- Germany

- /

- Capital Markets

- /

- XTRA:BWB

Undiscovered Gems in Europe to Explore This September 2025

Reviewed by Simply Wall St

Amid recent concerns over the independence of the U.S. Federal Reserve and political instability in Europe, the pan-European STOXX Europe 600 Index ended August nearly 2% lower, reflecting broader market anxieties. Despite these challenges, small-cap stocks can present unique opportunities for investors seeking growth potential in uncertain times, as they often offer innovation and agility that larger companies may lack.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Next Geosolutions Europe (BIT:NXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Next Geosolutions Europe SpA offers marine geoscience and offshore construction support services across Europe, Asia, and North America with a market cap of €580.80 million.

Operations: Next Geosolutions Europe generates revenue primarily from its engineering services, amounting to €304.99 million. The company's market capitalization is €580.80 million.

Next Geosolutions Europe, a small player in the construction sector, is showing promising signs of growth and value. Its earnings grew by 47.8% over the past year, outpacing the industry's 39.2% rise, while trading at 37.5% below estimated fair value suggests potential upside for investors. Despite a dip in profit margins from last year's 35.8% to 14.1%, its interest payments are well covered by EBIT at an impressive 92.8x coverage ratio, reflecting strong financial health. The company also enjoys a positive free cash flow position and holds more cash than total debt, indicating solid financial management and stability amidst market volatility.

- Navigate through the intricacies of Next Geosolutions Europe with our comprehensive health report here.

Assess Next Geosolutions Europe's past performance with our detailed historical performance reports.

va-Q-tec (HMSE:VQT)

Simply Wall St Value Rating: ★★★★★☆

Overview: va-Q-tec AG specializes in the development, production, and marketing of vacuum insulation panels and phase change materials across Germany, the European Union, and international markets with a market capitalization of €406.90 million.

Operations: The company's primary revenue streams are derived from its German operations, contributing €78.91 million, and its UK subsidiary, Va-Q-Tec UK LTD, generating €40.77 million.

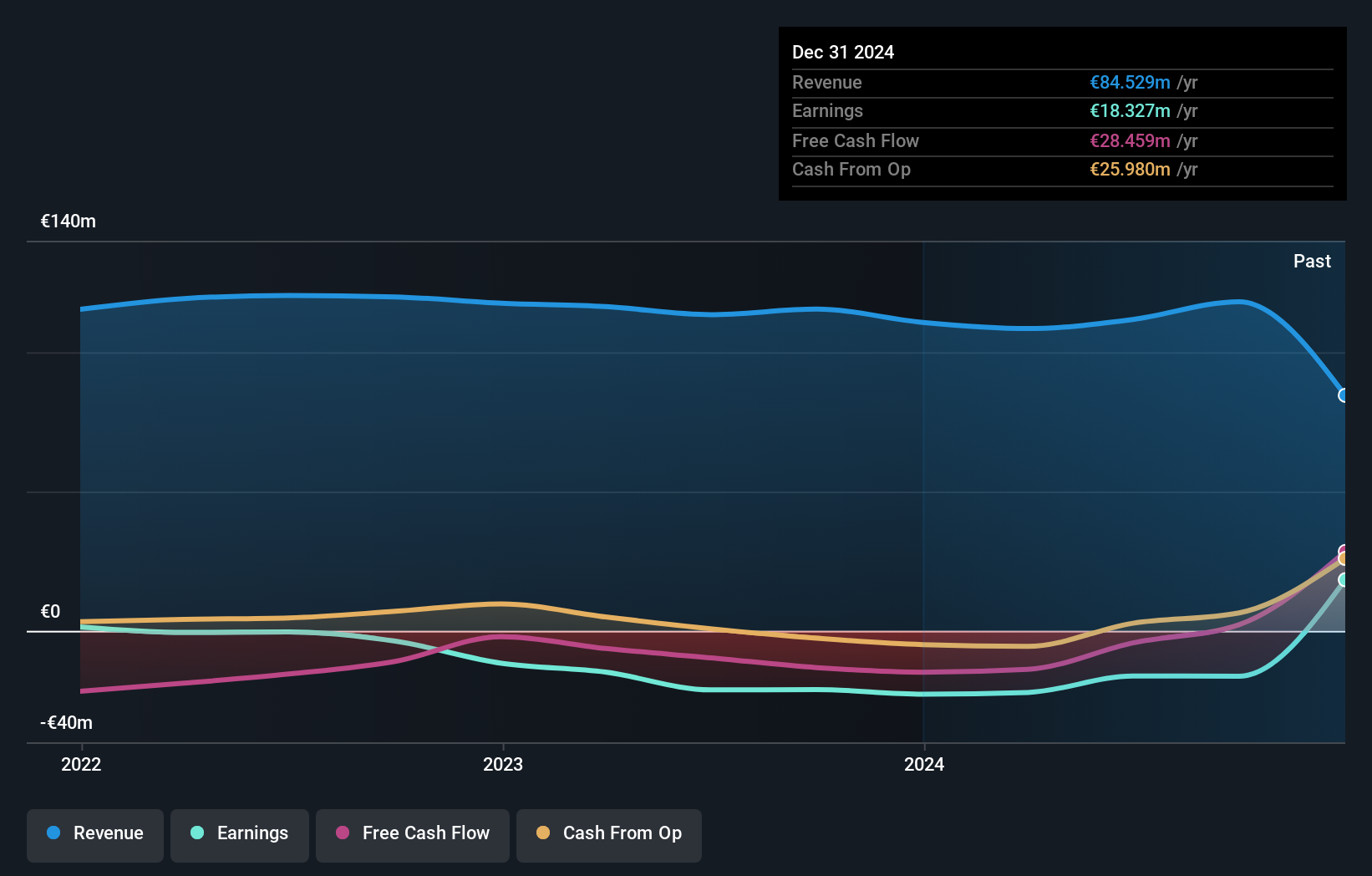

va-Q-tec, a promising player in the European market, has recently turned profitable with net income reaching €18.33M for 2024, a significant turnaround from the previous year's €22.74M loss. The company's debt to equity ratio impressively decreased from 80.2% to 43.5% over five years, reflecting prudent financial management. A notable one-off gain of €23.9M impacted its recent earnings positively, while trading at about 77% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this sector. Despite challenges with sales dropping to €84.53M from last year’s €110.69M, va-Q-tec's strategic positioning remains intriguing.

Baader Bank (XTRA:BWB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Baader Bank Aktiengesellschaft offers investment and banking services across Europe, with a market capitalization of €256.19 million.

Operations: The company generates revenue primarily from its investment and banking services across Europe. It has a market capitalization of €256.19 million, indicating its size within the financial sector.

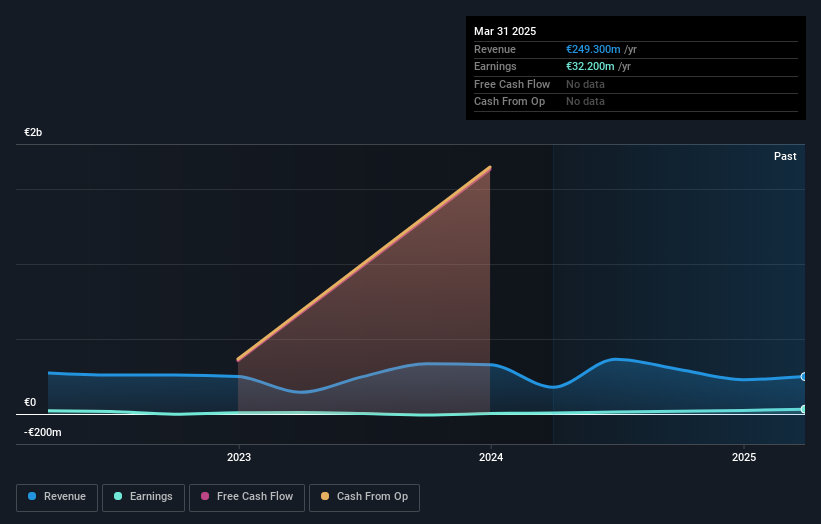

Baader Bank, a notable player in the European financial scene, has demonstrated impressive earnings growth of 268.1% over the past year, significantly outpacing the Capital Markets industry average of 30.4%. The bank's debt-to-equity ratio has improved from 58.4% to 42.1% over five years, reflecting prudent financial management. With a price-to-earnings ratio of just 5.3x compared to the German market's 18.7x, it offers compelling value for investors seeking quality earnings at a reasonable price point. Additionally, Baader Bank's recent acquisition of a MiCAR crypto trading license positions it as a strong contender in the burgeoning EU cryptocurrency market.

- Click here to discover the nuances of Baader Bank with our detailed analytical health report.

Examine Baader Bank's past performance report to understand how it has performed in the past.

Taking Advantage

- Investigate our full lineup of 330 European Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baader Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BWB

Solid track record with excellent balance sheet.

Market Insights

Community Narratives