- Italy

- /

- Aerospace & Defense

- /

- BIT:PAG

We Think Porto Aviation Group (BIT:PAG) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Porto Aviation Group S.p.A. (BIT:PAG) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Porto Aviation Group's Net Debt?

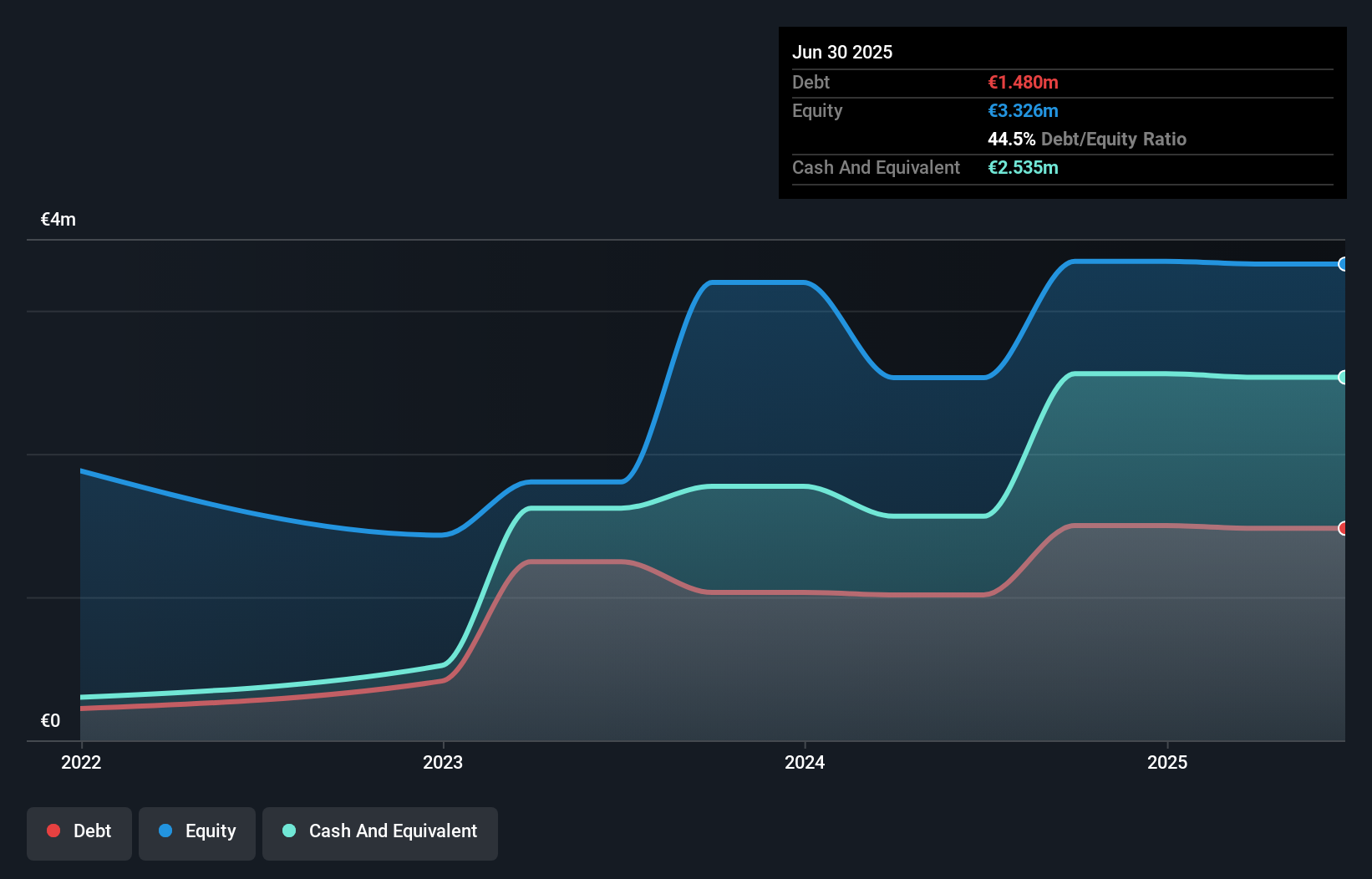

You can click the graphic below for the historical numbers, but it shows that as of June 2025 Porto Aviation Group had €1.48m of debt, an increase on €1.01m, over one year. However, it does have €2.54m in cash offsetting this, leading to net cash of €1.05m.

A Look At Porto Aviation Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Porto Aviation Group had liabilities of €1.96m due within 12 months and liabilities of €1.60m due beyond that. Offsetting these obligations, it had cash of €2.54m as well as receivables valued at €474.8k due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €558.1k.

Of course, Porto Aviation Group has a market capitalization of €11.6m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Porto Aviation Group also has more cash than debt, so we're pretty confident it can manage its debt safely.

See our latest analysis for Porto Aviation Group

It was also good to see that despite losing money on the EBIT line last year, Porto Aviation Group turned things around in the last 12 months, delivering and EBIT of €1.1m. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Porto Aviation Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Porto Aviation Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent year, Porto Aviation Group recorded free cash flow worth 68% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

We could understand if investors are concerned about Porto Aviation Group's liabilities, but we can be reassured by the fact it has has net cash of €1.05m. And it impressed us with free cash flow of €748k, being 68% of its EBIT. So we don't think Porto Aviation Group's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Porto Aviation Group (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:PAG

Porto Aviation Group

Engages in the production of gliders and aircrafts in Italy.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives