- India

- /

- Gas Utilities

- /

- NSEI:IRMENERGY

IRM Energy Limited's (NSE:IRMENERGY) P/E Is Still On The Mark Following 36% Share Price Bounce

The IRM Energy Limited (NSE:IRMENERGY) share price has done very well over the last month, posting an excellent gain of 36%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

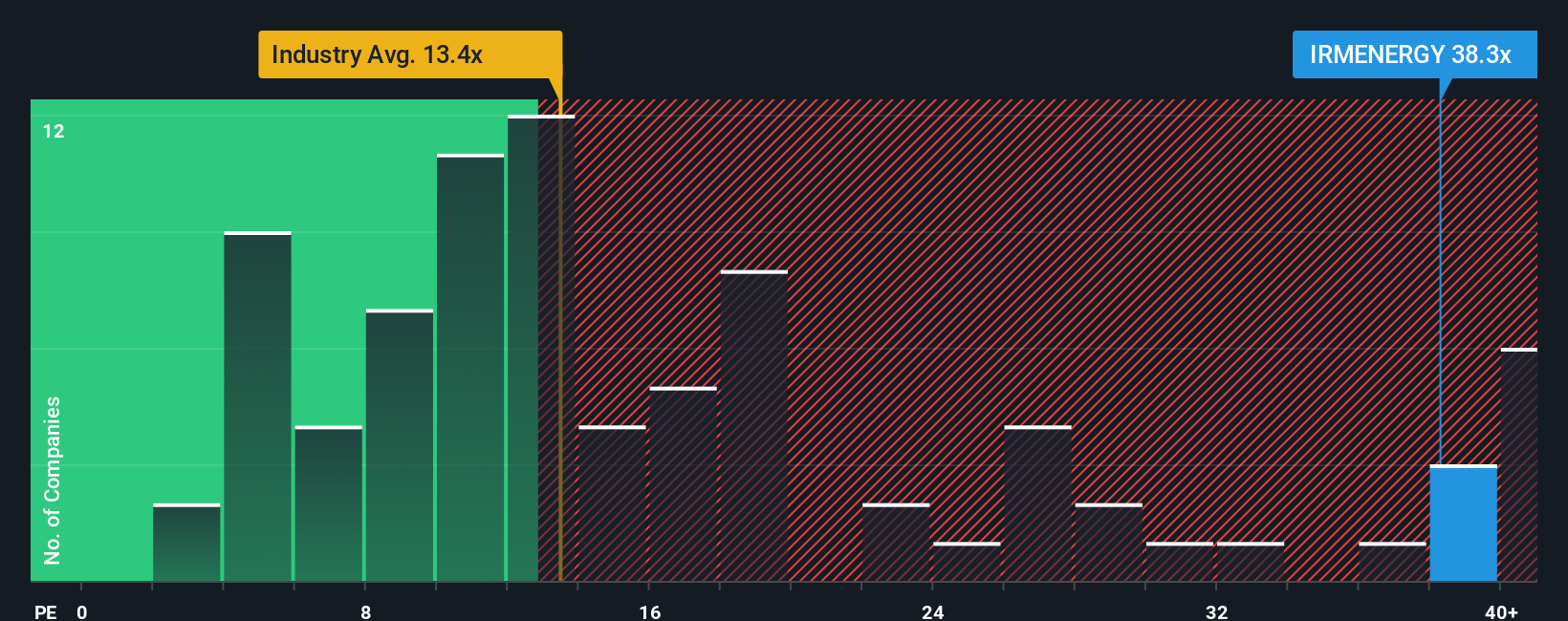

Since its price has surged higher, IRM Energy may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 38.3x, since almost half of all companies in India have P/E ratios under 28x and even P/E's lower than 16x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

While the market has experienced earnings growth lately, IRM Energy's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for IRM Energy

Does Growth Match The High P/E?

In order to justify its P/E ratio, IRM Energy would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 52%. The last three years don't look nice either as the company has shrunk EPS by 77% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 69% over the next year. That's shaping up to be materially higher than the 25% growth forecast for the broader market.

With this information, we can see why IRM Energy is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in IRM Energy's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that IRM Energy maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for IRM Energy (1 makes us a bit uncomfortable!) that you should be aware of.

You might be able to find a better investment than IRM Energy. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRMENERGY

IRM Energy

A city gas distribution company, engages in the laying, building, operating, and expanding of city and local natural gas distribution networks in India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives