Strong Q3 Results and Euronext 100 Inclusion Could Be a Game Changer for BPER Banca (BIT:BPE)

Reviewed by Sasha Jovanovic

- BPER Banca SpA recently reported robust third quarter 2025 earnings, with net income reaching €575.1 million, and €1.48 billion for the first nine months of the year, while also being added to the Euronext 100 Index after being removed from the Euronext 150 Index.

- This combination of strong financial performance and index inclusion suggests heightened market attention, potentially for both fundamental and technical reasons.

- We'll now consider how BPER Banca's impressive quarterly earnings update could influence its longer-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BPER Banca Investment Narrative Recap

To be a shareholder in BPER Banca, you typically need confidence in its ability to drive profitable growth through operational scale, expanded fee-based revenues, and ongoing digital transformation, while successfully managing its high exposure to the Italian market. The recent strong third-quarter earnings and Euronext 100 inclusion may bolster short-term sentiment, but the most important near-term catalyst remains the integration of BPSO, where execution risks still outweigh the direct impact of these announcements. Among the recent developments, BPER Banca's robust third-quarter net income of €575.1 million stands out as the most relevant, as it demonstrates the bank's capacity to deliver higher profitability despite sector and economic challenges. This performance provides support for its growth-focused narrative, but effective cost management and sustained asset quality remain under close scrutiny due to ongoing integration complexity. However, it's important to recognize that despite the strong earnings, the largest risk investors should keep in mind relates to the challenging BPSO integration process...

Read the full narrative on BPER Banca (it's free!)

BPER Banca's narrative projects €7.3 billion revenue and €2.4 billion earnings by 2028. This requires 11.9% yearly revenue growth and a €0.8 billion earnings increase from €1.6 billion today.

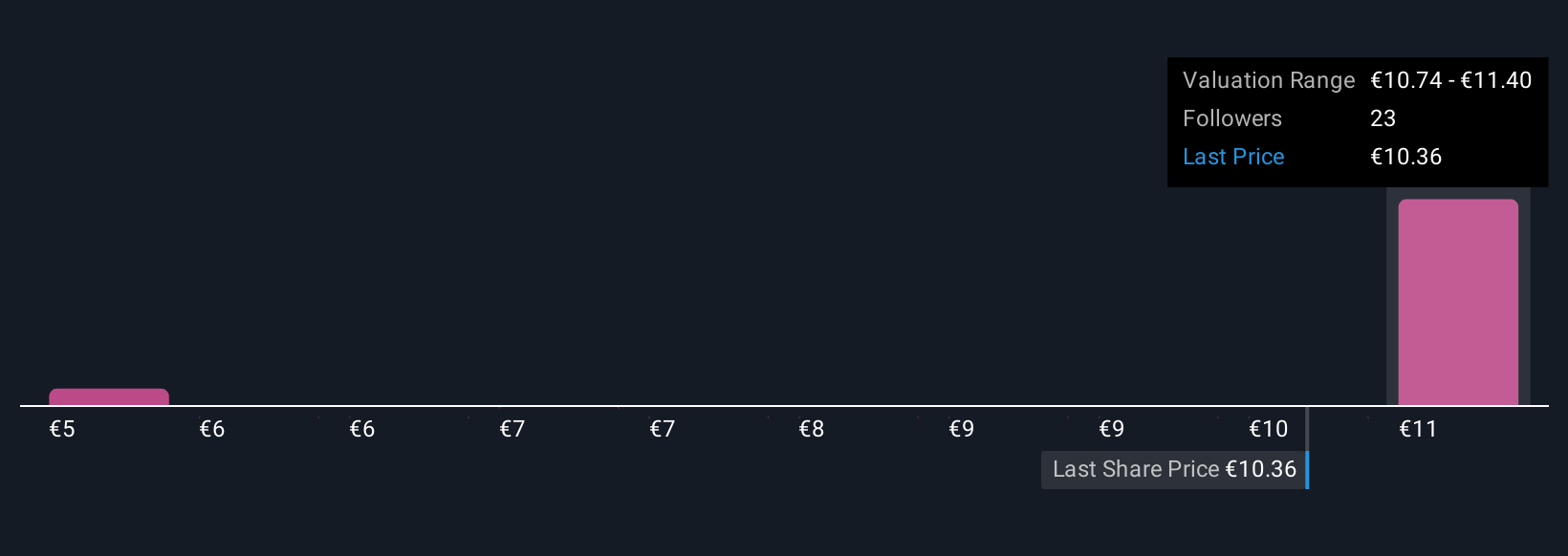

Uncover how BPER Banca's forecasts yield a €11.40 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set BPER Banca’s fair value estimates from €4.87 to €11.40, highlighting significant divergence across six unique opinions. With the success of the BPSO integration remaining a key factor, you will want to explore how differing outlooks could affect future performance.

Explore 6 other fair value estimates on BPER Banca - why the stock might be worth as much as €11.40!

Build Your Own BPER Banca Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BPER Banca research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BPER Banca research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BPER Banca's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BPER Banca might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BPE

BPER Banca

Provides banking products and services for individuals, and businesses and professionals in Italy and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives