Subdued Growth No Barrier To Antares Vision S.p.A. (BIT:AV) With Shares Advancing 25%

Antares Vision S.p.A. (BIT:AV) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

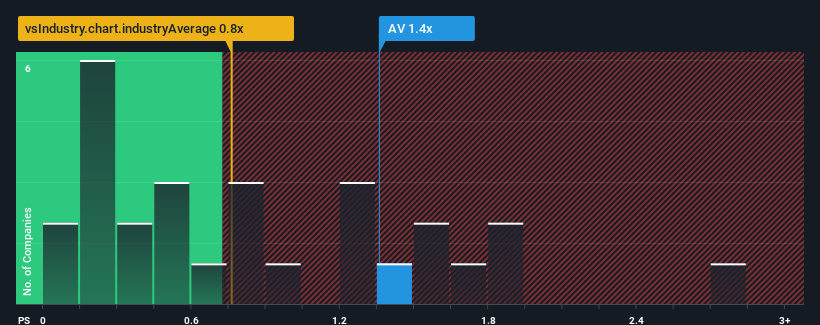

Following the firm bounce in price, when almost half of the companies in Italy's Machinery industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Antares Vision as a stock probably not worth researching with its 1.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Antares Vision

What Does Antares Vision's P/S Mean For Shareholders?

There hasn't been much to differentiate Antares Vision's and the industry's retreating revenue lately. Perhaps the market is expecting the company to reverse its fortunes and beat out a struggling industry in the future, elevating the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Antares Vision's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Antares Vision?

The only time you'd be truly comfortable seeing a P/S as high as Antares Vision's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 1.1% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 6.2% each year over the next three years. With the industry predicted to deliver 5.4% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's curious that Antares Vision's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Antares Vision's P/S Mean For Investors?

Antares Vision's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Antares Vision currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Antares Vision with six simple checks on some of these key factors.

If you're unsure about the strength of Antares Vision's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:AV

Antares Vision

Engages in the production, installation, and maintenance of inspection systems for quality control.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives