I.CO.P.. Società Benefit And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index edges higher, buoyed by easing inflation and supportive monetary policy from the European Central Bank, investors are increasingly turning their attention to small-cap stocks that may offer unique growth opportunities. In this environment, identifying promising companies like I.CO.P. Società Benefit and other lesser-known entities can be key for investors seeking to capitalize on emerging trends and resilient sectors in Europe's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

I.CO.P.. Società Benefit (BIT:ICOP)

Simply Wall St Value Rating: ★★★★★★

Overview: I.CO.P. S.p.A. Società Benefit specializes in construction and special engineering services for both public and private sectors across Italy and internationally, with a market capitalization of €308.13 million.

Operations: The company's revenue primarily comes from heavy construction, amounting to €110.92 million.

I.CO.P. Società Benefit, a dynamic player in the construction sector, showcases impressive financial health with its debt to equity ratio dropping from 200.8% to 61.4% over five years. The company's earnings surged by 253.6% last year, far outpacing the industry average of 28.3%. With net income reaching €17.86 million for 2024 compared to €5.05 million previously, I.CO.P.'s profitability is evident despite sales dipping from €117.77 million to €110.77 million in the same period; however, revenue climbed significantly from €112.2 million to €187.24 million, suggesting robust operational performance and potential for future growth.

- Take a closer look at I.CO.P.. Società Benefit's potential here in our health report.

Evaluate I.CO.P.. Società Benefit's historical performance by accessing our past performance report.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★★★

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €420.28 million.

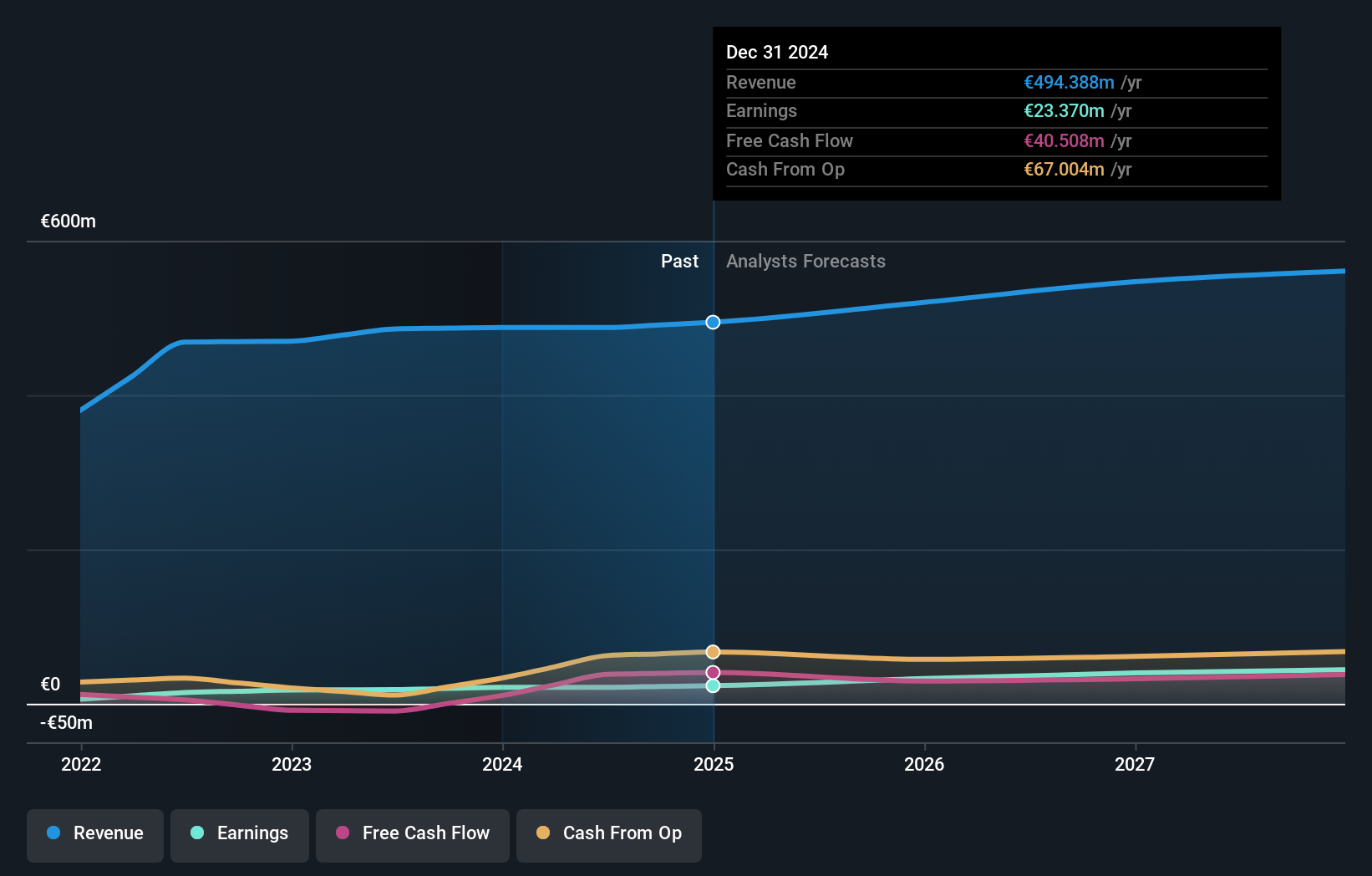

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, amounting to €494.39 million. The company's market capitalization stands at €420.28 million.

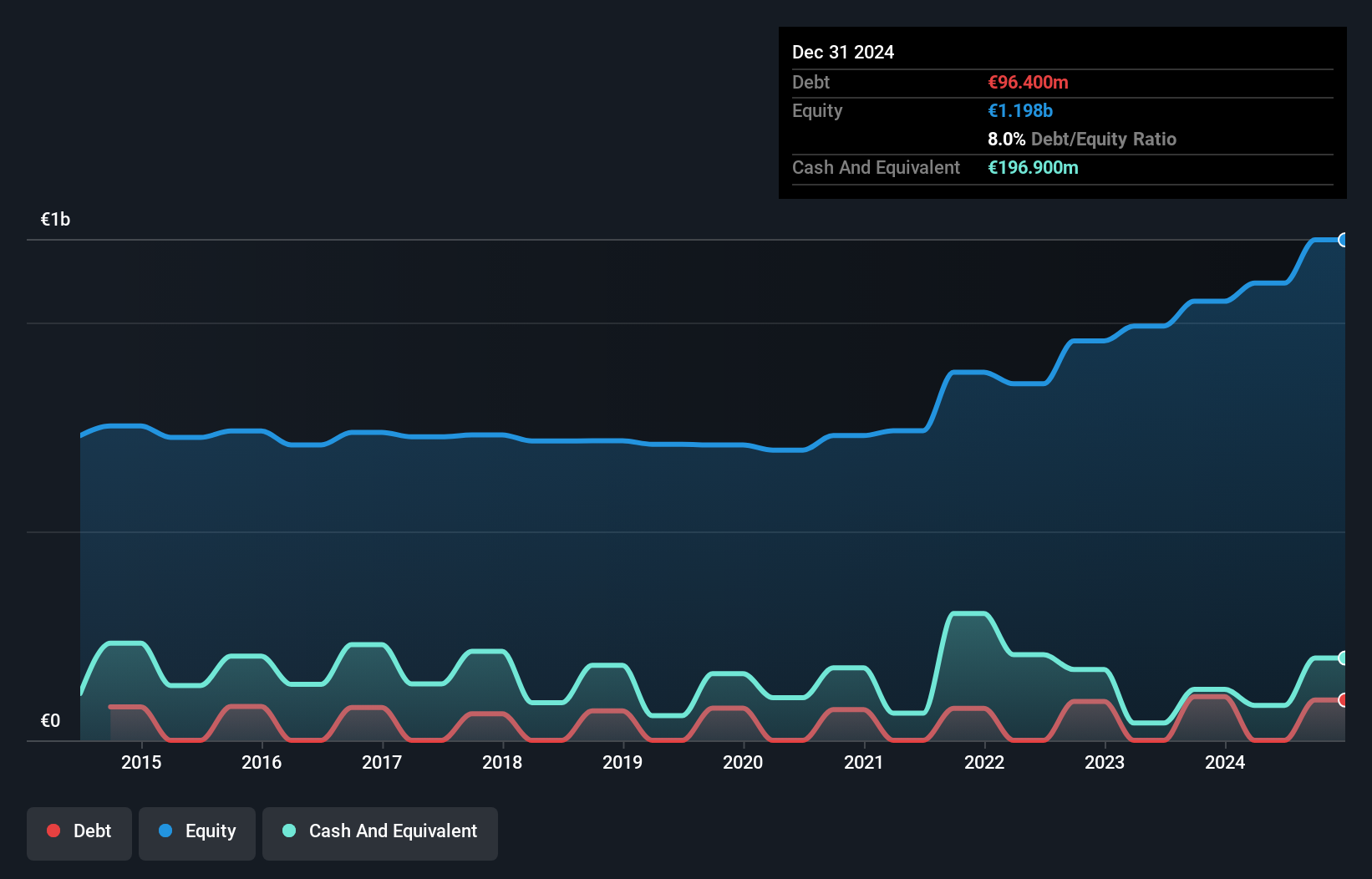

EPC Groupe, a notable name in the chemicals sector, has demonstrated robust financial health with its debt to equity ratio dropping from 73.9% to 45.5% over five years and interest payments well covered by EBIT at 3.5x. The company reported a net income of €23.37 million for the year ending December 2024, up from €21.35 million previously, alongside earnings per share rising to €11.22 from €10.16 last year. Trading at about 35% below estimated fair value and boasting high-quality earnings, EPC seems poised for growth with projected annual earnings increase of nearly 20%.

- Navigate through the intricacies of EPC Groupe with our comprehensive health report here.

Gain insights into EPC Groupe's past trends and performance with our Past report.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG operates in the production, distribution, and sale of electricity under the naturenergie brand both in Switzerland and internationally, with a market capitalization of CHF 1.04 billion.

Operations: The primary revenue streams for Naturenergie Holding AG include Customer-Oriented Energy Solutions (€1.03 billion), Renewable Generation Infrastructure (€903.30 million), and System Relevant Infrastructure (€455.10 million).

Naturenergie Holding, a small cap player in the European energy sector, has shown impressive earnings growth of 67.2% over the past year, outpacing its industry peers who saw a -7% change. This growth is supported by high-quality earnings and excellent value trading at 40.7% below its fair value estimate. The company's debt to equity ratio improved from 10.9 to 8 over five years, indicating prudent financial management. Despite forecasts suggesting a potential average decline of 9.7% in earnings annually for the next three years, NEAG's interest payments are comfortably covered by EBIT at an impressive 253 times coverage, showcasing robust financial health amidst market challenges.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 330 European Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPC Groupe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXPL

EPC Groupe

Engages in the manufacture, storage, and distribution of explosives in Europe, Africa, Asia Pacific, and the Americas.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives