What trends should we look for it we want to identify stocks that can multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Pirelli & C (BIT:PIRC) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Pirelli & C, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

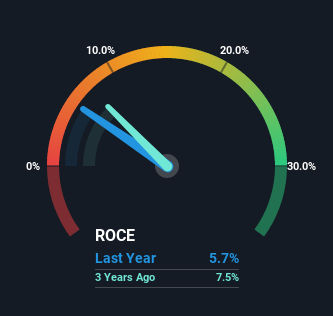

0.057 = €585m ÷ (€14b - €3.6b) (Based on the trailing twelve months to December 2021).

Therefore, Pirelli & C has an ROCE of 5.7%. In absolute terms, that's a low return but it's around the Auto Components industry average of 6.7%.

View our latest analysis for Pirelli & C

In the above chart we have measured Pirelli & C's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Pirelli & C.

So How Is Pirelli & C's ROCE Trending?

Over the past five years, Pirelli & C's ROCE and capital employed have both remained mostly flat. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. With that in mind, unless investment picks up again in the future, we wouldn't expect Pirelli & C to be a multi-bagger going forward. With fewer investment opportunities, it makes sense that Pirelli & C has been paying out a decent 33% of its earnings to shareholders. Given the business isn't reinvesting in itself, it makes sense to distribute a portion of earnings among shareholders.

The Bottom Line

In a nutshell, Pirelli & C has been trudging along with the same returns from the same amount of capital over the last five years. And investors appear hesitant that the trends will pick up because the stock has fallen 19% in the last three years. Therefore based on the analysis done in this article, we don't think Pirelli & C has the makings of a multi-bagger.

Pirelli & C does have some risks, we noticed 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:PIRC

Pirelli & C

Manufactures and supplies tires for cars, motorcycles, and bicycles worldwide.

Adequate balance sheet and fair value.