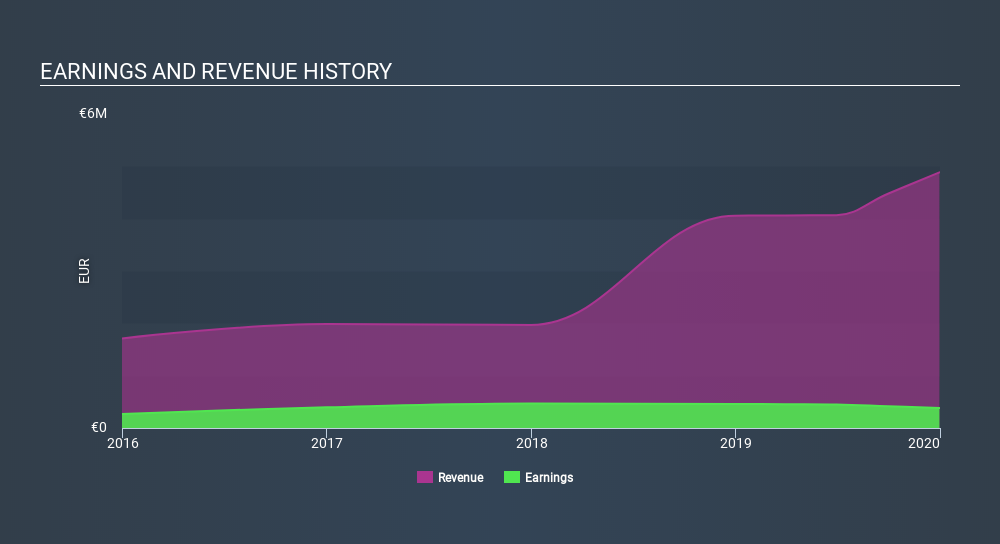

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While they no doubt would have preferred make a profit, at least Circle shareholders didn't do too badly in the last year. Their loss of 12% actually beat the broader market, which lost around 18%. The falls have continued up until the last quarter, with the share price down 6.8% in that time. Momentum traders would generally avoid a stock if the share price is in a downtrend. We prefer keep an eye on the trends in business metrics like revenue or EPS. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Circle has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Circle is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:CIRC

Circle

Provides management consultancy, IT, and software solutions for the port, maritime, and logistics sectors in Italy.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives